Key moments

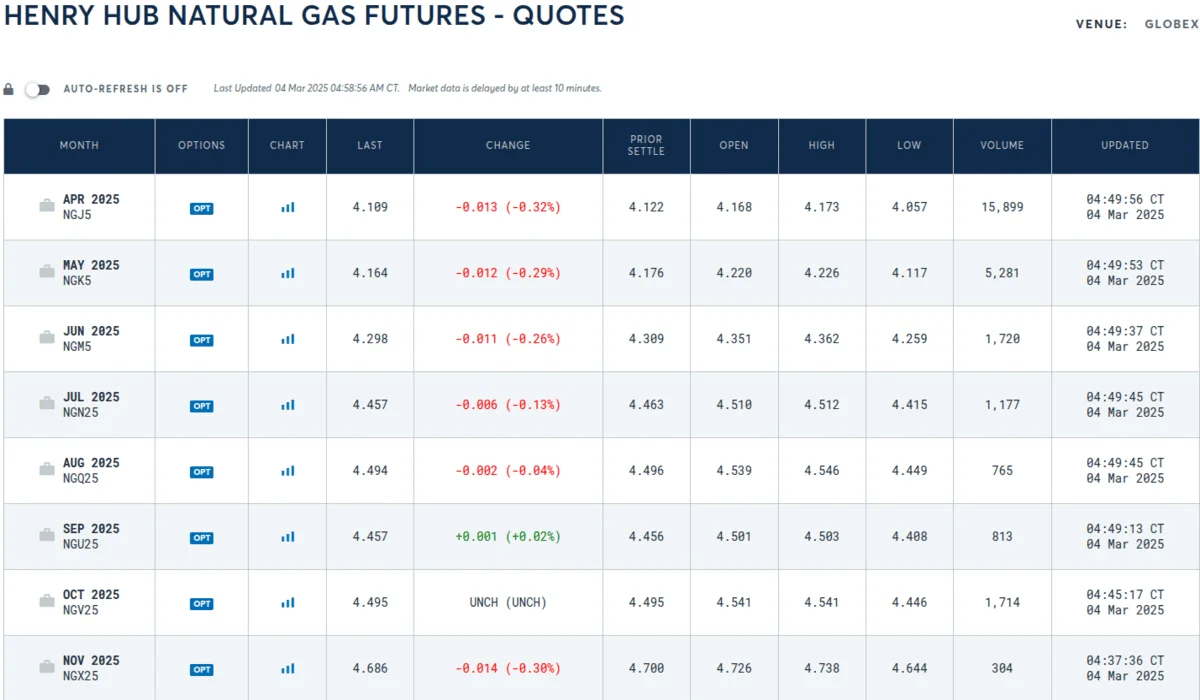

- Front-month gas futures for April delivery on the New York Mercantile Exchange increased by 7.5%, settling at $4.122 per mmBtu.

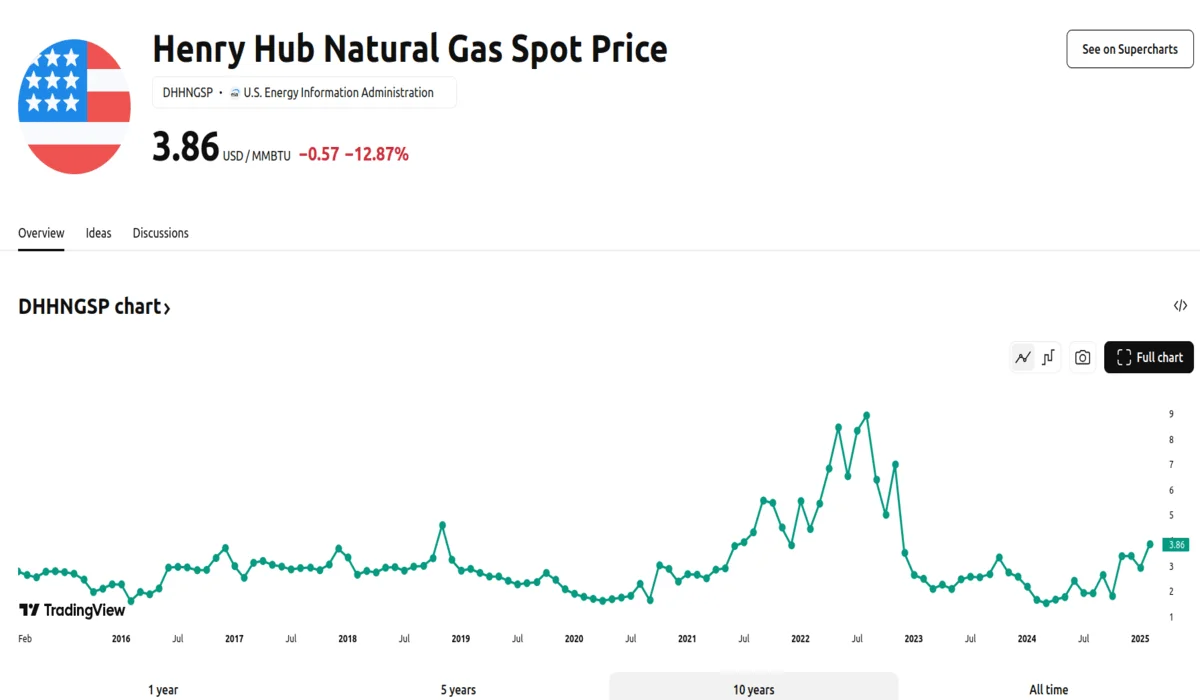

- Henry Hub gas prices reached $3.98 per mmBtu, marking a recovery from a two-week low of $3.74 per mmBtu observed a week prior.

- Energy companies have significantly depleted gas storage, with current stockpiles approximately 12% below the five-year average.

Henry Hub Gas Prices Recover from Two-Week Low

The United States natural gas market experienced a notable surge in futures prices, driven by record-breaking liquefied natural gas (LNG) export flows and heightened demand forecasts. Front-month gas futures for April delivery on the New York Mercantile Exchange saw a 7.5% rise, closing at $4.122 per mmBtu. This increase occurred despite forecasts of mild weather conditions through mid-March, which typically reduce the need for withdrawing gas from storage.

Henry Hub gas prices demonstrated a recovery, reaching $3.98 per mmBtu, up from a two-week low of $3.74 per mmBtu recorded the previous week. The surge in prices is partly attributed to the United States’ continued role as a leading LNG exporter. In February, LNG export flows reached a new record of 15.6 billion cubic feet per day (bcfd), bolstered by newly launched units at Venture Global’s Plaquemines LNG plant.

The Plaquemines LNG plant, having achieved first LNG production within 30 months of its final investment decision, is poised to become one of the world’s largest LNG facilities once fully operational. Venture Global’s rapid development of LNG infrastructure underscores the United States’ commitment to meeting the growing global demand for natural gas, particularly in Europe.

Despite anticipated mild weather, gas demand in the Lower 48 states is projected to be higher than previously estimated. Moreover, gas storage levels remain approximately 12% below the five-year average, a consequence of the substantial withdrawals during earlier periods of extreme cold.

The United States has solidified its position as the world’s leading LNG supplier, surpassing Australia and Qatar. This growth is fueled by increased global demand and geopolitical factors, including the ongoing situation in Europe.

Average gas output in the Lower 48 U.S. states has risen to 105.8 bcfd in March, exceeding the record of 104.7 bcfd set in February. The amount of gas flowing to major U.S. LNG export plants has also increased, reaching an average of 15.8 bcfd in March.