Key moments

- Gold is set to post its biggest weekly drop in over three months, down 2% for the week, due to a stronger US dollar.

- The dollar index is poised for a 0.7% weekly gain, while the US Federal Reserve’s monetary policy trajectory remains uncertain.

- Some analysts suggesting that the PCE data may not significantly shift rate expectations, potentially limiting gold’s decline.

A stronger dollar, which is poised for a 0.7% weekly gain, is making gold more expensive for international buyers, contributing to the metal’s decline

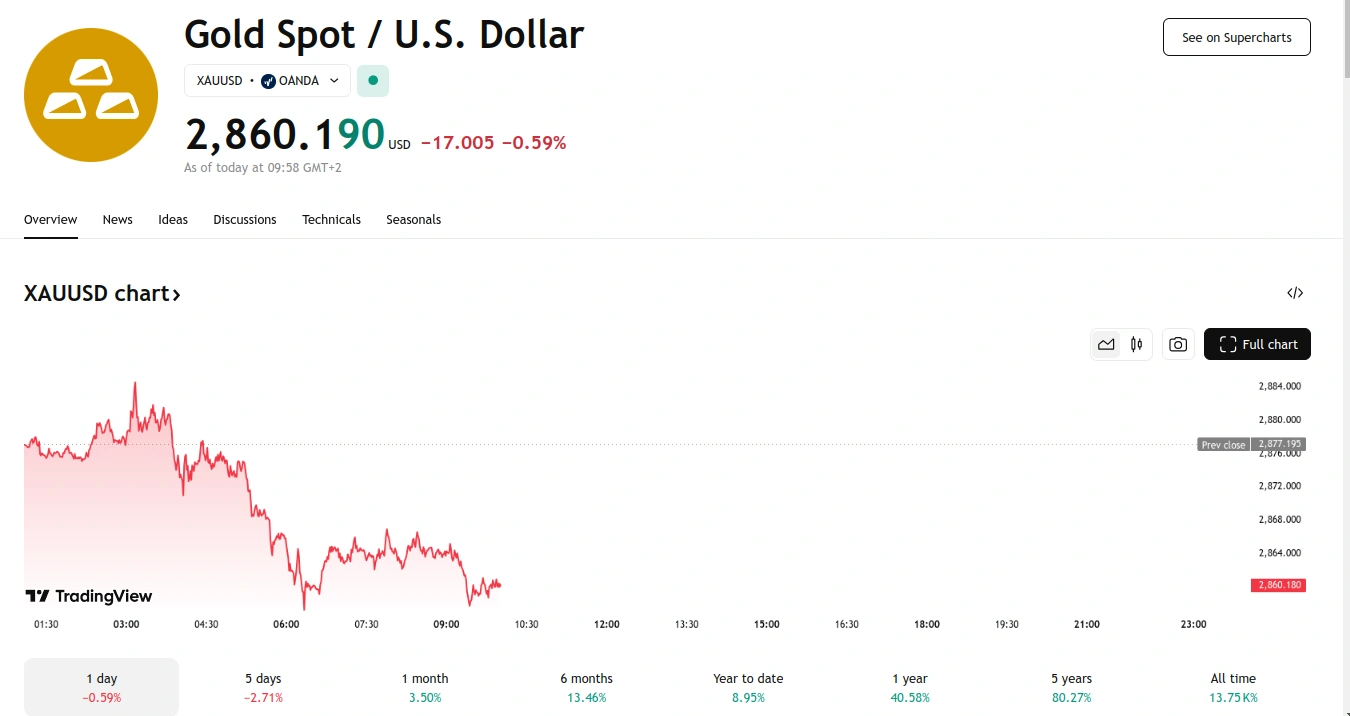

Gold prices continued to slide on Friday, putting the precious metal on track for its largest weekly drop since November. The decline is largely attributed to a strengthening US dollar, which has made gold more expensive for foreign investors. As of 0232 GMT, spot gold had fallen 0.1% to $2,874.69 per ounce.

The metal is currently down 2% for the week, marking its first weekly decline after eight consecutive weeks of gains. US gold futures also eased 0.3% to $2,886.80. The dollar index, which measures the greenback’s value against a basket of currencies, is set to gain 0.7% for the week, further contributing to gold’s decline.

According to IG market strategist Yeap Jun Rong, “Gold’s safe-haven status may not be enough to shield it from profit-taking activities, especially with the uncertainty surrounding trade and a stronger US dollar.” The comments come as US President Donald Trump announced plans to impose tariffs on Mexican and Canadian goods, as well as an additional duty on Chinese imports.

The Philadelphia Federal Reserve Bank President Patrick Harker has expressed support for maintaining current interest rates, which could impact gold’s appeal. As a non-yielding asset, gold tends to lose its luster when interest rates rise. Investors are now eagerly awaiting the release of the Personal Consumption Expenditures (PCE) data, the Federal Reserve’s preferred measure of inflation, which is scheduled for 1330 GMT.

Yeap noted that the PCE data may not significantly impact rate expectations, as other inflation indicators suggest that inflation could remain under control. This could limit any potential shift in rate pricing, and subsequently, gold’s value. As the market awaits the release of this critical data, investors are left wondering if now is a good time to invest in gold.