Key moments

- President Trump’s consideration of a 25% tariff on copper imports is causing significant market volatility and driving price increases.

- The potential tariffs have created a substantial price gap between Comex copper futures in New York and LME futures in London, reflecting the market’s anticipation of U.S. import restrictions.

- The prospect of tariffs has triggered a global search for copper supplies to be shipped to the U.S. before any levies are imposed.

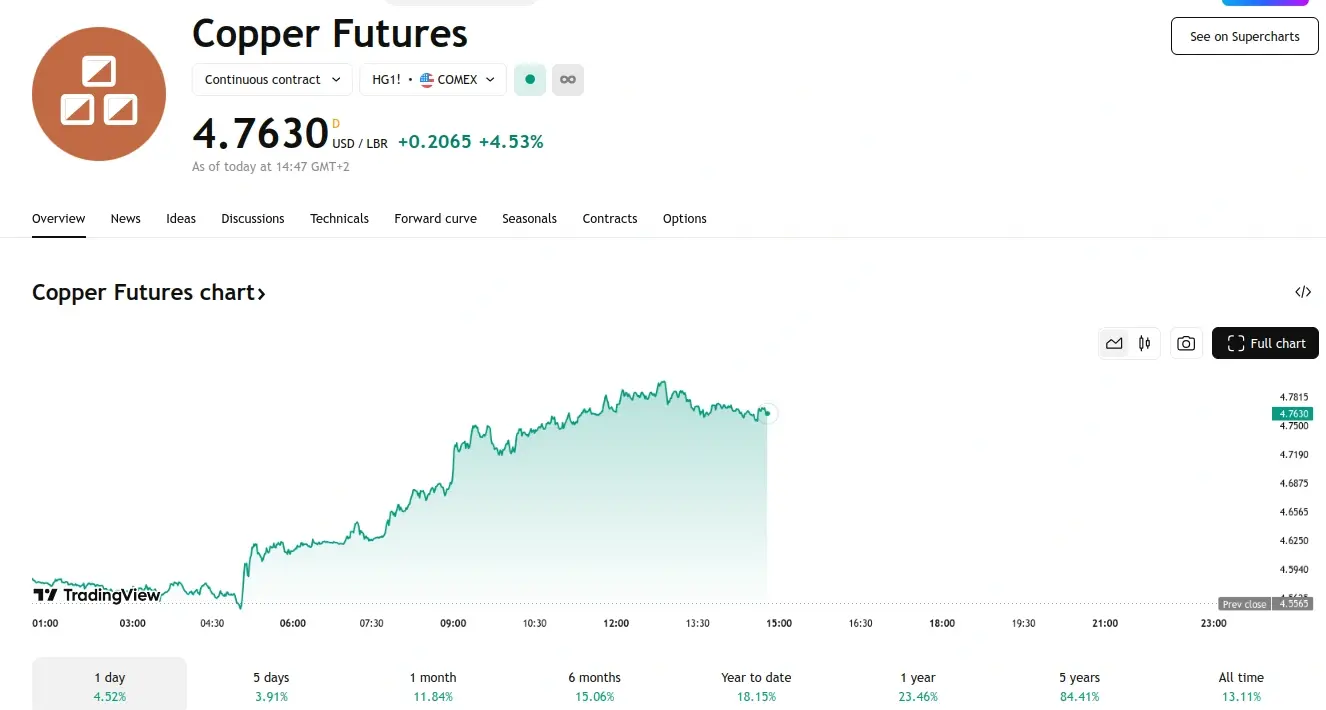

Copper Futures Rebounded Above $4.60 Per Pound Wednesday, Driven By Renewed Concerns Over Potential U.S. Tariffs

Copper futures rebounded above $4.60 per pound on Wednesday, erasing earlier losses as market participants remained focused on the potential for the U.S. President Donald Trump to impose tariffs on the metal. This recovery was largely driven by ongoing concerns stemming from Trump’s earlier initiation of an investigation into copper import tariffs, aimed at strengthening domestic production of this essential commodity. Copper’s critical role in sectors like electrification and defense underscores the significance of these potential tariffs. The U.S., reliant on limited domestic smelting capacity and substantial imports, faces potential supply constraints.

Simultaneously, investors reacted to China’s announcement, the world’s largest copper consumer, which reaffirmed its 2025 GDP growth target at approximately 5%, maintaining consistency with the previous year’s objective. This stability in China’s economic outlook provided a degree of market reassurance amidst prevailing trade uncertainties.

Copper prices experienced a significant surge, exceeding 5% in New York trading, outpacing global benchmarks, following President Trump’s indication that copper imports could be subject to a 25% tariff. Trump’s remarks, delivered during a congressional address on Tuesday, triggered a rapid increase in Comex copper futures during Asian trading hours. Traders reacted to the possibility of higher-than-expected tariffs being implemented sooner than anticipated.

Trump’s announcement last week, detailing a Commerce Department investigation into copper imports on national security grounds, had already propelled Comex prices, widening the gap with London and Shanghai equivalents. While the investigation is projected to take months and the specific tariff rates remained initially undisclosed, Trump clarified his intention to impose a 25% levy on copper, aligning it with aluminum and steel tariffs.

“A 25% tariff was clearly not what the market was expecting before those comments, and now traders are scrambling to price in the correct level, whatever that might end up being,” noted Ole Hansen, head of commodity strategy at Saxo Bank AS. “Whatever the final tariff is, the disruption to global trade flows is very real.”

The Comex surge also influenced the London Metal Exchange (LME), with three-month copper prices rising by up to 2.4%. The persistent premium of New York futures over LME prices, reflecting anticipated tariffs, was further amplified by Wednesday’s surge, resulting in Comex copper trading approximately 11.5% higher than LME, approaching the 13% peak observed last month. This price differential has already spurred a global search for copper supplies to be shipped to the U.S. before tariffs are imposed, and traders are expected to intensify these efforts.