Key moments

- Indian indices opened lower this Friday morning, reversing their two-session gains, due to IT and banking declines ahead of US jobs data.

- Sensex fell 217.51 points (0.29%) to 74,122.58, while Nifty50 dropped 21 points (0.09%) to 22,523 in the early trading session.

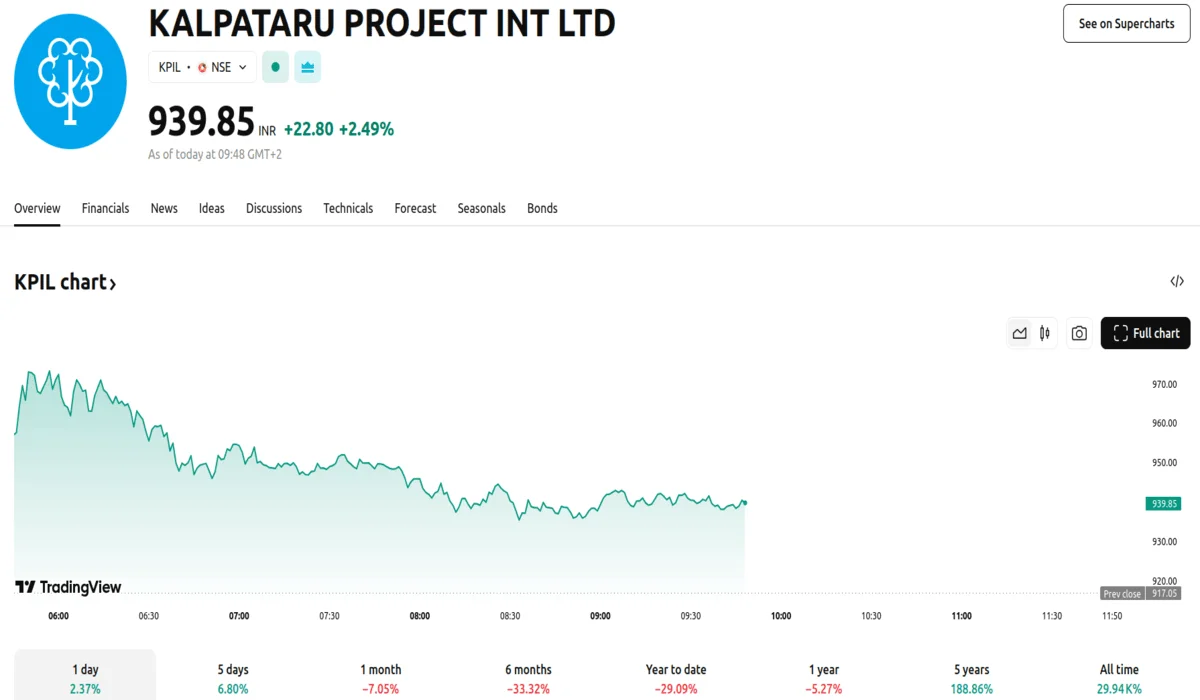

- Kalpataru Projects International and its subsidiaries reported a surge in new orders, contributing to a 6% increase in the company’s stock value.

74,122 Sensex Level Observed, 2,306 Crore Deal Pushes Kalpataru Projects Stock Upward

The Indian stock market started the Friday session on a downward trajectory, reversing the gains observed in the preceding two sessions. This shift occurred amidst a backdrop of fluctuating Asian markets and a noticeable downturn in the information technology and private banking sectors. The market’s performance is being closely monitored as investors anticipate the release of crucial United States labor market data, which is expected to provide further insights into the economic climate.

Early trading figures revealed a decrease in the BSE Sensex, which fell to 74,122.58, and a corresponding drop in the Nifty50 to 22,523. These figures were recorded at approximately 9:40 am local time and reflect the market’s immediate response to prevailing economic uncertainties. The preceding two trading sessions had seen both the Nifty50 and BSE Sensex climb by approximately 2% each, fueled by optimism about potential reductions in US tariffs and a decrease in crude oil prices.

The recent suspension of tariffs on the majority of goods from Mexico and Canada by the US administration has introduced further volatility into the global financial markets. Among the companies listed on the Sensex, Infosys, Zomato, HCL Tech, NTPC, and ICICI Bank experienced early declines, contrasting with the gains seen by Adani Ports, Tata Motors, Tata Steel, Reliance Industries, and L&T.

Kalpataru Projects International witnessed a significant surge in its stock value following the announcement of new orders and awards totaling Rs 2,306 crore. Additionally, Brigade Enterprises shares saw a rise following the launch of a residential project in Chennai with a revenue potential of 1,700 crore rupees. Sector-wise, the banking, fast-moving consumer goods, and IT sectors were the primary contributors to the market’s decline. However, the broader market indices, such as the Nifty Midcap 100 and Nifty Smallcap 100, demonstrated gains of 0.2% and 0.7%, respectively.

Investors are maintaining a cautious stance as they await the release of US jobs data and a speech by the Federal Reserve Chair, both scheduled for after-market hours. Market analysts have noted that the recent postponement of tariffs by the US administration indicates a preference for negotiated agreements over long-term high tariffs, recognizing the potential adverse effects on the US economy. The softening of the dollar index could be positive for the Indian market, particularly in light of India’s recovering growth and fair stock market valuations.

Despite the ongoing sell-offs by foreign institutional investors, the Indian market has shown resilience, with increased buying activity from domestic institutional investors, high-net-worth individuals, and retail investors. Technical analysis suggests that the Nifty may find support at the 22,500 level, with potential resistance at 22,600.

In the global context, most Asian markets reported declines, with the MSCI Asia ex Japan index experiencing a drop of 0.8%. Wall Street equities also saw a downturn, with the Nasdaq Composite confirming a correction. The global bond market continued its sell-off, following a significant increase in German 10Y Bond yields. Foreign institutional investors continued to sell equities, while domestic institutional investors increased their buying.

Crude oil prices remained relatively stable, although they are on track for their largest weekly decline since October, influenced by uncertainties surrounding US tariff policies and anticipated increases in production. In the currency markets, the Indian rupee weakened slightly, dropping 2 paise to trade at 87.14 against the US dollar, while the dollar index, which measures the greenback’s strength against a basket of 6 major currencies, experienced a minor decrease of 0.02%, settling at 104.04.