Key moments

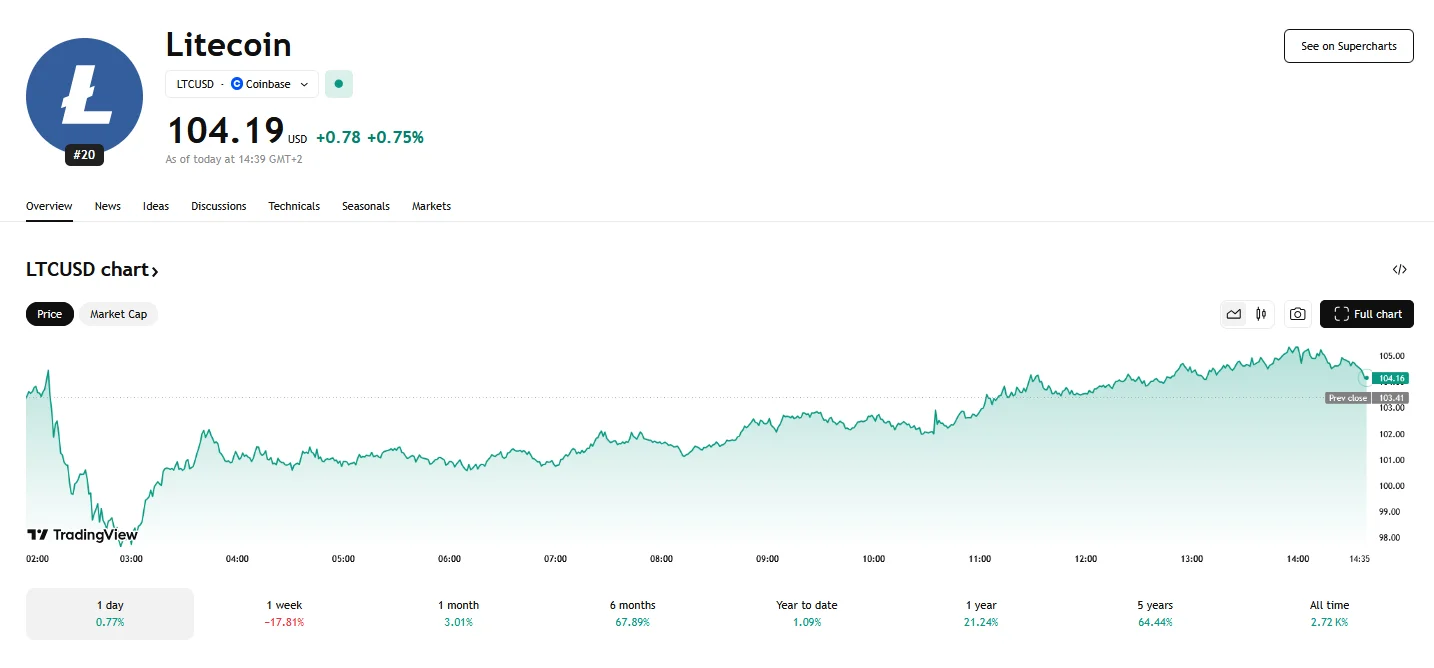

- Litecoin’s price plummeted below $98 on Friday, driven by its exclusion from the U.S. Crypto Strategic Reserve, sparking bearish sentiment.

- Litecoin’s value has rebounded from its previous lows, now fluctuating between $104 and $105.

- Addresses holding large LTC quantities accumulated 440,000 coins, indicating a strategic buying opportunity during the price dip.

Litecoin Surges Back Above $100 Post Crash

Litecoin’s market journey this week presented a narrative of a sharp decline followed by a recovery. Initially, the asset experienced a significant downturn on Friday, culminating in a drop below $98. This downward spiral was largely attributed to Litecoin’s conspicuous absence from the U.S. Crypto Strategic Reserve, a decision that triggered a wave of bearish sentiment among traders. However, at press time, Litecoin’s price hovers around $104 and $105.

The announcement of the strategic reserve, which focused on a select group of layer-1 blockchains, excluded Litecoin, leading to a surge in short positions. Data from CoinGlass revealed a stark imbalance, with short leverage positions far exceeding long positions, signaling a prevailing bearish outlook. This disparity highlighted the market’s reaction to Litecoin’s perceived diminished importance within the context of U.S. crypto policy. In addition, the upcoming White House Crypto Summit and the release of the U.S. Non-Farm Payrolls (NFP) reports are expected to influence market sentiment.

However, we should reiterate that Friday’s initial plunge was short-lived as technical indicators, which previously pointed towards oversold conditions, began to show signs of improvement. This shift was further bolstered by significant whale activity. This week saw addresses holding between 100,000 and 1 million LTC accumulating approximately 440,000 coins over the week, representing a $45 million influx. This accumulation suggested that large holders viewed the price dip as a strategic buying opportunity, indicating potential undervaluation.

The Market Value to Realized Value (MVRV) ratio, a metric used to assess unrealized profits and losses, also supported the notion that Litecoin had entered an accumulation phase. A decline in this ratio, particularly into negative territory, often signals a market bottom and precedes price rebounds. In Litecoin’s case, the MVRV ratio suggested that the cryptocurrency was undervalued, further attracting buyers.