Key moments

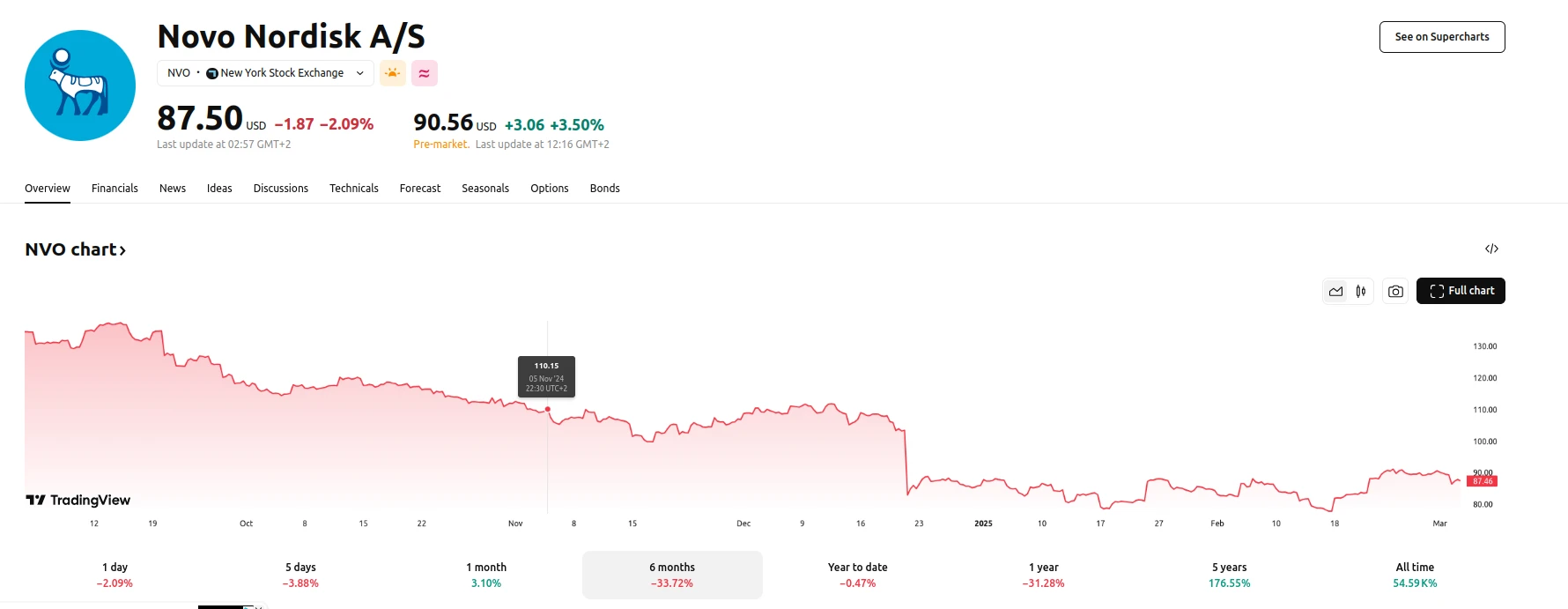

- Novo Nordisk stock drops approximately 40% from its June 2024 peak.

- The US FDA confirms sufficient production of Ozempic and Wegovy, ending shortage concerns.

- Competition from Eli Lilly’s tirzepatide intensifies, impacting Novo Nordisk’s market share.

Market Adjusts After Period of Explosive Growth, Competition Intensifies

Novo Nordisk, a pharmaceutical company known for its GLP-1 drugs like Ozempic and Wegovy, has experienced a significant market correction, with its stock value falling by roughly 40% since its peak in June of the previous year. This downturn follows a period of exceptional growth, where the company’s stock more than quintupled in value. The decline reflects a shift in investor sentiment, influenced by increasing competition and evolving market dynamics.

The company’s previous success was largely driven by the popularity of Ozempic and Wegovy, which leverage the active ingredient semaglutide. While semaglutide remains a market leader, sales growth has slowed compared to the previous year. Furthermore, competition from Eli Lilly’s tirzepatide, marketed as Mounjaro and Zepbound, has intensified. Clinical trials have indicated that tirzepatide may offer greater weight loss efficacy, leading to increased market share for Eli Lilly. This competitive pressure has contributed to investor concerns about Novo Nordisk’s future growth trajectory.

Despite the recent decline, Novo Nordisk continues to hold a strong position in the GLP-1 market. The FDA’s confirmation that the shortage of Ozempic and Wegovy has been resolved could potentially boost sales growth in the coming year. Additionally, the company is actively developing cagrisema, a combination treatment that aims to compete with tirzepatide. While initial trial results were mixed, ongoing research and development efforts may yield improved outcomes. Analysts predict that the overall GLP-1 drug market could reach $150 billion by 2030, suggesting ample room for growth. While the efficacy of tirzepatide has created a competitive market, it is still expected that demand will remain strong for semaglutide. The company’s current valuation suggests a moderate growth expectation, but future developments, particularly with cagrisema, could potentially lead to greater earnings growth.