Key moments

- Elon Musk’s net worth has declined by over $100 billion (25%) since mid-December

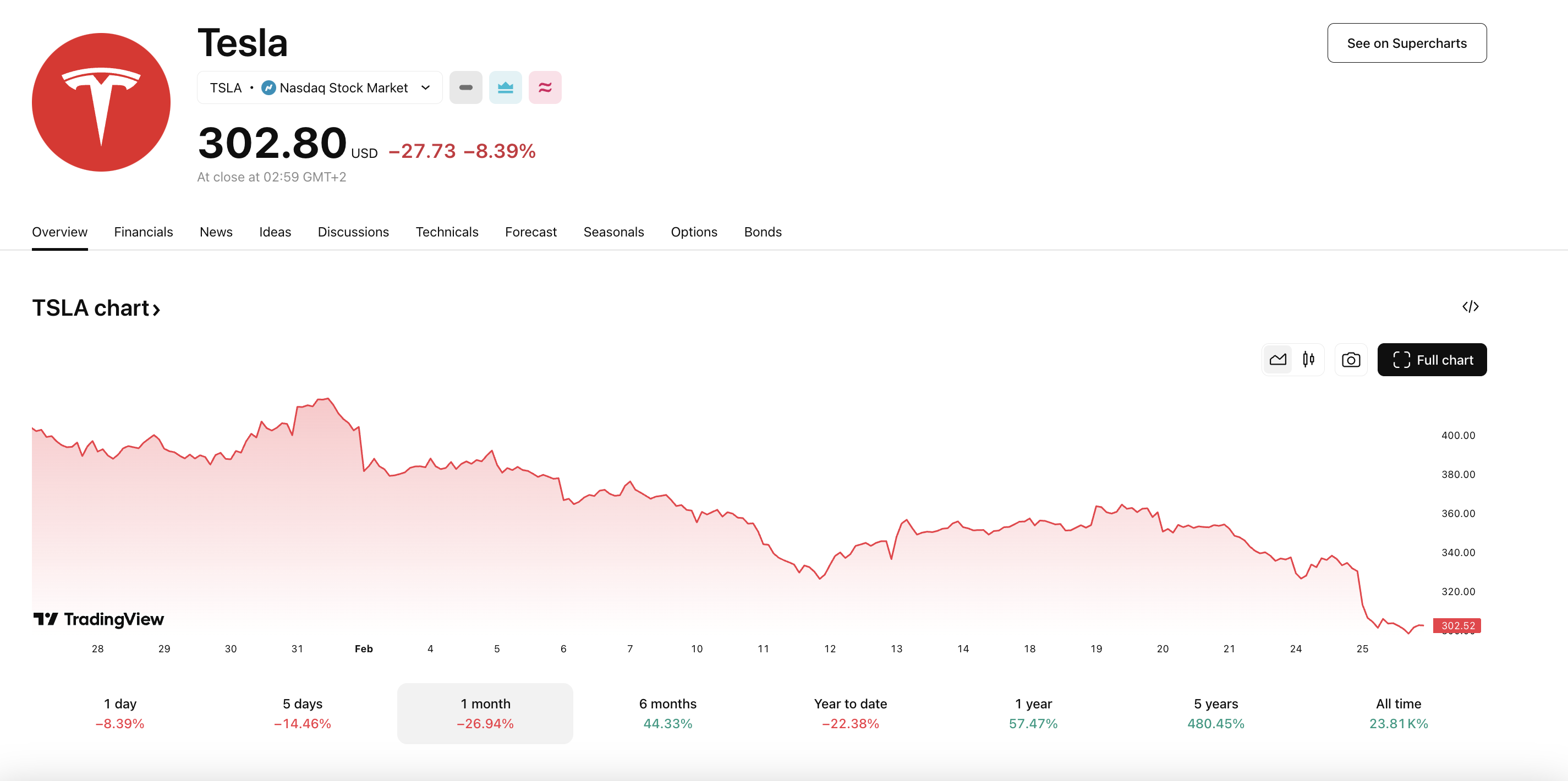

- Tesla’s stock has dropped 25% year-to-date and 8% on Tuesday, closing at $302.80.

- The company has lost its trillion-dollar status amid the sell-off.

Elon Musk’s wealth, although significantly reduced, still maintains his position as the world’s wealthiest person. The decline in his net worth is primarily attributed to the accelerating sell-off of Tesla shares in recent weeks. The latest stock drop comes as new data reveals a 45% year-over-year decline in new Tesla vehicle registrations in Europe for January, despite the overall growth of electric-battery vehicles on the continent. Sales in China have also trended downward.

Possible reasons for the decline include European buyers’ backlash against Musk’s involvement with the Trump administration and investors locking in gains from the past year. Despite the recent drop, Tesla’s stock is still up 52% over the past 12 months.

According to Gary Black, managing partner at The Future Fund, Tesla shares may fall further this year due to revised corporate management guidance on deliveries in 2025. However, some investors remain optimistic about the company’s long-term prospects, citing its superior products, upcoming robo-taxi service, and full-self-driving technology.

Musk’s multiple responsibilities, including leading SpaceX, X, xAI, and Neuralink, have not deterred investors, who continue to value Tesla stock highly due to his unique capabilities. The company’s upcoming innovations, such as a new, more affordable vehicle and unsupervised autonomy, are expected to drive future sales and growth.