During yesterday’s trading session EUR/GBP traded within the range of 0.7919-0.7964 and closed at 0.7923, losing 0.44% on a daily basis.

At 6:23 GMT today EUR/GBP was up 0.01% for the day to trade at 0.7923. The pair touched a daily high at 0.7926 at 5:45 GMT.

Fundamental view

Euro zone

The preliminary Gross domestic product (GDP) in Italy, the third largest economy in the Euro zone, probably rose 0.1% in the second quarter from the previous quarter, when it declined 0.1%. At the same time, the Italian GDP may have risen 0.1% in the second quarter compared to year ago, following a 0.5% slump in the previous quarter.

The preliminary GDP is a gauge of economic activity. The index is defined as the difference between the value of all goods and services produced and the cost of raw materials that were used for their creation. GDP measured at market prices reflects production activities of local firms. The cost method is applied as follows: GDP = private cost + state definitive cost + gross fixed capital expenditure + change in inventories + investments in stocks, with the exception of those made in precious metals + Import – Export. It is expressed as a percentage change from the previous quarter/year.

Higher than expected readings, would support euros demand. The National Institute for Statistics (Istat) is scheduled to release an official report at 9:00 GMT.

United Kingdom

A survey by Halifax Bank of Scotland (HBOS), the largest mortgage lender in the United Kingdom, may show that home values rose at an annualized pace of 9.6% last month, according to preliminary estimates. In June prices of British homes, purchased with loans from the bank, climbed 8.8%. In monthly terms, prices probably rose 0.4% in July, following an unexpected 0.6% drop in June. A higher than projected rate of increase would be considered as a bullish signal for the sterling. The official values will be released at 7:00 GMT.

At the same time, annualized industrial output in the United Kingdom probably expanded 1.6% in June, following another 2.3% increase during the preceding month. In monthly terms, industrial production probably increased 0.6% in June, following an unexpected 0.7% slump in the previous month., that was the biggest since August 2013. The index presents the change in the total inflation-adjusted value of production in sectors such as manufacturing, mining and energetics.

In addition, UK’s annualized manufacturing production, a short-term indicator which accounts for almost 80% of nation’s industrial output, probably expanded 2.1% in June. In May manufacturing output rose at an annualized pace of 3.7%. In monthly terms, production probably increased 0.6% during last month. As it is a key component of country’s Gross Domestic Product, in case manufacturing production expanded more than projected, this would have a bullish effect on the sterling.

The Office for National Statistics (ONS) will release the official figures at 8:30 GMT.

Technical view

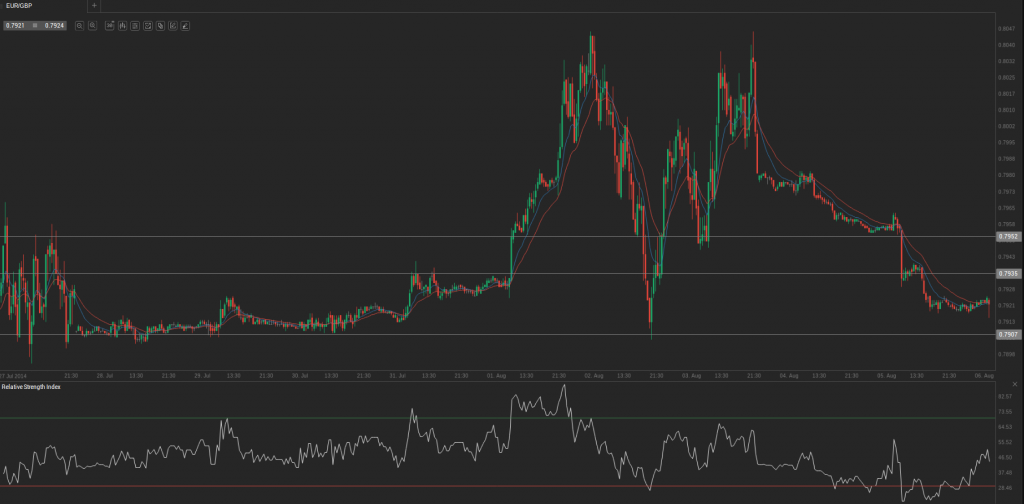

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 0.7935. In case EUR/GBP manages to breach the first resistance level at 0.7952, it will probably continue up to test 0.7980. In case the second key resistance is broken, the pair will probably attempt to advance to 0.7997.

If EUR/GBP manages to breach the first key support at 0.7907, it will probably continue to slide and test 0.7890. With this second key support broken, the movement to the downside will probably continue to 0.7862.

In weekly terms, the central pivot point is at 0.7958. The three key resistance levels are as follows: R1 – 0.8011, R2 – 0.8039, R3 – 0.8092. The three key support levels are: S1 – 0.7930, S2 – 0.7877, S3 – 0.7849.