Key moments

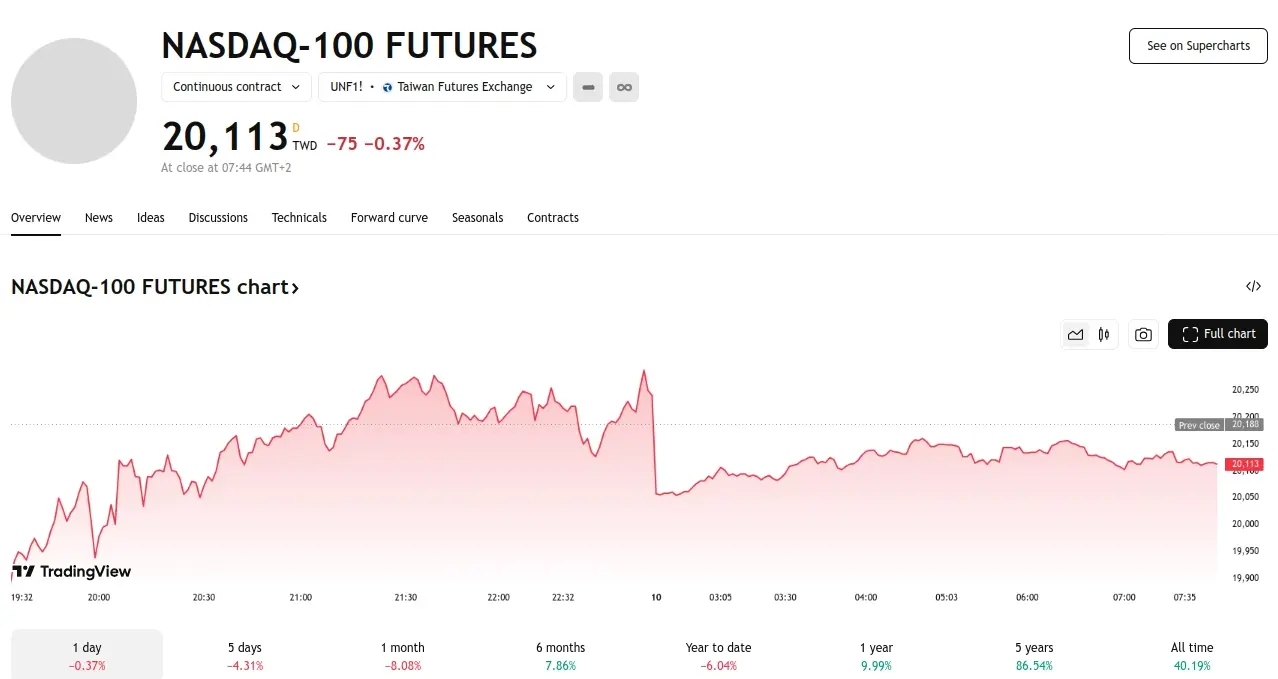

- S&P 500, Nasdaq 100, and Dow Jones futures all experienced substantial declines, following a week where major indexes saw losses exceeding 2%.

- Upcoming releases of the CPI, PPI, and consumer sentiment data will be closely watched for their impact on inflation, a central concern for the Federal Reserve and investors.

- Ongoing economic policy debates and tariff negotiations, combined with the Federal Reserve’s cautious approach to interest rate adjustments, are contributing to market unease.

Stock Futures Plunged Sunday Night, Signaling Potentially Volatile Week Ahead for Wall Street

Sunday night saw a sharp decline in stock futures, foreshadowing another potentially turbulent week for Wall Street after a significant downturn earlier in March. According to CNBC data, S&P 500 futures decreased by 0.8%, Nasdaq 100 futures fell by nearly 1%, and Dow Jones futures dropped 268 points, or 0.6%.

This downturn follows a severe sell-off in the previous week, where the S&P 500 plummeted 3.10%, the Dow Jones Industrial Average lost 2.37%, and the Nasdaq Composite tumbled 3.45%, marking its most substantial decline since September.

Contributing to this market volatility were economic policies emanating from Washington, alongside ongoing tariff negotiations with Mexico and Canada. These factors generated uncertainty, prompting investors to seek safer havens.

The upcoming week is packed with economic data releases, which could amplify the market’s instability. The New York Fed’s consumer expectations survey is scheduled for release on Monday, but the primary focus remains on inflation, a key concern for both the Federal Reserve and market participants.

Specifically, the Consumer Price Index (CPI) for February will be disclosed on Wednesday, followed by the Producer Price Index (PPI) on Thursday, and the University of Michigan’s consumer sentiment index on Friday.

Comerica Bank’s chief economist, Bill Adams, suggested that “the total and core CPI likely increased at a more tempered rate in February, following substantial surges in the preceding month.” He also emphasized that ongoing tariff disputes and trade uncertainties continue to exert upward pressure on producer prices.

On Friday, Federal Reserve Chair Jerome Powell addressed the prevailing uncertainty, stating that the central bank is “focused on distinguishing genuine signals from mere noise.” He indicated that his team is in no rush to modify interest rates, emphasizing that the Fed will await “greater clarity” before implementing any adjustments.

The economic policies of the Biden administration also remain a significant factor. On Friday, former Treasury Secretary Scott Bessent acknowledged, “The economy is beginning to gain momentum.”

Investors are closely monitoring whether Washington will intervene with measures to stabilize the markets. However, given President Trump’s recent statement, “I’m not even looking at the stock market,” last week, such interventions appear unlikely.