Key moments

- The ASX 200 experiences a 1.2% drop in morning trading, reversing gains from the previous day, influenced by substantial overnight losses in US markets.

- Technology stocks within the ASX demonstrate a more severe decline, with the S&P/ASX All Technology Index falling by 2.8%.

- Growing fears of a potential recession in the US, coupled with global trade tensions and geopolitical uncertainties, drive market sentiment.

US Market Downturn and Economic Concerns Impact Australian Trading

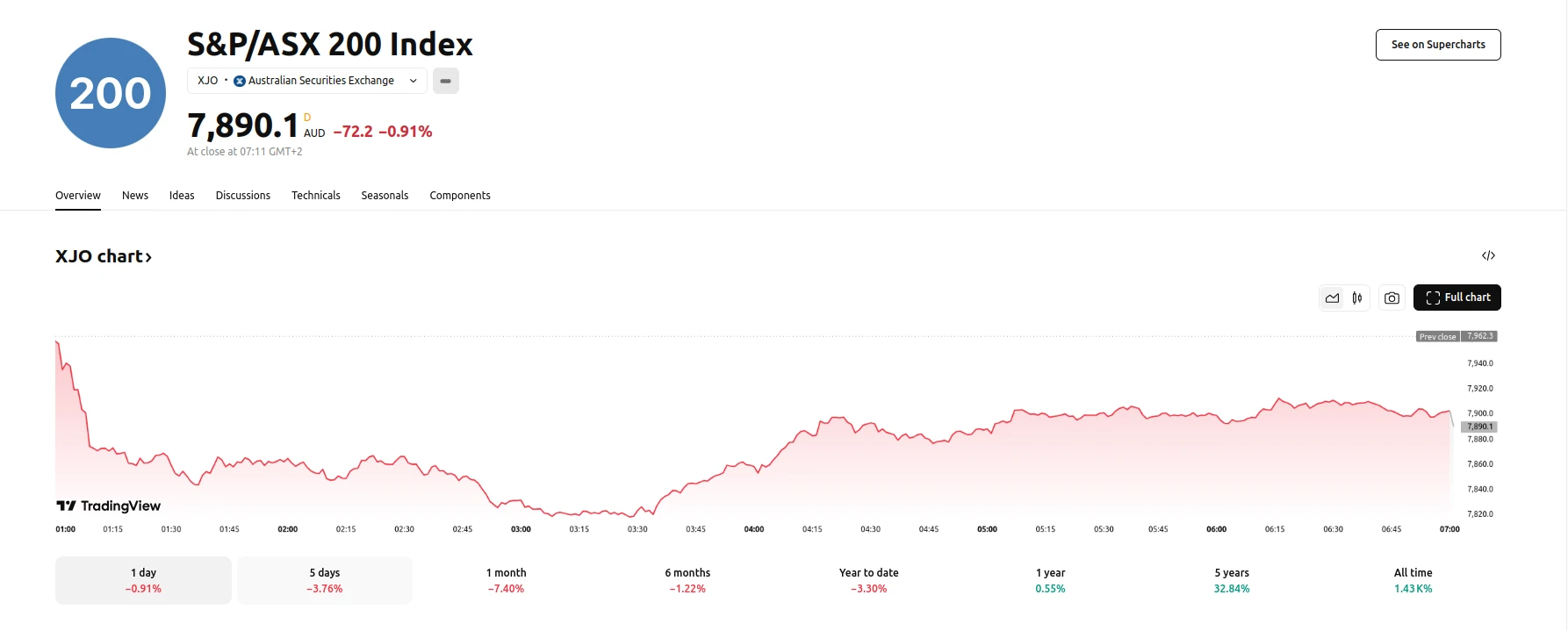

The S&P/ASX 200 Index encountered a notable decrease during Tuesday’s morning trading session, registering a 1.2% decline to 7,871.0 points. This downturn followed a modest 0.2% increase on Monday, highlighting the volatility currently impacting global markets. The primary catalyst for this decline is the significant downturn observed in US stock markets overnight, where the S&P 500 and Nasdaq Composite indices experienced substantial losses. Specifically, the Nasdaq Composite shed US$1.1 trillion in value, with tech giants like Nvidia (-5.1%) and Tesla (-15.4%) experiencing considerable drops.

The impact of the US market’s performance is particularly evident in the Australian technology sector. The S&P/ASX All Technology Index witnessed a 2.8% decrease, indicating the sector’s heightened sensitivity to global market fluctuations. Furthermore, the performance of major ASX 200 companies was mixed, with Commonwealth Bank of Australia shares declining by 2.0%, while BHP Group and CSL Limited shares saw minimal changes.

The overarching concern driving market sentiment is the growing apprehension regarding a potential recession in the United States. This anxiety has been exacerbated by statements from US officials regarding economic transitions and ongoing trade disputes. Market analysts emphasize that the current uncertainties, including global tariff policies and geopolitical shifts, are contributing to investor caution. They suggest that until greater clarity emerges regarding the future of the global economic landscape, market volatility is likely to persist.