Key moments

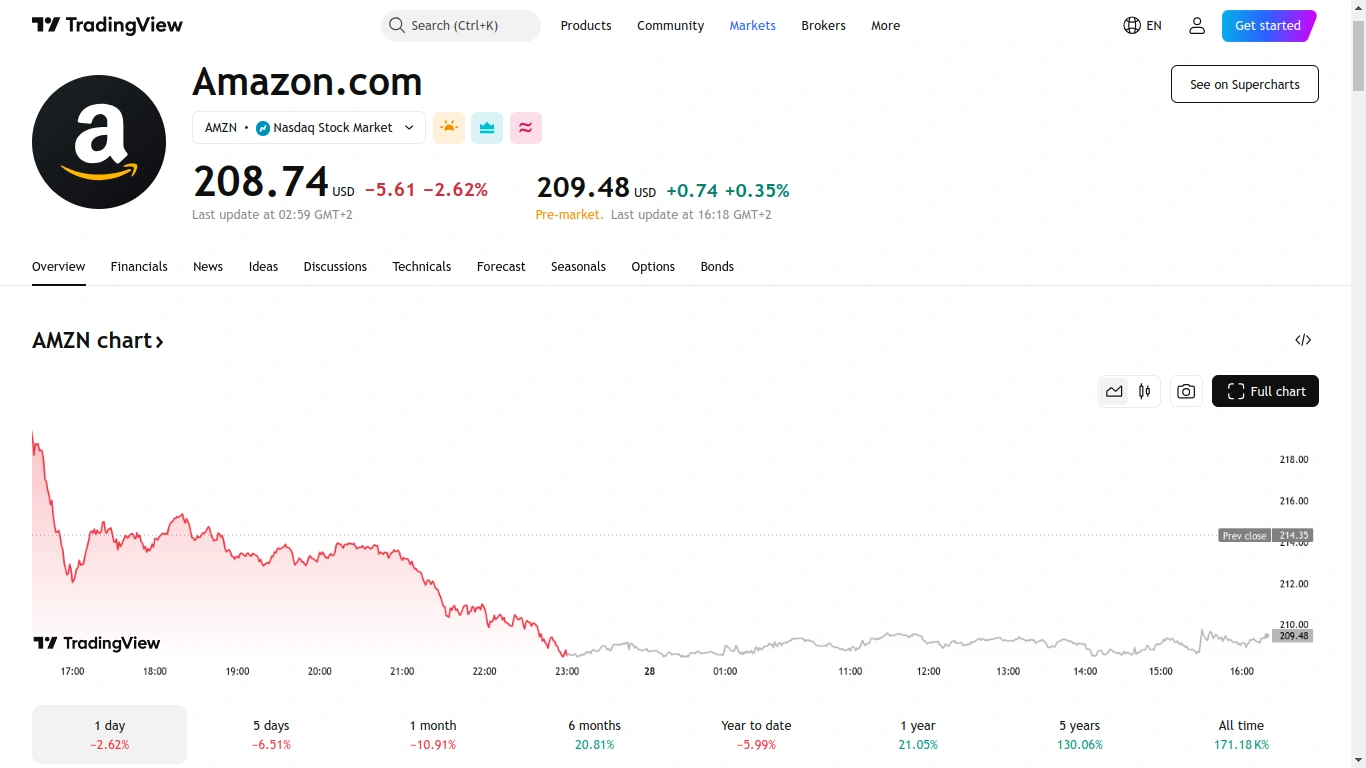

- Amazon’s stock experienced a 12% drop in value over the past month.

- The highly anticipated Alexa+ AI update failed to revive Amazon’s struggling shares.

- Amazon’s decline is part of a wider trend affecting the “Magnificent Seven” tech stocks, influenced by a cooling macroeconomic climate and uncertainties surrounding economic policies.

Amazon’s Stock Plunge Underscores Market Challenges as Shares Continue Decline Despite New Launch

In a week marked by widespread declines across the technology sector, Amazon’s stock has notably underperformed, experiencing a substantial 12% drop in value over the past month. This downturn persists despite the company’s efforts to stimulate investor interest through the unveiling of the Alexa+ AI update, a long-anticipated product launch that, surprisingly, failed to bolster Amazon’s shares, which further diminished in after-hours trading on Thursday, February 27th.

Analysts’ projections for Amazon.com Inc.’s stock trajectory present a range of perspectives. While some express skepticism, the prevailing sentiment on Wall Street remains optimistic, particularly regarding the near-term outlook.

During Thursday’s trading session, all members of the “Magnificent Seven” Big Tech cohort witnessed declines. Among them, Nvidia suffered the most significant setback, despite reporting robust fourth-quarter earnings, as its first-quarter forecast fell short of expectations, leading to an 8.5% drop in its stock price. Notably, Amazon, Alphabet, Microsoft, Nvidia, and Tesla are all trading at least 10% below their respective 52-week highs.

This prevailing bearish trend reflects a moderating macroeconomic environment, with the uncertainties surrounding Donald Trump’s economic policies tempering the post-election rally that had particularly benefited American technology stocks.

Amazon continues to aggressively pursue advancements in artificial intelligence, recently unveiling Alexa+, an enhanced version of its Alexa feature. Launched on Wednesday, February 26th, Alexa+ integrates generative AI capabilities, enabling the platform to engage in conversational interactions rather than relying on rigid, predefined commands.

In terms of search and information retrieval, Alexa+ functions as a voice-activated chatbot. However, its extensive integration with numerous applications and services facilitates more action-oriented applications. Discussing the implications for Amazon’s business, CEO Andy Jassy expressed confidence that the more sophisticated Alexa will generate direct revenue streams.

Amazon’s investments in cloud computing and AI through Amazon Web Services (AWS) remain substantial. Additionally, the company is expanding its same-day delivery services and has bolstered its entertainment portfolio with the acquisition of MGM Studios, securing the James Bond franchise. Despite these advancements, Amazon faces headwinds, including ongoing labor disputes. The company’s most recent quarterly results showcased strong overall performance, with AWS serving as a primary catalyst for growth.