Key moments

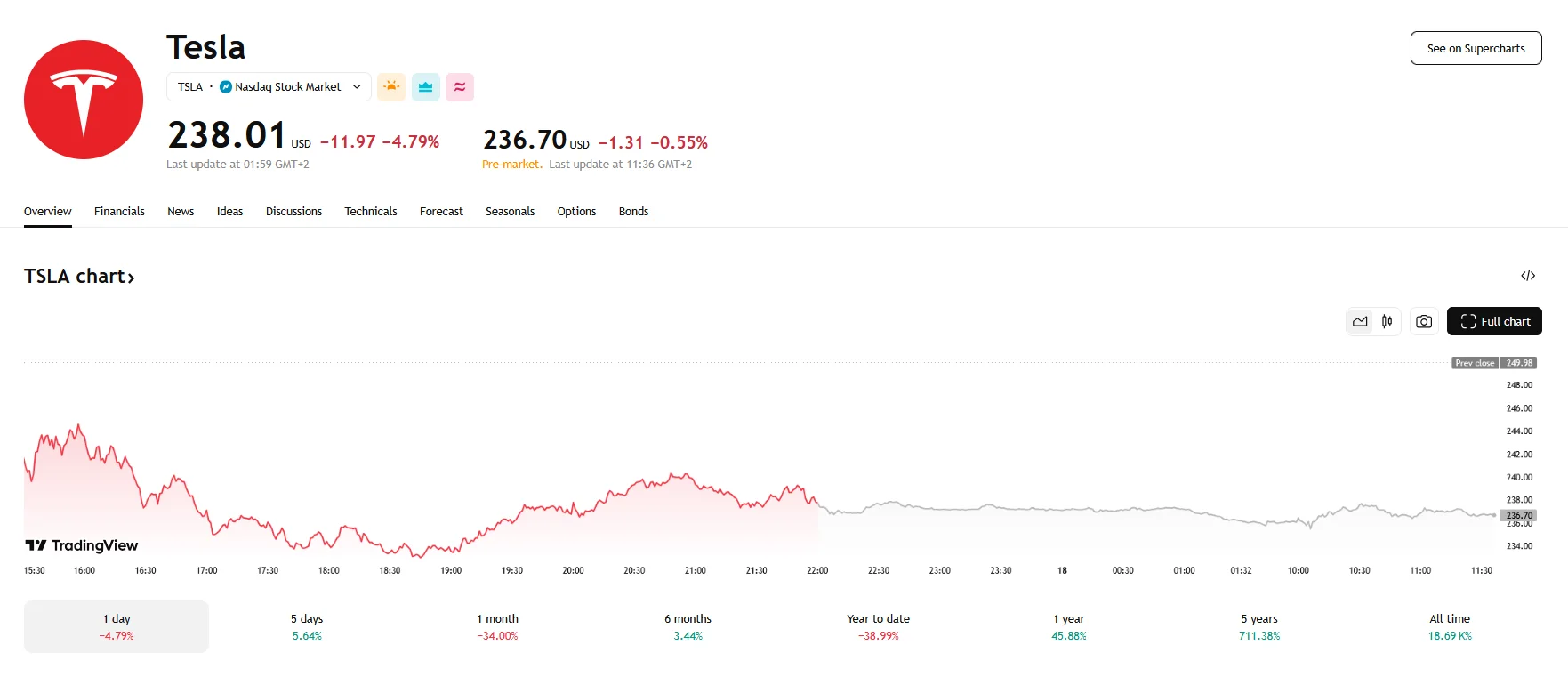

- Tesla’s shares slid 4.8% on Monday, extending the electric vehicle maker’s period of market difficulty.

- Mizuho Securities analyst Vijay Rakesh drastically reduced Tesla’s full-year delivery forecast to 1.8 million.

- JPMorgan’s Ryan Brinkman also lowered delivery expectations, anticipating fourth-quarter figures to not exceed 355,000. Additionally, Brinkman lowered Tesla’s stock price target by $10.

Tesla’s Stagnation Fears Grow as Stock Faces Pressure

Tesla’s stock experienced a significant downturn on Monday, falling by 4.8% to $238, a continuation of a challenging period for the electric vehicle giant. This decline occurred amid growing concerns among investors and analysts regarding the company’s overall market performance.

Monday’s drop was fueled, in part, by revised delivery estimates from prominent analysts. Vijay Rakesh of Mizuho Securities significantly lowered his full-year delivery projection from 2.3 million to 1.8 million vehicles. This adjustment indicates a potential stagnation in Tesla’s growth, as it delivered approximately 1.8 million vehicles in the preceding year. According to Rakesh, geopolitical tensions, brand perception issues in both the U.S. and Europe, increased competition from Chinese electric vehicle manufacturers, and weaker-than-anticipated demand for the Model Y refresh are the factors behind his updated forecast.

JPMorgan also reconsidered its Tesla delivery forecast, as analyst Ryan Brinkman lowered the estimated first-quarter deliveries to 355,000 vehicles, 28% lower than last quarter’s 495,000 deliveries. This would also mark an 8% year-over-year decline. In addition, Brinkman reduced the price target for Tesla’s stock by $10, with the current estimate now standing at $120.

The analysts expressed worry about Tesla’s brand perception. Elon Musk’s political activities have led to rising concerns that his actions may be alienating potential customers, with protests and reports of vandalism indicating growing public discontent.

These revised forecasts and concerns about brand perception have significantly impacted investor sentiment. Tesla’s stock has now experienced eight consecutive weeks of losses, marking an unprecedented streak for the company. Adding to the concern, Tesla is being challenged by Chinese EV companies, and it has been facing issues in terms of data collection in the local market due to Chinese privacy regulations.