Oscar Munoz, Chief Executive of United Continental Holdings Inc (UAL), provided answers to lawmakers in relation to the April 9th incident, involving the forceful removal of a passenger from Flight 3411 from Chicago to Louisville.

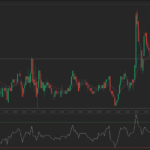

United Air shares closed higher on Wednesday, while marking their fourth gain in the past six trading sessions. The stock went up 0.51% ($0.36) to $71.33, with the intraday high and the intraday low being at $71.92 and $70.66 respectively. In the week ended on April 23rd the shares of the transportation company added 0.71% to their market value compared to a week ago, which marked the fourth gain in the past five weeks. The stock has extended its advance to 0.98% so far during the current month, following a 4.66% slump in March. The latter has been the largest monthly decrease since June 2016. For the entire past year, United Air shares gained 27.19%.

It is a practice for the airline to use offers to prompt volunteers to get off a flight. According to an April 26th letter by the United Air CEO to the US Senate Commerce Committee, the company has 16 volunteers for every passenger who needs to be involuntarily denied boarding.

In 2016, the carrier had involuntarily denied boarding to 3 765 clients out of more than 86.8 million mainline passengers, the CEO noted in the letter.

The transportation company had a deadline until April 27th to provide answers regarding the incident in early April, when Dr. David Dao, 69, was forcefully dragged off by airport security officers in order to make room for 4 members of the crew. The Vietnamese-American doctor was later hospitalized and will probably file a lawsuit against United Air.

According to Munoz, on April 9th the four Republic Airlines crew members were at the gate approximately when boarding occurred, while the airline increased compensation offered to volunteers on-board. Since no volunteers appeared, the flight crew continued with an “involuntary denied boarding process”. The CEO explained that four passengers were selected to get off the flight, based on their fare class and domestic routes.

According to CNN Money, the 17 analysts, offering 12-month forecasts regarding United Air’s stock price, have a median target of $81.00, with a high estimate of $105.00 and a low estimate of $72.00. The median estimate is a 13.56% surge compared to the closing price of $71.33 on April 26th.

The same media also reported that 9 out of 18 surveyed investment analysts had rated United Air’ stock as “Buy”, while 8 – as “Hold”.

Daily and Weekly Pivot Levels

With the help of the Camarilla calculation method, todays levels of importance for the United Air stock are presented as follows:

R1 – $71.45

R2 – $71.56

R3 (Range Resistance – Sell) – $71.68

R4 (Long Breakout) – $72.02

R5 (Breakout Target 1) – $72.43

R6 (Breakout Target 2) – $72.60

S1 – $71.21

S2 – $71.10

S3 (Range Support – Buy) – $70.98

S4 (Short Breakout) – $70.64

S5 (Breakout Target 1) – $70.23

S6 (Breakout Target 2) – $70.06

By using the traditional method of calculation, the weekly levels of importance for United Continental Holdings Inc (UAL) are presented as follows:

Central Pivot Point – $69.36

R1 – $71.18

R2 – $72.79

R3 – $74.61

R4 – $76.42

S1 – $67.75

S2 – $65.93

S3 – $64.32

S4 – $62.70