Key moments

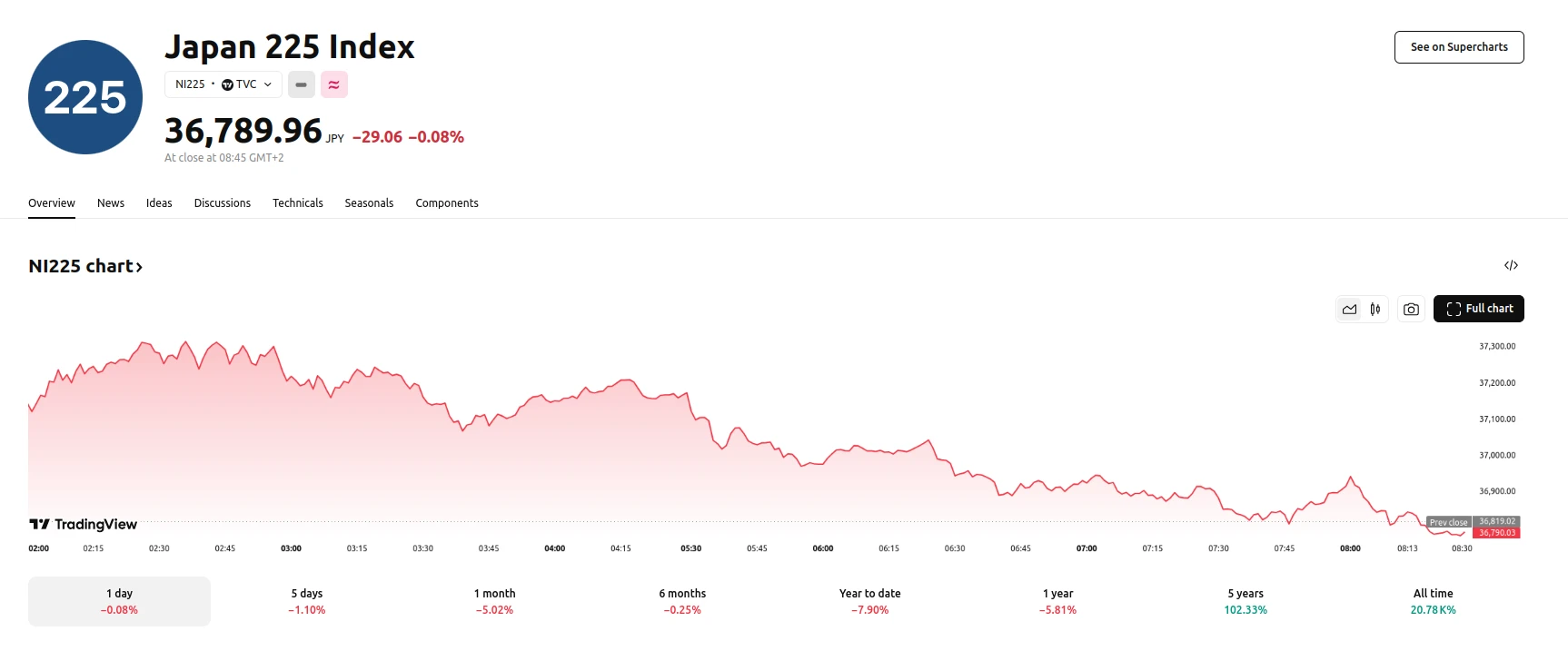

- Nikkei 225 reverses initial gains, closing down 0.08% at 36,790.

- Trade tensions escalate with US tariff threats, impacting market sentiment.

- Bank of Japan signals balance sheet reduction, indicating a move away from ultra-loose monetary policy.

Nikkei 225 Sees Minor Decline Amid Trade and Monetary Policy Concerns

The Nikkei 225 Index experienced a marginal decline on Thursday, closing at 36,790, a 0.08% decrease from the previous day. This subtle drop occurred despite the index initially surging by over 1%, reflecting a late-session shift in investor sentiment driven by heightened trade uncertainties. Specifically, renewed threats of additional tariffs by the United States, following retaliatory measures from trading partners, introduced a degree of unease into the Japanese market. Compounding the situation are repeated indications from the US regarding reciprocal tariffs due to take effect next month, reinforcing concerns about potential disruptions to global trade flows.

Simultaneously, the Bank of Japan’s (BoJ) Governor, Kazuo Ueda, provided further clarity on the central bank’s intention to reduce its balance sheet. This development signals a potential shift away from the prolonged period of ultra-loose monetary policy that has characterized Japan’s economic strategy. The BoJ’s decision is underpinned by robust wage growth and consumption trends observed in the Japanese economy, which have generated conditions suitable for policy adjustments. The indications of a reduction in the balance sheet bring the Japanese market to focus on future changes to the monetary policy of Japan, a point which had previously been held static.

Sector-wise, notable declines among key index constituents such as Toyota Motor, SoftBank Group, and Fast Retailing contributed to the index’s overall downward trajectory. Conversely, Mitsubishi Electric recorded a gain, bolstered by its announcement regarding the expansion of its missile defense and cross-domain operations, a move aligned with Japan’s significant defense expenditure initiatives. This fluctuation in corporate performance, coupled with the prevailing trade and monetary policy uncertainties, collectively shaped the market’s response, resulting in the Nikkei 225’s marginal decline.