Key moments

- The US Energy Secretary unveiled his intentions to seek up to $20 billion to replenish the nation’s depleted oil reserve to its maximum capacity of 700 million barrels.

- The current holdings of the Strategic Petroleum Reserve stand at 395 million barrels, a dramatic reduction from its maximum capacity.

- The refill initiative, which may take years to complete, aims to restore the reserve’s holdings to “just close to the top” to maintain efficient operating status.

Oil Reserve Holdings Presently Amount to 395 Million Barrels

The US Energy Secretary, Chris Wright, has announced plans to seek funding to replenish the Strategic Petroleum Reserve, a move that aligns with President Donald Trump’s goal of boosting domestic oil production and energy security. The reserve, created in the 1970s, has a maximum capacity of 700 million barrels, but its current holdings are significantly lower due to sales during the previous administration.

The sales, which totaled around 290 million barrels, were made to address emergency needs and fund unrelated projects, such as road repairs. Energy Secretary Wright noted that the rapid drawdowns may have caused infrastructure problems, and some of the funding sought will be used for maintenance.

The refill initiative is expected to take years to complete and will require congressional approval, which is not guaranteed. President Trump had pledged to replenish the reserve during his inaugural address in January, as part of a broader effort to promote conventional energy. The reserve’s holdings were reduced sharply during the Biden administration, particularly after Russia’s invasion of Ukraine, when gasoline prices spiked.

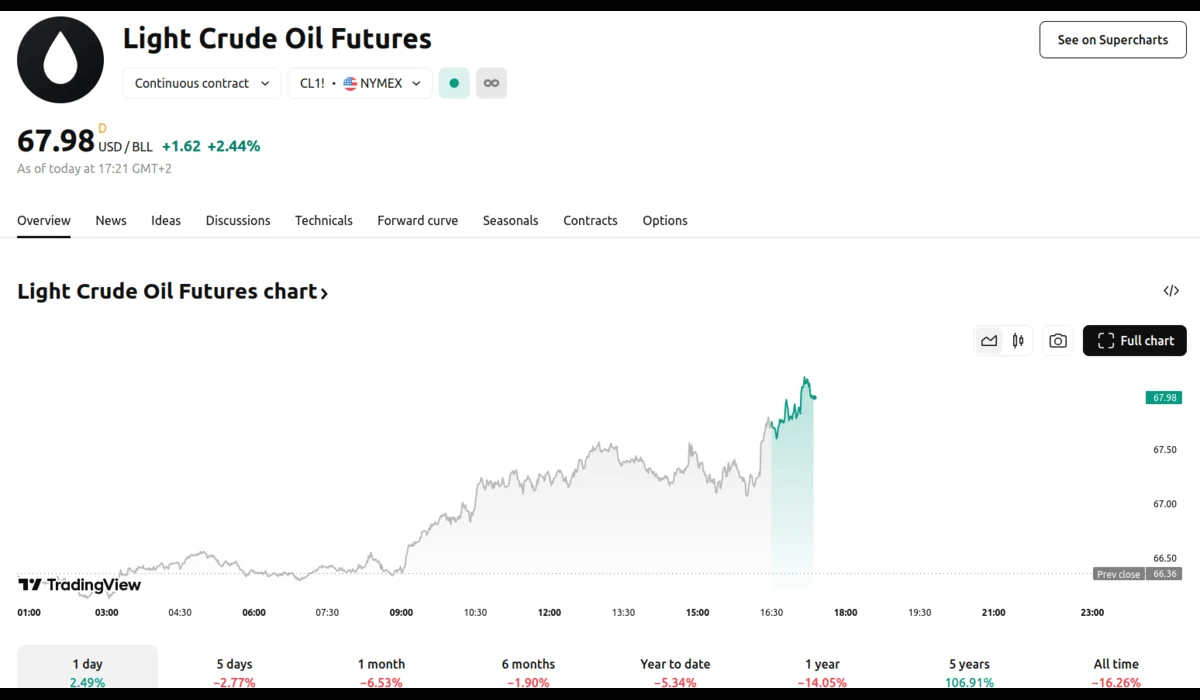

The Energy Department’s funds for purchases ran out after the previous administration bought approximately 60 million barrels, and Wright has yet to make a specific request to Congress for more funds. The news of the refill initiative has already had an impact on the market, with US crude futures briefly touching $67.68 a barrel in New York. They have since increased to $67.98, up 2.44% from the previous day. The refill initiative is a crucial step towards ensuring the nation’s energy security and providing a cushion against potential crude supply disruptions.