Yesterday’s trade saw EUR/CHF within the range of 1.2093-1.2116. The pair closed at 1.2115, gaining 0.13% on a daily basis.

At 6:40 GMT today EUR/CHF was down 0.01% for the day to trade at 1.2112, which is also the current low for the day.

Fundamental view

Euro zone

The surplus on Euro zones seasonally adjusted current account probably expanded to 21.3 billion EUR in June from 19.50 billion EUR in May.

Regions current account produced a record-high surplus at the amount of 32.91 billion EUR in December 2013.

The current account reflects the difference between savings and investments in the Euro area. It is the sum of the balance of trade, net current transfers (cash transfers) and net income from abroad (earnings from investments made abroad plus money sent by individuals working abroad to their families back home, minus payments made to foreign investors).

A current account surplus indicates that the net foreign assets of the region have increased by the respective amount, while a deficit suggests the opposite. A nation with a surplus on its current account is considered as a net lender to the rest of the world, while a current account deficit puts it in the position of a net borrower. A net lender is consuming less than it is producing, which means it is saving and those savings are being invested abroad, or foreign assets are created. A net borrower is consuming more than it is producing, which means that other countries are lending it their savings, or foreign liabilities are created. An expanding surplus or a contracting deficit on the areas current account usually has a bullish effect on the euro.

The European Central Bank is expected to release the official data at 8:00 GMT.

Technical view

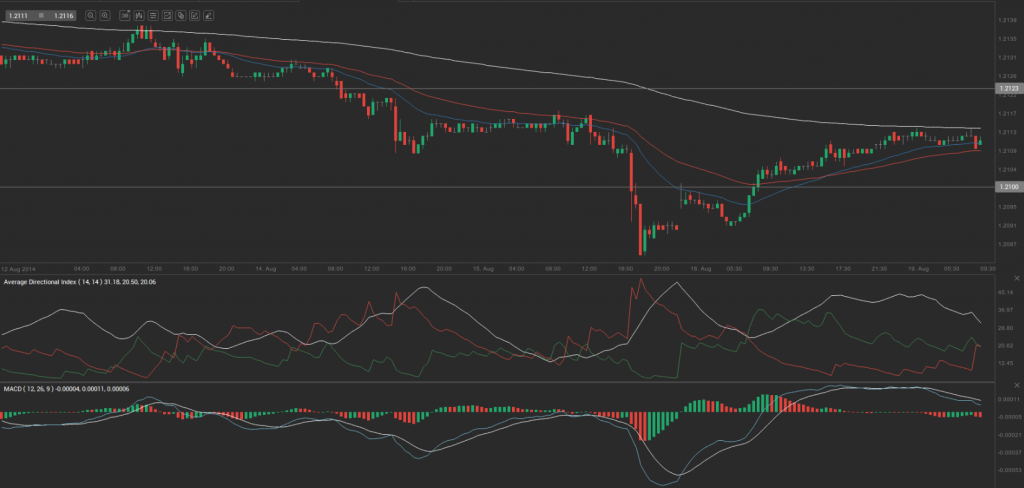

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 1.2108. In case EUR/CHF manages to breach the first resistance level at 1.2123, it will probably continue up to test 1.2131. In case the second key resistance is broken, the pair will probably attempt to advance to 1.2146.

If EUR/CHF manages to breach the first key support at 1.2100, it will probably continue to slide and test 1.2085. With this second key support broken, the movement to the downside will probably continue to 1.2077.

The mid-Pivot levels for today are as follows: M1 – 1.2081, M2 – 1.2093, M3 – 1.2104, M4 – 1.2116, M5 – 1.2127, M6 – 1.2139.

In weekly terms, the central pivot point is at 1.2108. The three key resistance levels are as follows: R1 – 1.2128, R2 – 1.2162, R3 – 1.2182. The three key support levels are: S1 – 1.2074, S2 – 1.2054, S3 – 1.2020.