Key moments

- Intel’s stock initially surged during early trading hours due to reports that Nvidia and Broadcom are still testing its 18A chip fabrication process.

- Investor expectations of a major deal between Intel and TSMC were dashed when TSMC announced a $100 billion investment in the U.S. semiconductor industry without any mention of Intel.

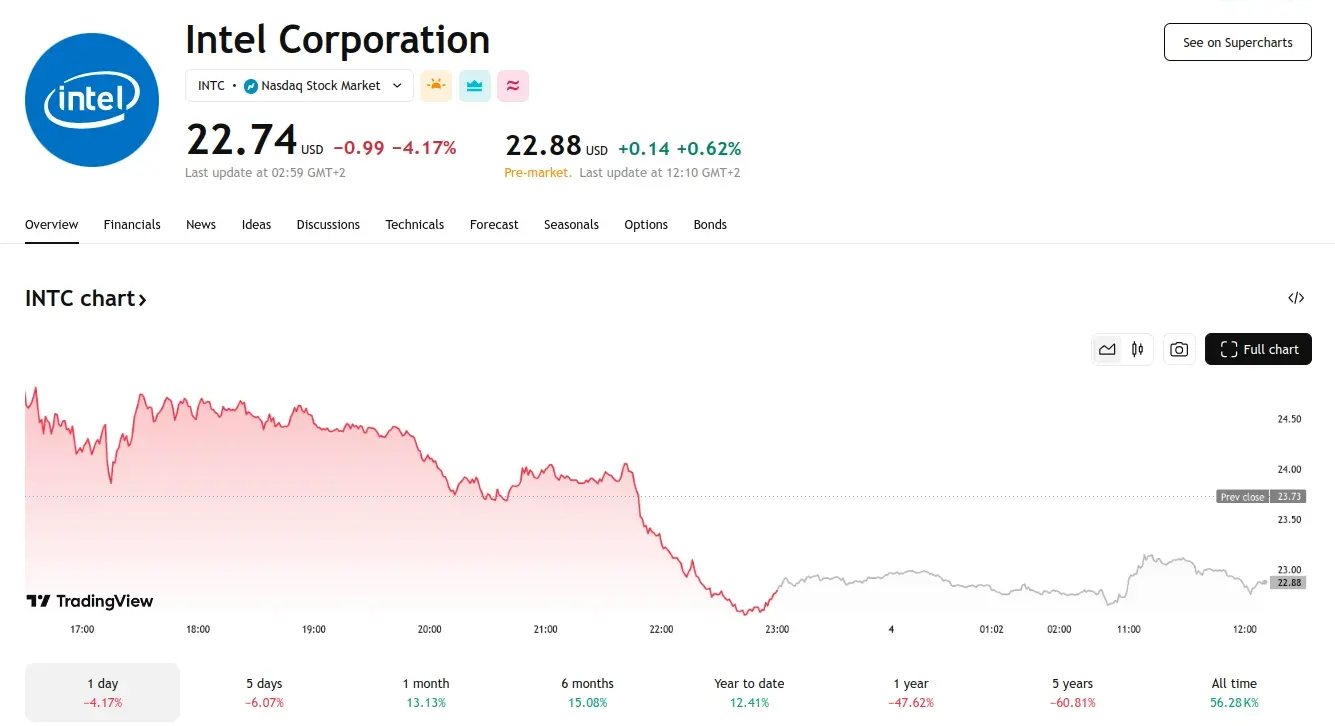

- Intel’s stock experienced significant intraday swings, initially rising on positive news but ultimately closing down 4.2%.

Intel’s stock experienced significant volatility, ultimately closing down 4.2% in a challenging trading session for the technology sector, despite an earlier surge of up to 5.5%.

Initially, Intel’s stock defied the broader market trend, driven by two positive developments. Reports surfaced that Nvidia and Broadcom are continuing to evaluate Intel’s 18A chip fabrication platform, a crucial component of Intel’s foundry strategy. This news sparked optimism, as securing contracts from these influential AI chip designers would be a major win for Intel’s manufacturing business. Additionally, investors anticipated a potential major announcement involving Intel and Taiwan Semiconductor Manufacturing (TSMC) following a meeting between TSMC’s CEO and President Trump. However, the announcement that came was not what investors anticipated, triggering a sharp reversal in Intel’s stock.

The report from Reuters indicated that Nvidia and Broadcom are still in the testing phase of Intel’s 18A process, assessing its suitability for their chip designs. This ongoing evaluation is significant, as Intel has yet to secure substantial external contracts for its 18A technology. The continued interest from these key AI chip designers provided initial support for Intel’s stock, leading investors to believe further positive news was forthcoming.

TSMC’s CEO, C.C. Wei, met with President Trump, and the outcome was a $100 billion investment announcement in the U.S. semiconductor industry by TSMC.

Given TSMC’s previous consideration as a potential buyer or partner for Intel’s foundry business, investors speculated that a deal between the two companies would be announced. However, no such announcement materialized, leading to a rapid sell-off of Intel’s stock. The absence of a deal between Intel and TSMC disappointed investors, prompting a swift shift in market sentiment and a significant drop in Intel’s share price.