Key moments

- Gap Inc. reported a diluted earnings per share of $0.54, significantly exceeding the analyst estimate of $0.38.

- Operating margin improved by 120 basis points, reaching 6.2%, reflecting effective cost control.

- Comparable sales for Gap and Banana Republic brands increased by 7% and 4% respectively, after adjustments.

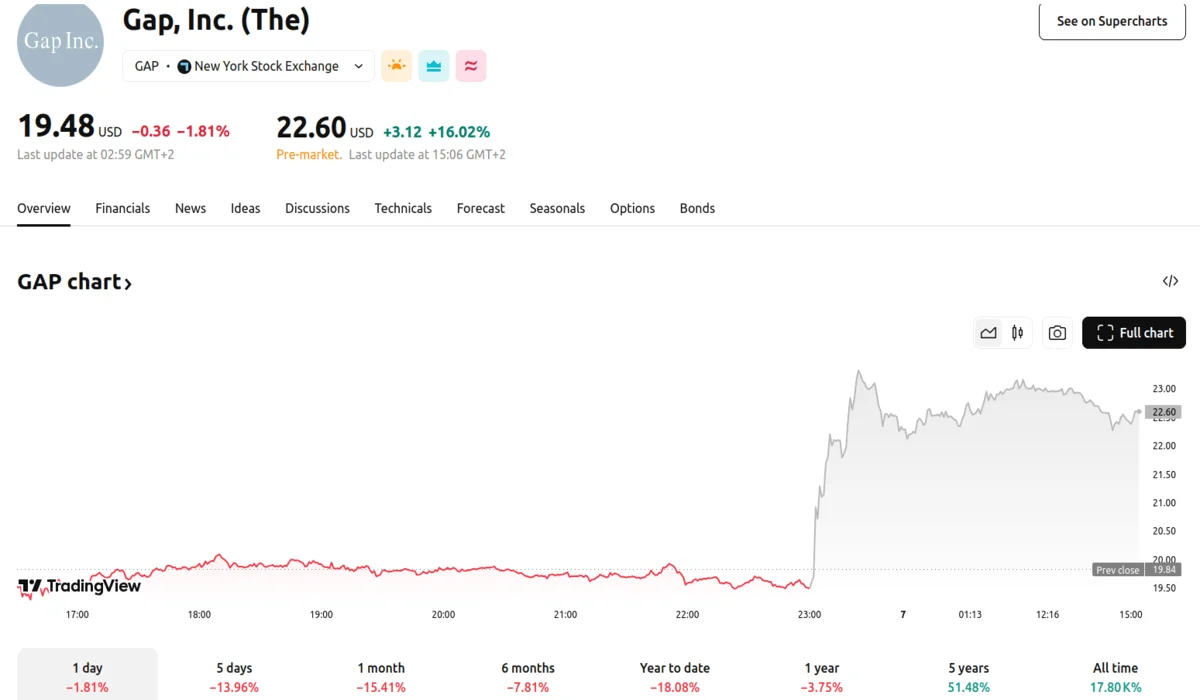

Gap’s Stock Rallies after Q4 Net Sales Beat of $4.15 Billion in Q4

Gap Inc., the parent company of popular retail chains such as Old Navy, Banana Republic, Athleta, and Gap, released its fiscal Q4 results yesterday, prompting a positive market reaction as the company’s stock surged 17% in pre-market trading on Friday. While net sales experienced a 3% YoY decline, landing at $4.15 billion, this figure still surpassed the analyst expectations of $4.07 billion. The company’s standout performance was in its earnings per share, which reached $0.54, notably higher than the predicted $0.38.

The company’s diverse brand portfolio, catering to a wide range of consumer preferences, has been a key asset. Gap’s omnichannel strategy, integrating both physical and online retail experiences, has also proven crucial in navigating the evolving retail landscape. In recent years, Gap has focused on expanding its international presence through franchises and optimizing its domestic operations.

During the fourth quarter, Gap demonstrated significant operational improvements. Operating income rose to $259 million from $214 million in the previous year, and the operating margin increased by 1.2 percentage points to 6.2%, a direct result of effective cost management. Net income also saw an 11.4% increase, reaching $206 million.

The reported decline in net sales was partially attributed to a calendar anomaly, as the fiscal 2024 lacked a 53rd week, which skewed YoY comparisons. When adjusted for this, comparable sales showed strong performance, with the Gap and Banana Republic brands seeing increases of 7% and 4%, respectively. However, Athleta experienced a 5% decline in sales. Inventory management remained efficient, with inventory levels increasing by only 3.6% despite ongoing supply chain challenges. Gap’s market cap currently stands at $7 billion.

The positive trajectory of Gap’s performance is further evidenced by its consistent same-store sales growth throughout 2024 and its optimistic outlook for 2025. The company projects net sales growth of 1% to 2% and operating income growth of 8% to 10%, indicating confidence in its future prospects. The positive evolution of brand strategies, including marketing and design improvements, have all contributed to Gap’s current success.