Key moments

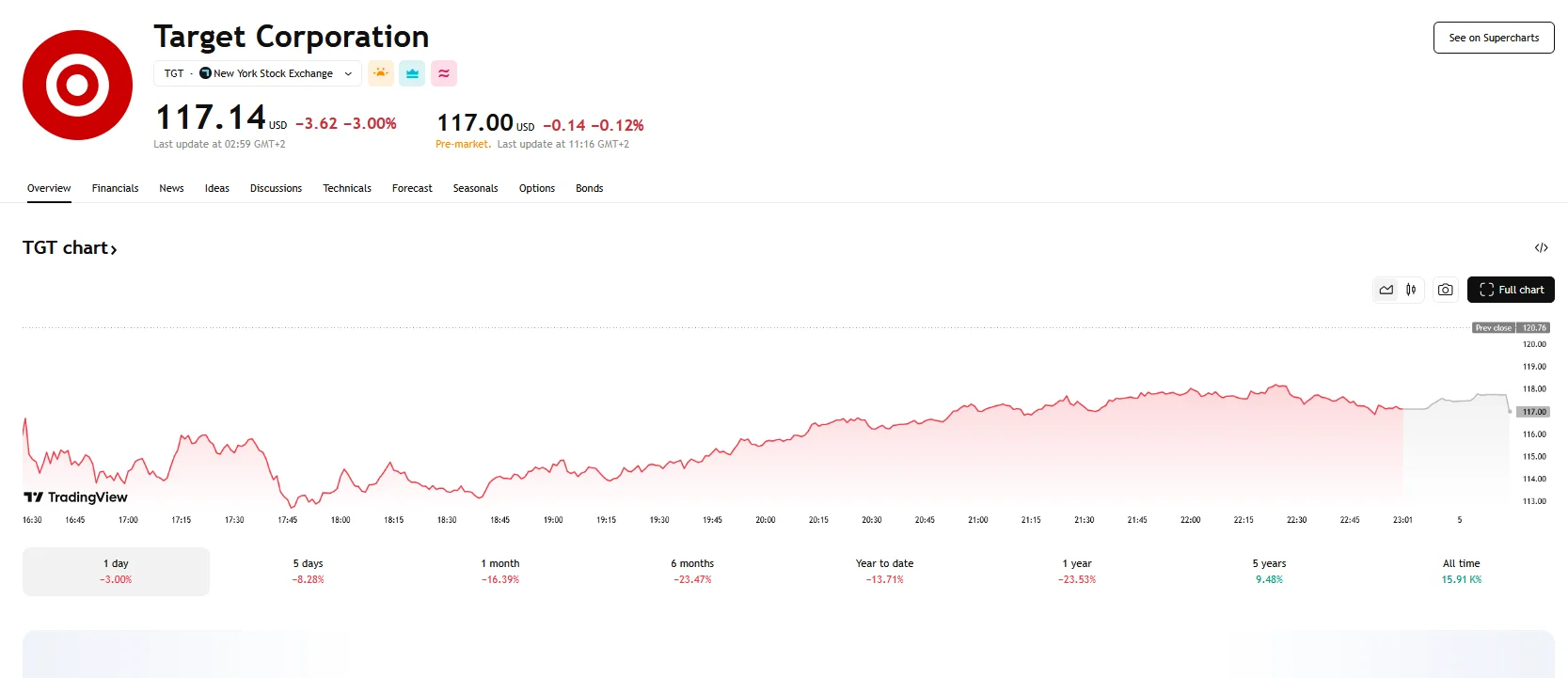

- Despite Target’s Q4 financial results exceeding analyst predictions in both earnings per share and revenue, the company’s stock value experienced a 3% drop, closing at $117.14.

- The market’s negative reaction was primarily driven by apprehensions over potential price increases stemming from tariffs levied on imports from Mexico and Canada, as well as general economic instability.

- Target’s projections for FY25, which included an adjusted EPS range slightly above consensus estimates and a projected 1% net sales growth, did little to alleviate investor concerns.

Target Stock Suffers as Tariff Fears Overshadow Earnings Report

Target Corporation’s share price fell by approximately 3% and closed at $117.14 on Tuesday, a reaction to the company’s fourth-quarter earnings report and subsequent forecasts. Despite surpassing analyst expectations for both earnings and revenue, concerns surrounding potential tariff impacts and general consumer uncertainty weighed heavily on investor sentiment. The stock price recovered slightly on Wednesday, going above $117.50, before dropping once again.

Target’s latest quarterly financial statement showcased results that outperformed market expectations. The company reported an adjusted profit of $2.41 per share, which was higher than the forecasted $2.25. Additionally, the company’s total sales reached $30.92 billion, surpassing the estimated $30.38 billion. The strong showing was driven by a rise in customer visits, substantial growth in online sales, and better-than-expected performance in non-essential product categories, including cosmetics, clothing, entertainment, sports equipment, and toys. Specifically, sales from stores open at least a year increased by 1.5%, while online sales saw a significant jump of 8.7%.

Despite the favorable financial outcomes, apprehensions about future cost increases stemming from tariffs and general economic instability dampened market enthusiasm. The chief executive, Brian Cornell, specifically cautioned about potential price escalations for fresh food products, pointing to the effects of tariffs levied against imports from Mexico and Canada. These factors, alongside widespread economic anxieties, played a role in the subsequent decrease in the company’s stock value.

Investor confidence was further muddled by Target’s financial forecasts for the coming year. The company projected earnings per share between $8.80 and $9.80, a slight increase over the anticipated $8.70. They also projected a roughly 1% growth in net sales, while expecting comparable sales to stay at the same level.

Notwithstanding the immediate negative response from the market, several financial analysts still hold a positive view of Target’s future. The company’s ongoing financial commitment to bolstering its online presence, improving its physical retail locations, and refining its distribution network are perceived as strong signs of potential future growth. Furthermore, the broadening of their product range and their dedication to creating a distinctive consumer experience are anticipated to foster increased customer retention.

Nevertheless, the uncertainty surrounding trade levies and their potential to influence customer purchasing habits continues to be a major source of apprehension. Given the retail sector’s inherent vulnerability to shifts in consumer behavior, any elements that could result in elevated costs or reduced expenditures are expected to negatively impact investor confidence.