Key moments

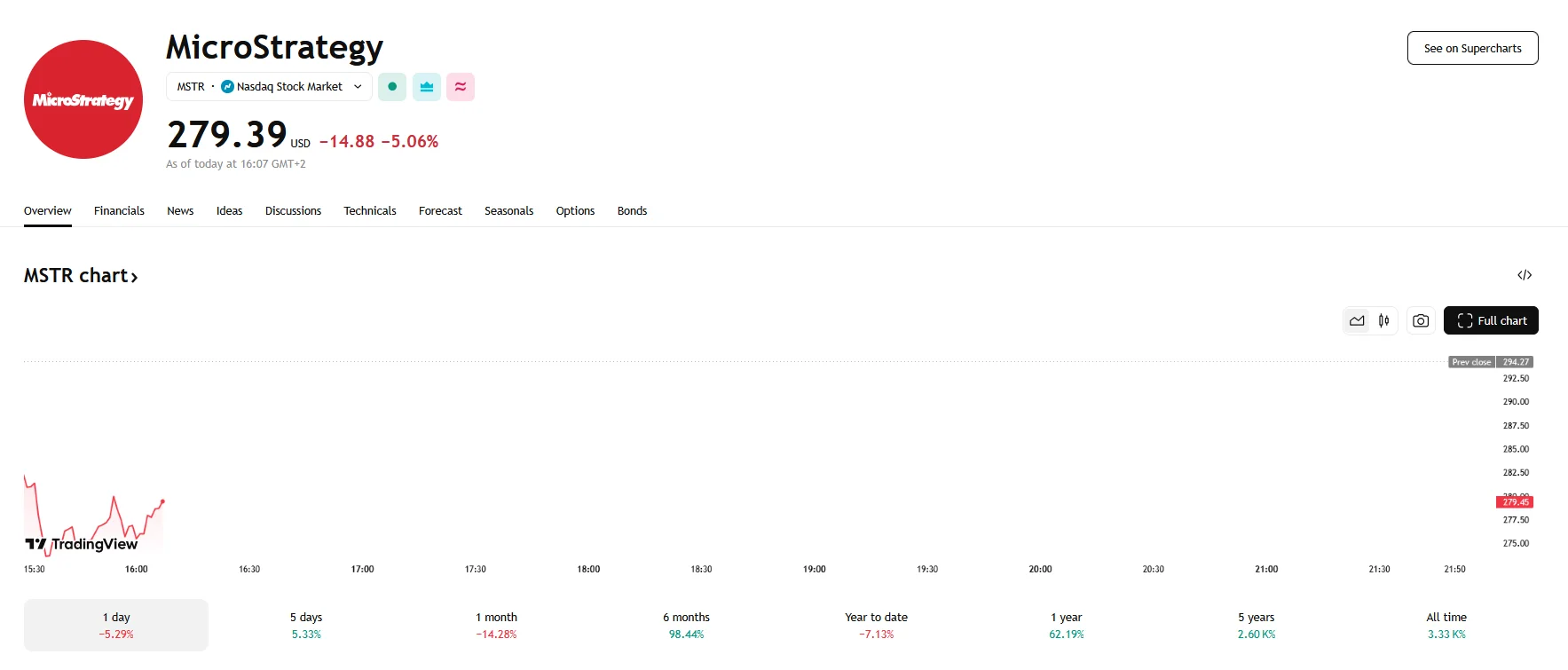

- MicroStrategy’s share price experienced a significant drop on Tuesday, falling 5% and dipping below $280.

- Strategy aims to raise $500 by selling 5 million perpetual preferred shares.

- Strategy appears to be taking a cautious approach, as indicated by the scale of its recent Bitcoin purchases.

$500M Preferred Stock Sale Set to Aid MicroStrategy in Purchasing More Bitcoin

Tuesday saw the share price of MicroStrategy, recently rebranded as Strategy, fall sharply under Monday’s threshold of $290. The stock dipped 5% to reach just below $280 before rebounding to some extent. This movement coincided with the company’s announcement of a significant financial maneuver aimed at bolstering its already substantial Bitcoin holdings.

Strategy has recently revealed its intention to sell off a total of 5 million shares belonging to the company’s Series A Perpetual Preferred Stock. This move is set to provide a steady stream of capital for further Bitcoin acquisitions, with the sale amounting to $500 million. Moreover, Strategy will not be forced to dilute the voting power of current shareholders as perpetual shares do not grant voting rights and instead come with the perk of annual 10% dividends. While substantial, this move is far smaller in scale than the $21 billion in company stock that, according to an announcement issued earlier this month, Strategy plans to sell for the same purpose.

At present, the crypto market is experiencing a period of fluctuating cryptocurrency values and uncertainty. While the company has been a prominent and aggressive buyer of Bitcoin, its recent purchase of 130 Bitcoin for $11 million (averaging $82,981) is relatively smaller compared to earlier acquisitions.

The market’s reaction to recent developments surrounding Strategy has been mixed. While Strategy’s continued commitment to Bitcoin typically signals bullish sentiment within the cryptocurrency community, the smaller scale of recent purchases, combined with the planned preferred stock issuance, suggests a degree of caution. Concerns about market volatility, amplified by geopolitical uncertainties and potential economic impacts from US trade policies, could be influencing this more measured approach. As the largest corporate holder of Bitcoin, with holdings exceeding 499,000 BTC, Strategy’s actions continue to be closely watched by both cryptocurrency enthusiasts and participants in traditional financial markets.