Key moments

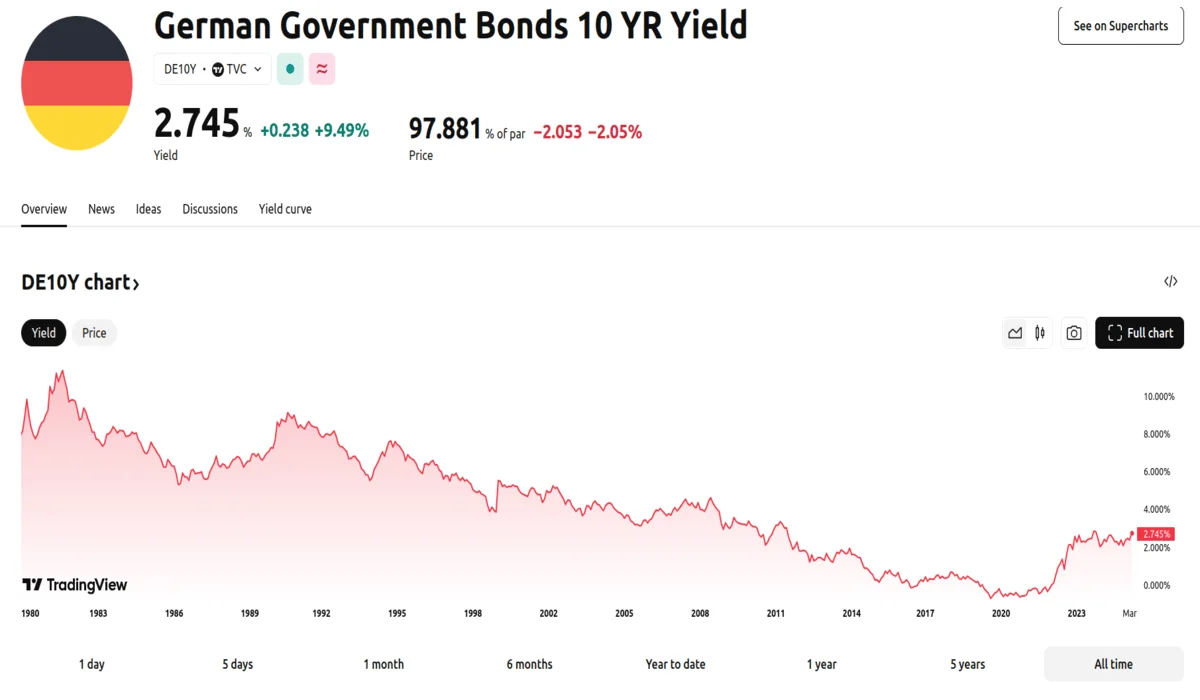

- The yield on the 10-year Bund increased by 0.25 percentage points, reaching 2.73%, marking the largest single-day surge since 1997.

- A new agreement exempts defense spending over 1% of GDP and creates a €500 billion infrastructure fund.

- Germany’s DAX index rose by 3.3%, recovering from previous losses influenced by U.S. tariffs.

10-Year Bond Surges Dramatically after Government Unveils Debt Rule Changes

German borrowing costs experienced a significant increase, with the yield on the 10-year Bund surging to 2.73%. This 0.25-pp rise represented the largest single-day movement in German bond yields since 1997. The surge occurred after a landmark agreement between local political factions to revise the nation’s fiscal policies.

The agreement, brokered by Friedrich Merz and the Social Democrats, involved exempting defense spending exceeding 1% of the GDP from Germany’s constitutional borrowing constraints. Additionally, a €500 billion off-balance sheet vehicle will be created to fund infrastructure investments through debt. Debt regulations for states will be relaxed.

Economists at Deutsche Bank characterized this agreement as “one of the most historic paradigm shifts in German postwar history,” drawing parallels to the fiscal expansion witnessed during German reunification. Analysts at Goldman Sachs projected that this package could potentially elevate German economic growth to 2% in the coming year, a significant increase from their previous forecast of 0.8%.

Meanwhile, the euro strengthened against the dollar, rising by 0.7% to $1.070, a level not seen since November. The German DAX index also experienced a substantial increase, surging by 3.3% as market confidence improved.

The political agreement, which requires a two-thirds majority in parliament for constitutional changes, is scheduled for a vote this month. While the Green party, a potential key ally, has expressed a need to review the details, analysts anticipate their eventual support.

Economists, including Sebastian Dullien, research director of the Düsseldorf-based Macroeconomic Policy Institute, predict a potential acceleration in German economic growth as early as the second half of the year. They foresee the possibility of achieving “normal growth rates of 2% per year.”

Germany’s economy had faced challenges, with two consecutive years of GDP contraction due to high energy costs, weak corporate investment, and low consumer demand. The nation’s debt, at approximately 63% of the GDP, remains lower than that of other major Western economies.

The market’s reaction to the fiscal policy changes was largely positive, with investors perceiving the increased spending as a catalyst for economic growth. German infrastructure companies, such as Heidelberg Materials (up almost 15%), Siemens Energy (up almost 9%), and Thyssenkrupp (up nearly 13%), experienced significant gains. The defense sector also saw growth, with Rheinmetall and Thales rising 3% and 7%, respectively.

The positive sentiment extended to other European markets, with the Stoxx Europe 600 index rising by 1.3%. Asian markets also rebounded following comments from U.S. Commerce Secretary Howard Lutnick, suggesting potential reductions in tariffs on Mexico and Canada. U.S. S&P 500 futures contracts increased by 0.2%, while the dollar weakened by 0.7% against a basket of six major currencies.