Finnish telecommunications equipment maker Nokia Oyj is in advanced talks to buy French competitor Alcatel-Lucent SA, the two companies said in a joint statement in response to recent media speculation.

Finnish telecommunications equipment maker Nokia Oyj is in advanced talks to buy French competitor Alcatel-Lucent SA, the two companies said in a joint statement in response to recent media speculation.

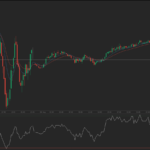

The deal would combine two of the weaker players in the industry, creating a group worth over $42 billion that would better compete with Swedens Ericsson, the industry leader, and Chinas Huawei Technologies. The statement caused a 13% jump in Alcatel-Lucent shares, while Nokia tumbled by more than 6%.

Nokia said that the two companies are “in advanced discussions with respect to a potential full combination, which would take the form of a public exchange offer by Nokia for Alcatel-Lucent.” However, it remained uncertain at this stage that “these discussions will result in any agreement or transaction.”

The statement came in reaction to media reports that Nokia and Alcatel have resumed merger talks that have circled around for years in a continuously consolidating industry. A successful transaction would reshape the telecoms equipment business by creating a company with more than 100 000 employees worldwide and a total 2014 revenue of €25.9 billion, roughly the same as Ericssons. Huaweis telephone-carrier equipment business generated revenue of about €23.6 billion last year.

However, industry experts have voiced concern about the potential integration process as both companies were formed as a result of cross-border mergers that required significant restructuring efforts.

Nokias telecommunications-equipment unit struggled for years in what was a tricky joint venture between the Finnish groups infrastructure operations and that of Siemens AG. Meanwhile, Alcatel-Lucent combined French and US companies and has been going through a prolonged restructuring process to lift falling sales in its core home markets.

A successful deal would bolster Nokias market share in its core wireless infrastructure business, a year after the Finnish company exited the handset business by selling its troubled unit to Microsoft Corp. The announcement also comes amid reports that Nokia may be in talks to sell its Here mapping unit, cementing its focus on telecommunication equipment.

However, investors voiced concern that the acquisition may face troubles with securing political approval, given the French governments reluctance to sell key national businesses and the connected job cuts that often accompany such cost-saving deals. Alcatel employs about 6 000 people in France and 52 000 worldwide, while Nokias headcount amounts to around 62 000 employees.

The French Ministry of Economy declined an immediate comment, while one government official said, cited by the Wall Street Journal, that any approval of the deal would require a structure for the new company that would allow the exertion of significant French influence.

Mikael Rautanen, analyst at Inderes Equity Research, said for Reuters: “A merger would mean major risks for Nokia on future costs, as they also have to negotiate with the French government. An acquisition of Alcatels wireless division would be much easier. But the deal would be an excellent getaway for Alcatel-Lucent from its difficulties.”

Nokia Oyj traded 6.63% lower at €7.26 per share at 9:41 GMT in Helsinki, trimming its one-year increase to 42.54%. The company had a market capitalization of €28 billion prior to Tuesdays statement.

Alcatel-Lucent SA surged 12.14% to €4.33 by 9:43 GMT in Paris, marking a one-year change of +61.04%. The company was valued at €10.91 billion based on Mondays close.