Key moments

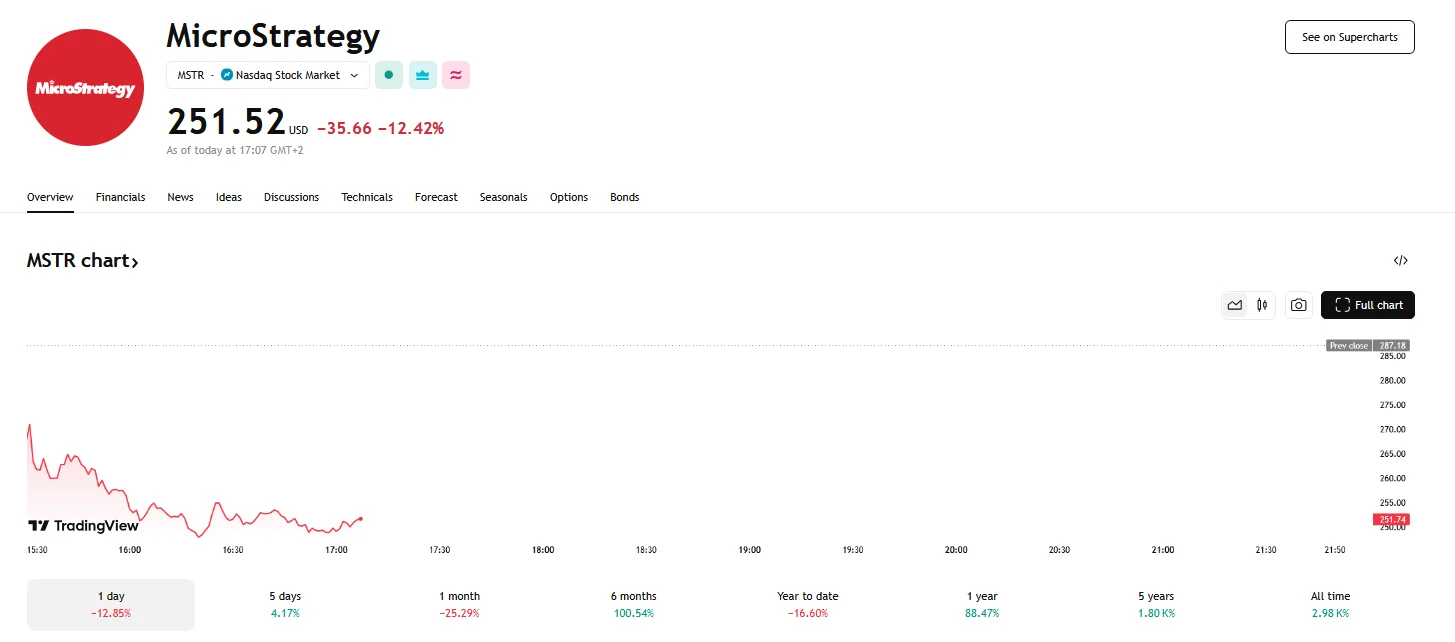

- MicroStrategy’s stock price has fallen below $255.

- Bitcoin has faced challenges in maintaining its value above $80,000, even dipping to $79,396. Market reactions to the White House crypto summit and concerns about potential economic transitions have contributed to this volatility.

- MicroStrategy’s announcement of a $21 billion at-the-market offering program for Series A preferred stock has drawn scrutiny.

MicroStrategy Stock Price Plunges in Tandem with Bitcoin’s Sharp Decline

The fluctuating fortunes of the cryptocurrency market have cast a shadow over MicroStrategy Inc., a company whose valuation is intricately linked to the performance of Bitcoin. Recent market turbulence has seen MicroStrategy’s stock price dip below the $255 threshold, a direct consequence of Bitcoin’s struggle to maintain its footing above the $80,000 mark.

MicroStrategy’s stock, trading under the ticker MSTR, has experienced significant swings, often mirroring Bitcoin’s price movements. The correlation was particularly evident as Bitcoin retreated to figures of around $80,000, even dipping to $79,396 at one point.

The recent downturn in Bitcoin’s price has been attributed to several factors, including market reactions to the White House crypto summit. Despite President Trump’s executive order establishing a strategic Bitcoin reserve, the absence of immediate plans for government Bitcoin purchases disappointed many traders. Additionally, remarks by President Trump regarding potential market “transitions” and the possibility of a recession contributed to market unease.

The impact of Bitcoin’s volatility extended beyond MicroStrategy, affecting other cryptocurrency-related stocks. Companies like Coinbase Global and Robinhood Markets also experienced declines, reflecting the broader market sentiment. The cryptocurrency market witnessed substantial liquidations, with a significant portion of bullish bets being wiped out.

MicroStrategy’s financial strategies have also come under scrutiny. The company recently announced a $21 billion at-the-market offering program to issue and sell Series A preferred stock. The proceeds from this program are intended for general corporate purposes, including the acquisition of more Bitcoin. However, the announcement coincided with a period of declining Bitcoin prices, adding to investor concerns.

The company’s substantial Bitcoin holdings, acquired at an average price of $66,357 per Bitcoin, represent a significant portion of its assets. The fluctuating value of these holdings directly impacts MicroStrategy’s financial performance and stock price. The company’s decision not to purchase additional Bitcoin between March 3 and March 9, despite market fluctuations, has also been a point of interest for investors.