Key moments

- Significant 146% year-over-year revenue increase in the fourth quarter, transitioning to a $23 million net income.

- Updated financial guidance projecting $540 million in global revenue, anchored by strong BRIUMVI product performance.

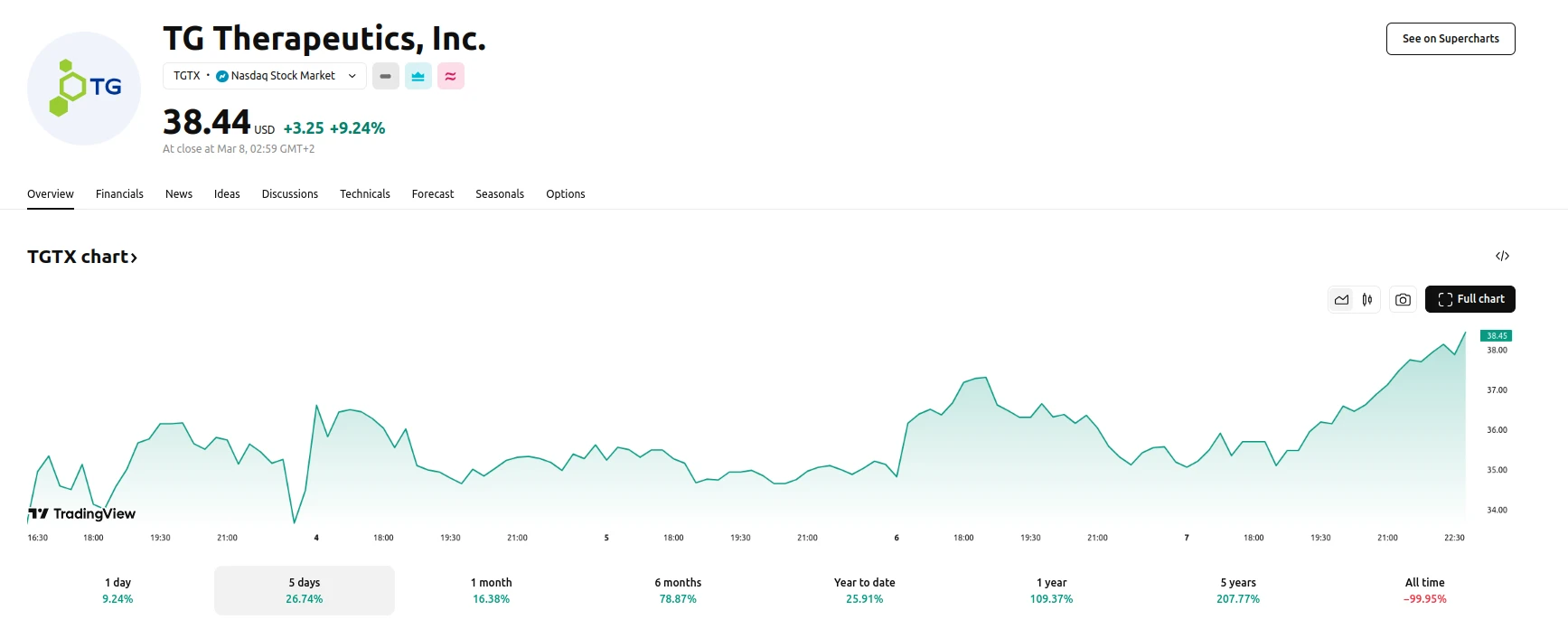

- Substantial 28% stock price surge despite broader market volatility and declines in major indices.

TG Therapeutics Sees Investor Confidence Soar on Strong Financial Performance: 146% Revenue Growth and $23 Million Profit Drive 28% Stock Surge

TG Therapeutics, a biopharmaceutical company focused on B-cell malignancies and autoimmune diseases, experienced a significant surge in its stock price last week, jumping almost 28% following the release of its fourth-quarter earnings report. The company’s financial results demonstrated a remarkable 146% increase in revenue compared to the same period last year, alongside a notable shift from a net loss to a $23 million net income. This financial turnaround has significantly bolstered investor confidence, particularly in a period marked by broader market volatility.

The company’s positive financial performance was further amplified by its updated financial guidance, which projects $540 million in global revenue. This optimistic outlook is heavily reliant on the strong performance of its BRIUMVI product, which has shown promising results in clinical trials. This positive momentum comes even as major market indices, such as the S&P 500 and Nasdaq, experienced weekly declines, influenced by factors including fluctuating Treasury yields and concerns regarding potential tariffs. TG Therapeutics’ ability to deliver exceptional financial results in a challenging market environment underscores its strong operational execution and product portfolio strength.

TG Therapeutics has taken deliberate financial actions, such as securing a $250 million loan, to ensure it has the resources for future expansion. These strategic moves, combined with share buybacks and strong profit reports, show a clear focus on increasing value for its shareholders. Within the last three years, the total shareholder return has amounted to 336.82%. This approach has allowed the company’s stock to perform exceptionally well, exceeding the average one-year return of the broader U.S. market, even while navigating the ups and downs of the pharmaceutical industry. These elements highlight the company’s ability to maintain a strong growth trajectory despite external pressures.