Key moments

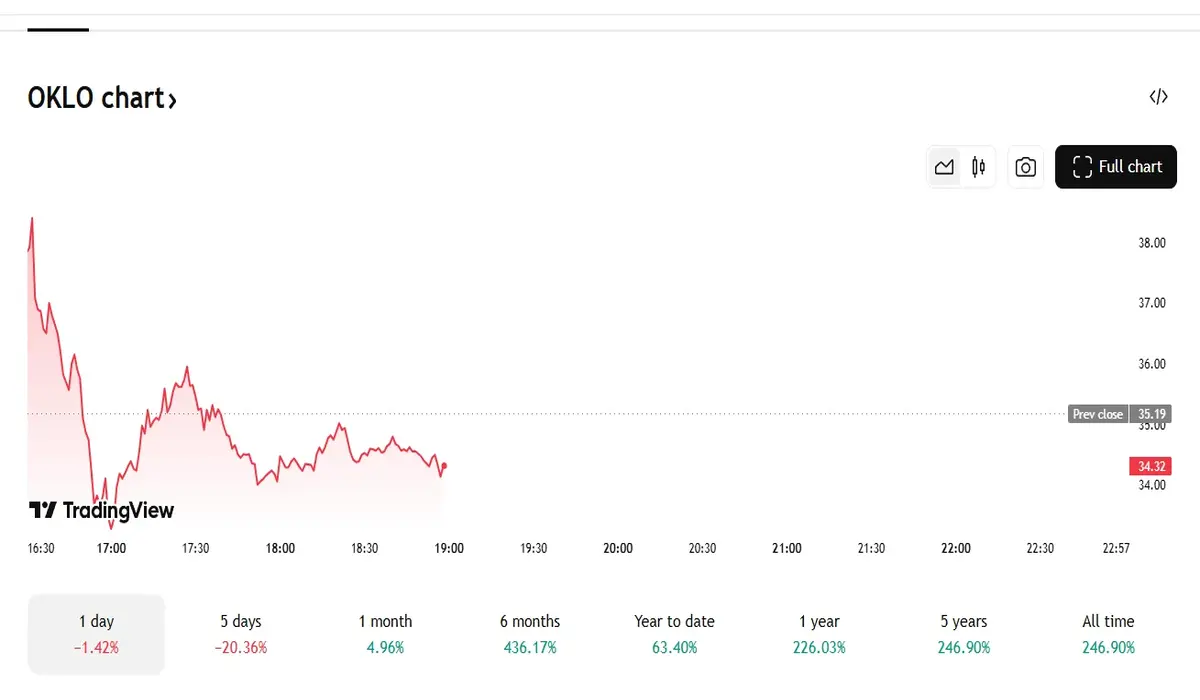

- Oklo’s share price experienced a significant 9.73% jump to $35.19 on Wednesday.

- The price soared as a result of Oklo’s inclusion in the U.S. Department of Energy’s Voucher Program.

- Oklo’s impressive year-to-date price performance of 46.77% and market capitalization of $3.92 billion underscore its growing influence in the energy sector.

In a market characterized by mixed sentiments and cautious investor behavior, Oklo Inc. (NYSE: OKLO) emerged as a standout performer on Wednesday, with its shares surging by 9.73% to close at $35.19. This impressive gain came amid broader market uncertainty, driven by U.S. President Donald Trump’s fluctuating tariff policies and other economic concerns. The catalyst behind Oklo’s rally was its recent inclusion in the U.S. Department of Energy’s (DOE) Voucher Program.

Founded with the mission to provide scalable, cost-effective, and sustainable energy solutions, Oklo has positioned itself as a leader in the development of next-generation nuclear power systems. The company focuses on fast reactor designs, which are known for their efficiency, safety, and ability to produce clean energy with minimal environmental impact.

The DOE’s Voucher Program is designed to accelerate the commercialization of cutting-edge technologies, providing financial support for advanced material characterization and real-world testing. By leveraging DOE-funded vouchers, Oklo aims to validate high-performance materials that are critical to the success of its reactor designs.

According to Oklo’s CEO, Jacob DeWitte, this partnership will help with the company’s broader goal of delivering clean energy solutions that meet the evolving needs of its customers. With a pipeline of 14 gigawatts of announced customers and partners, Oklo is well-positioned to capitalize on the increasing demand for sustainable energy across various industries.

This week’s announcement sparked a wave of optimism among investors, leading to the notable increase in the company’s stock price. Analysts have also revised their outlook on Oklo, citing the potential for accelerated development and commercialization of its technologies as a key driver of future growth.

The bullish sentiment surrounding Oklo is further evidenced by increased trading activity and heightened implied volatility in its stock. Investors are clearly betting on the company’s ability to deliver on its promises, particularly as it prepares to release its upcoming earnings report. With a year-to-date price performance of 46.77% and a market capitalization of $3.92 billion, Oklo is rapidly gaining momentum as a leading player in the clean energy sector.