Key moments

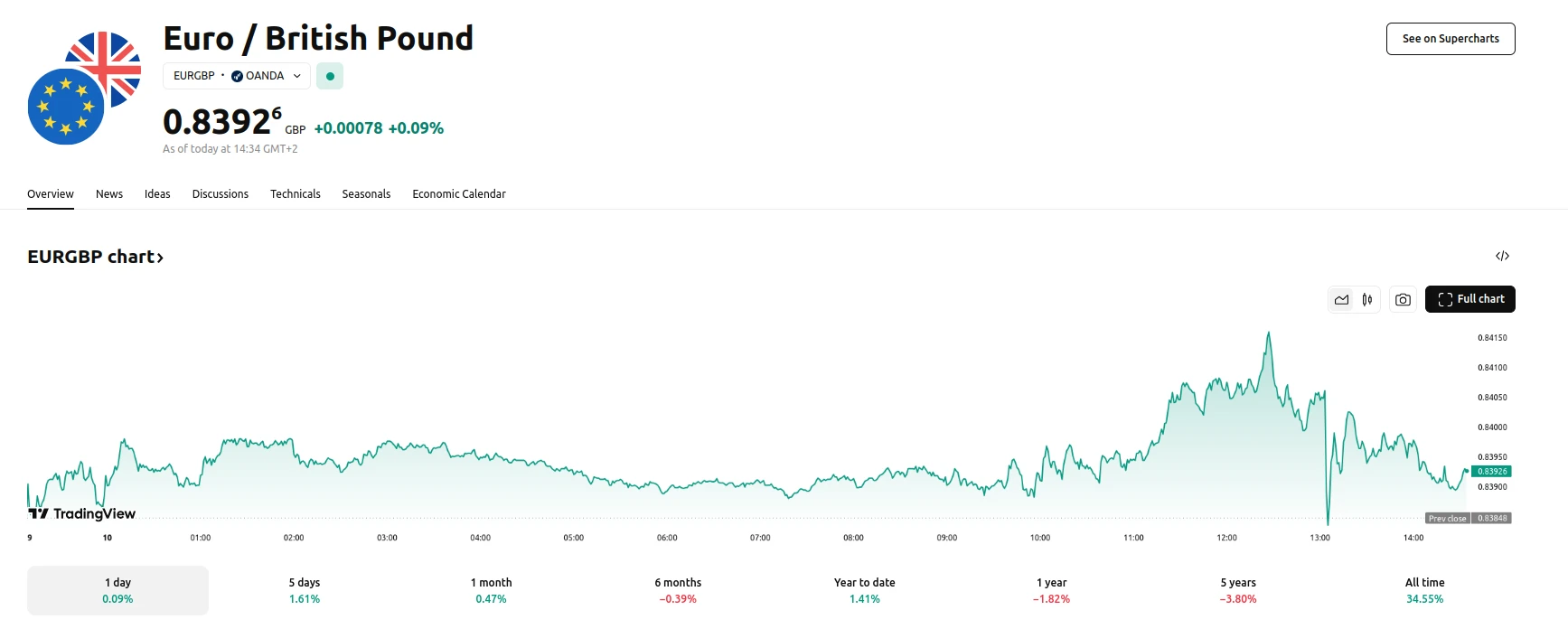

- Currency Pair Climbs to Near 0.84 on Euro Strength Driven by German Fiscal Outlook.

- UK Economic Uncertainty and Global Volatility Weigh on GBP.

- Danske Bank Forecasts EUR/GBP to Recede to 0.81 in 12 Months.

Euro Gains Against Pound Amid Fiscal Spending Uncertainty

The EUR/GBP currency pair experienced a notable surge last week, propelled by a sell-off in European fixed income markets. This movement was largely attributed to evolving expectations regarding Germany’s fiscal spending, which provided broad support to the Euro. Consequently, the currency pair approached the 0.84 mark, highlighting the impact of fiscal policy changes on currency valuations.

While concerns about fiscal stability in the UK have temporarily subsided, the British Pound (GBP) remains vulnerable to heightened uncertainty and elevated market volatility. These conditions have contributed to the EUR/GBP pair’s upward trajectory. Despite Danske Bank’s long-term bearish outlook on EUR/GBP, based on expectations of a hawkish Bank of England and improving UK macroeconomic data, the immediate outlook remains uncertain.

The potential for further gains in the EUR/GBP pair exists if the current period of increased volatility and Euro strength persists. Key events to watch this week include the release of the UK’s January GDP estimate and the parliamentary vote on Germany’s fiscal spending plans. Danske Bank maintains its 12-month target for the EUR/GBP pair at 0.81, anticipating a reversal of the recent upward trend.