Key moments

- A 3.54% decrease in the DAX occurred on March 4th, driven by US tariff announcements and a subsequent rush to safe-haven investments.

- To spur economic growth and enhance defense capabilities, Germany is adjusting its fiscal policy by introducing a €500 billion infrastructure fund.

- DAX futures surge by 465 points following the German fiscal policy announcement.

Fiscal Policy Shift and Infrastructure Fund Announcement Spark Market Optimism Amid Trade Tensions

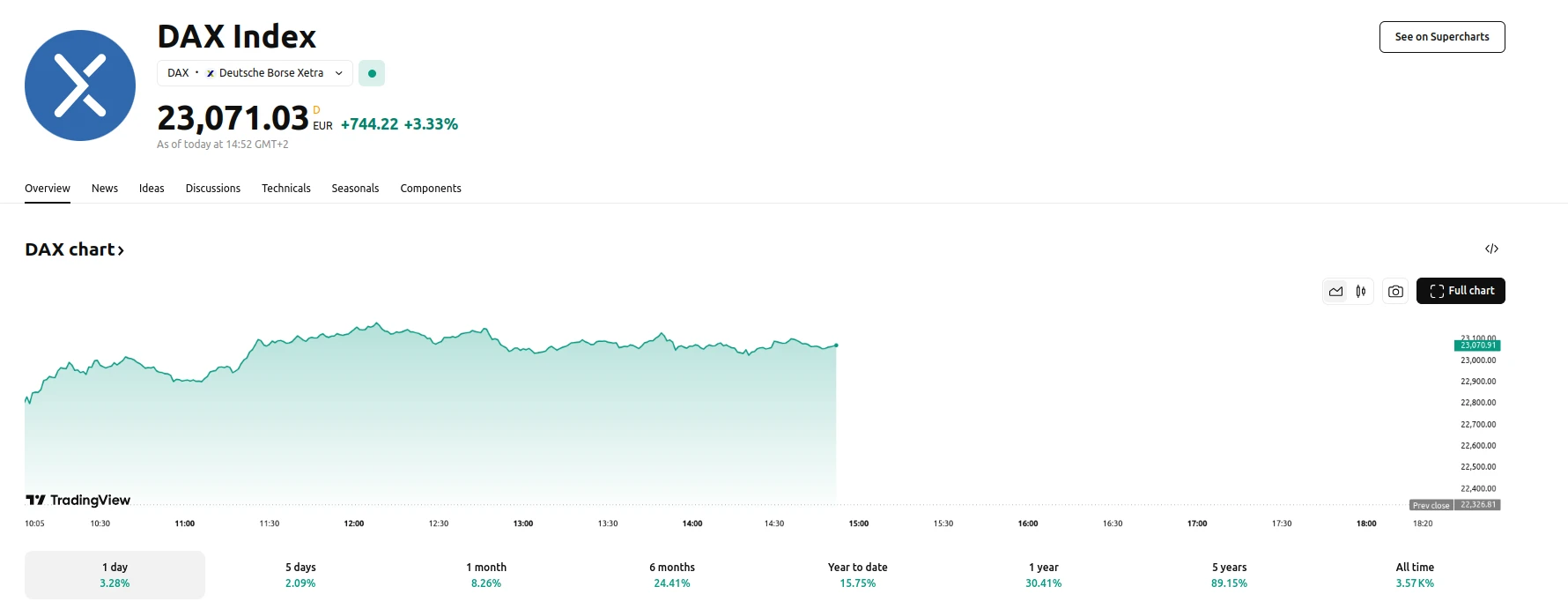

The German DAX index experienced significant volatility in recent trading sessions, reflecting the broader market uncertainty fueled by global trade tensions. On March 4th, the DAX saw a sharp decline of 3.54%, closing at 22,327, as President Trump’s tariff hikes on Canada, China, and Mexico prompted a flight to safe-haven assets. This sharp drop reversed the gains from the previous trading day, highlighting the sensitive nature of the market to geopolitical developments.

However, the subsequent trading day, March 5th, sees a dramatic shift in market sentiment following the announcement of Germany’s proposed fiscal reforms. The German government unveiled plans to loosen fiscal policy, proposing a €500 billion infrastructure fund aimed at stimulating economic growth and bolstering defense spending. This initiative includes exempting defense and security spending from fiscal limits, a move described by analysts as “extraordinary” and a significant shift in German economic policy. The DAX started trading at 22,804.81 EUR, with a daily trading range of 22,790.89 EUR to 23,176.39 EUR. This news triggered a substantial rebound in DAX futures, which surged by 465 points ahead of the European market opening.

The market’s positive reaction to Germany’s fiscal policy shift underscores the potential for government intervention to influence investor confidence. While external factors, such as US tariff policies and Federal Reserve outlook, continue to contribute to market volatility, the German government’s proactive measures are seen as a stabilizing force. The DAX technical indicators show that despite the recent fluctuations, the index remains above key moving averages, suggesting a potential for continued upward momentum. However, ongoing trade tensions and economic data releases will remain critical factors to watch in the coming days.