Yesterday’s trade saw EUR/NOK within the range of 8.3509-8.4574. The pair closed at 8.4205, gaining 0.51% on a daily basis.

Yesterday’s trade saw EUR/NOK within the range of 8.3509-8.4574. The pair closed at 8.4205, gaining 0.51% on a daily basis.

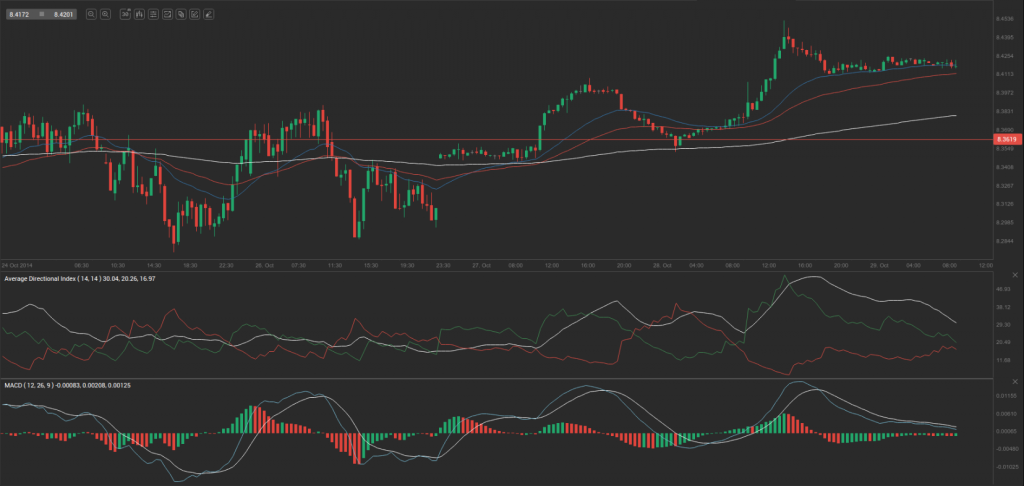

At 7:44 GMT today EUR/NOK was unchanged for the day to trade at 8.4178. The pair broke the first key weekly resistance and touched a daily high at 8.4270 at 3:20 GMT.

Fundamentals

Euro zone

Spanish retail sales

Annualized retail sales in Spain probably rose at a pace of 0.6% in September, according to the median estimate by experts, following another 0.4% gain in August. If so, this would be the fastest annual rate of increase since May. This indicator reflects the change in the total value of inflation-adjusted sales by retailers in the country and provides key information regarding consumer spending trend in a shorter term, while the latter is a key driving force behind economic growth. Companies, operating in the retail sector, provide monthly data regarding 4 main categories: food, personal equipment, household appliances and additional information in regard to other types of consumer goods. In case the retail sales index increased at a faster than expected pace, this would have a certain bullish effect on the euro. The National Institute of Statistics (INE) is expected to release the official report at 8:00 GMT.

Norway

Retail sales

Retail sales index in Norway probably rose 0.8% in September compared to a month ago, according to the median estimate by experts, after in August compared to July sales increased 0.6%. Annualized retail sales dropped 0.68% in August. This indicator reflects the change in the total value of inflation-adjusted sales by retailers in the country and provides key information regarding consumer spending trend, while the latter is a major driving force behind economic growth. The index encompasses a sample of over 13 200 items, which are included in the VAT register of the country. Sales of motor vehicles and fuel, office equipment, wood etc. are also included, in case these items are directly sold to end consumers. If the index of retail sales showed a better-than-expected performance, this would have a bullish effect on the krone. Statistics Norway is to release the official report at 9:00 GMT.

Unemployment

The rate of unemployment in Norway probably remained unchanged at 3.4% during August, according to the median forecast by experts. If so, this would be the highest level since February. In June unemployment rate was reported at 3.3%. It represents the percentage of the eligible work force that is unemployed, but is actively seeking employment. Unemployed persons are persons who were not employed in the survey week, but who had been seeking work during the preceding four weeks, and were available for work within the next two weeks. Persons in the labour force are either employed or unemployed. The remaining group of persons is labelled not in the labour force. Unemployed persons and persons not in the labour force constitute the group of non-employed persons. In case the unemployment rate met expectations or even increased further, this would have a bearish effect on the local currency. Statistics Norway will release the official employment data at 9:00 GMT.

Pivot Points

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 8.4096. In case EUR/NOK manages to breach the first resistance level at 8.4683, it will probably continue up to test 8.5161. In case the second key resistance is broken, the pair will probably attempt to advance to 8.5748.

If EUR/NOK manages to breach the first key support at 8.3619, it will probably continue to slide and test 8.3031. With this second key support broken, the movement to the downside will probably continue to 8.2553.

The mid-Pivot levels for today are as follows: M1 – 8.2792, M2 – 8.3325, M3 – 8.3857, M4 – 8.4390, M5 – 8.4922, M6 – 8.5455.

In weekly terms, the central pivot point is at 8.3574. The three key resistance levels are as follows: R1 – 8.4172, R2 – 8.4744, R3 – 8.5342. The three key support levels are: S1 – 8.3002, S2 – 8.2404, S3 – 8.1832.