Key moments

- The Mexican peso strengthened, appreciating 0.45% in 24 hours.

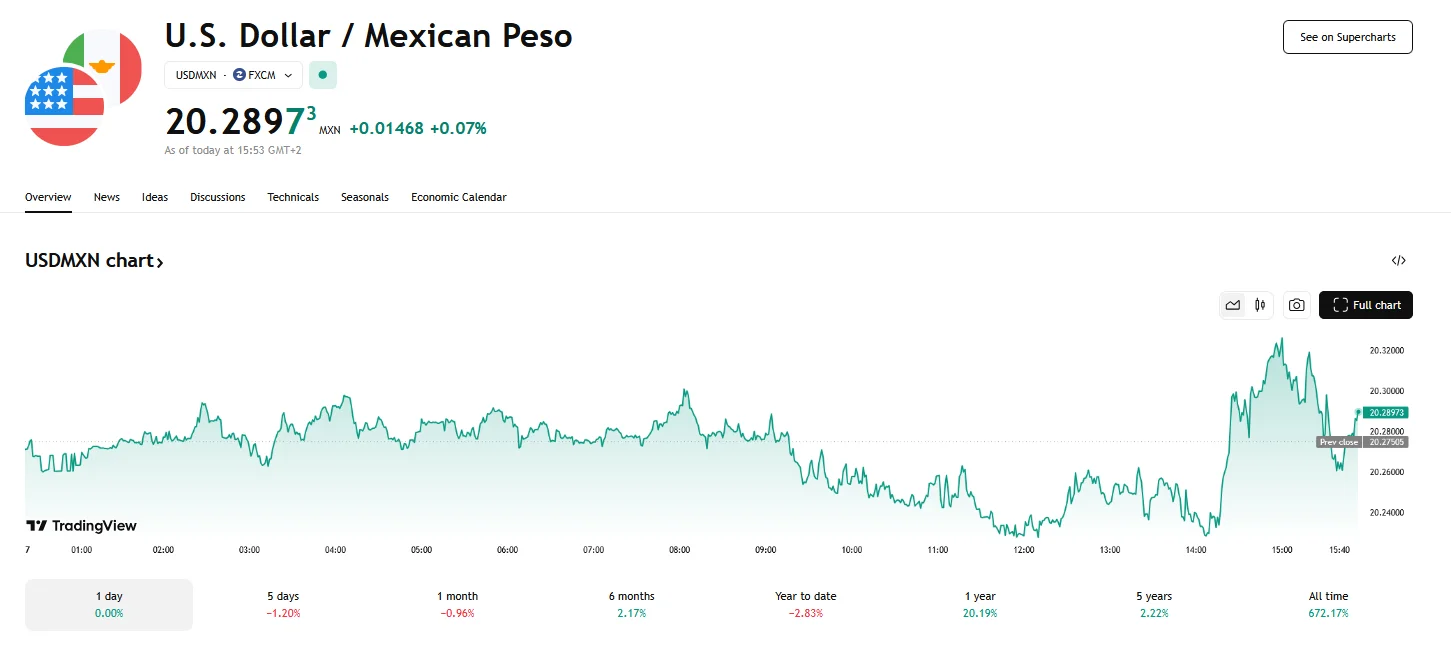

- The USD/MXN pair fluctuates between 20.2800 and 20.3000 at press time.

- Tariff postponement fueled the peso’s rise. President Trump’s decision to delay USMCA tariffs allowed investors to reassess positions, contributing to the peso’s upward trajectory.

Driven by Improved U.S.-Mexico Relations and a Crucial Tariff Postponement, the Mexican Peso Experienced a 0.45% Appreciation in the Last 24 Hours

The Mexican peso has displayed notable strength in recent trading sessions, driven by a confluence of political and economic factors. Notably, the decision by the U.S. administration to postpone tariffs on goods covered under the USMCA agreement has provided a significant boost to the Mexican currency.

In the past 24 hours, the Mexican peso experienced an appreciation of 0.45%, building upon gains from the previous day’s opening rate of 20.4400 against the U.S. dollar. This strengthening trend reflects a positive market response to the delayed tariff implementation, which had previously weighed heavily on investor sentiment. The postponement, resulting from talks between Mexican President Sheinbaum and President Trump, has allowed market participants to reassess their defensive positions against the peso, contributing to its upward trajectory.

However, the USD/MXN pair has shown some volatility. The USD/MXN rate rose sharply from a 20.22895 dip on Friday and is trading between 20.2800 and 20.3000 at the time of writing.

Adding to the peso’s positive momentum, recent U.S. labor statistics have contributed to a weakening of the U.S. dollar across global markets. Specifically, February’s ADP employment report demonstrated a considerable deficit in job creation, falling short of anticipated figures. Moreover, both U.S. jobless claims and Challenger job cuts surpassed projected levels, collectively suggesting the possibility of an impending economic slowdown. These unfavorable indicators have contributed to the dollar’s depreciation, thereby enhancing the peso’s positive momentum. In terms of technical analysis, the USD/MXN pair’s descent below the crucial 20.3800 support level implies bullish trends may persist.

Despite the current positive trends, investors remain vigilant, particularly regarding upcoming U.S. economic data. The U.S. Nonfarm Payrolls report is expected to significantly influence Federal Reserve policy expectations and, consequently, the USD/MXN exchange rate. Any unexpected developments in this report could trigger significant market volatility.