Key moments

- Tesla’s stock is experiencing its second-worst monthly performance ever.

- Investors are worried about Musk’s time management due to his increased public presence and political associations.

- Tesla’s plans to launch a robotaxi service in 2025 and its attempts to secure permits for self-driving operations in California may lead to potential turnaround.

Tesla Shares Plummet in Premarket Trading While Musk’s Multitasking Raises Concerns

Tesla’s stock is currently experiencing a significant downturn, poised to record its second-worst monthly performance in its history. Investors are actively seeking catalysts that could reverse this trend and are looking to CEO Elon Musk for decisive leadership.

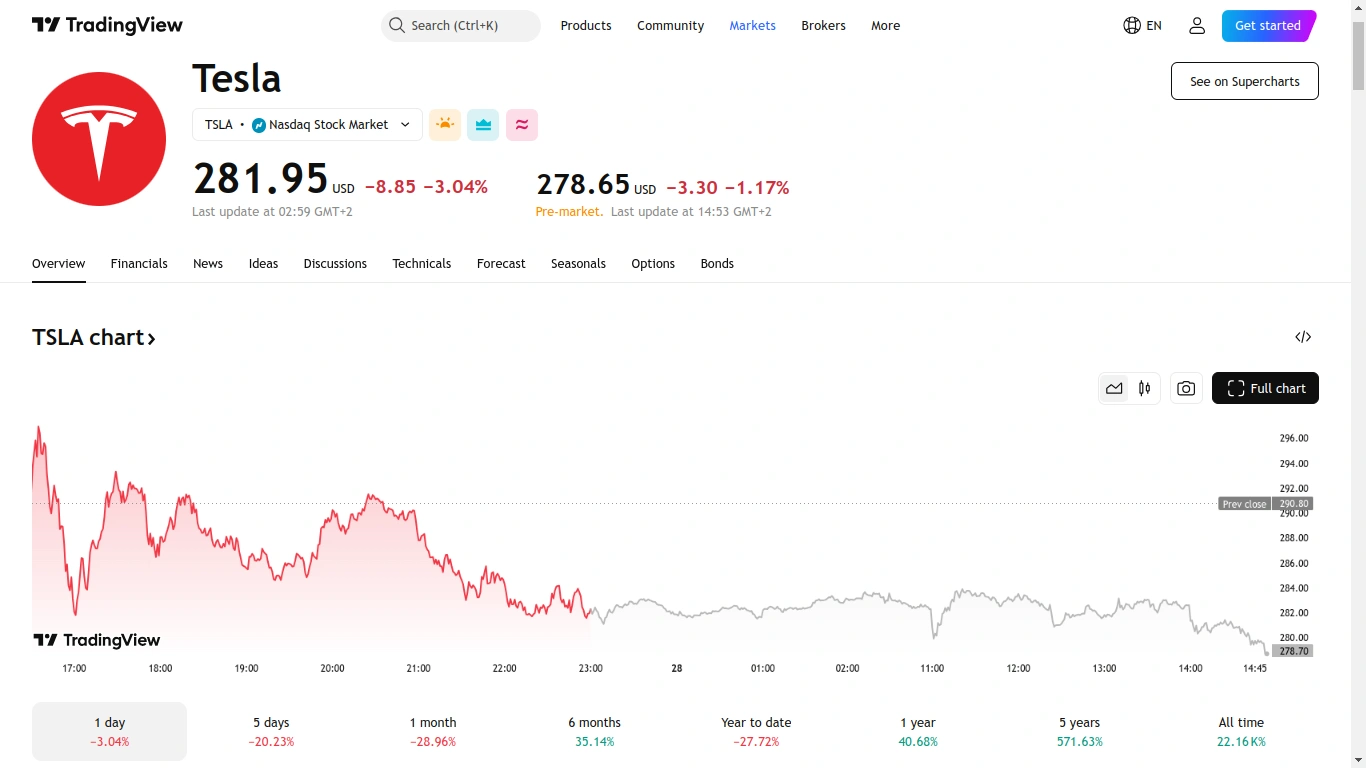

In premarket trading, shares of the electric vehicle manufacturer slightly decreased by 0.3%, reaching $280.91, while futures for the S&P 500 and the Dow Jones Industrial Average both saw increases of approximately 0.3%.

Regardless of the day’s trading outcome, February has proven to be an exceptionally challenging month for Tesla’s stock. Leading up to Friday’s trading, the stock had declined in 14 out of the month’s 19 trading days, including a consecutive six-day drop. Tesla’s stock has plummeted by 30%, placing it on track for its second-worst monthly performance ever, only surpassed by the roughly 37% drop experienced in December 2022.

A notable connection exists between the stock’s performance in 2022 and 2024. The December 2022 decline occurred shortly after Musk finalized his acquisition of the social media platform Twitter, later rebranded as X. At that time, investors expressed concerns regarding Musk’s ability to effectively manage his time and whether he could successfully integrate another business without adversely impacting the performance of his automotive company.

These concerns eventually subsided, and Tesla’s stock subsequently rallied by 100%.

Currently, investors observe Musk’s frequent presence in Washington, D.C., and are once again expressing apprehension about his time management. They are also concerned about the potential impact of the CEO’s close association with former President Donald Trump on Tesla’s traditional customer base, which consists largely of politically left-leaning consumers with a focus on environmental sustainability.

The accumulation of distraction risks is a growing concern, as noted by Wedbush analyst Dan Ives. “Investors have patience but this is starting to tip the scale and it’s weighing on shares along with brand issues related to Musk/Tesla,” he added. “Perception becomes reality on Wall Street.”

The development of self-driving cars is expected to be a critical factor. Tesla intends to launch an autonomous robotaxi service in 2025. Bloomberg reported on Thursday that Tesla has submitted an application for a permit to operate self-driving vehicles in California.

However, the specifics of Tesla’s application remain unclear. The company already possesses a permit to conduct tests of self-driving cars with a safety driver present. Furthermore, the California Department of Motor Vehicles has stated that it has not received any application for a self-driving license. Tesla has not responded to requests for comments regarding its permit activities in the state.