During yesterday’s trading session EUR/CAD traded within the range of 1.4635-1.4680 and closed at 1.4640, losing 0.19% on a daily basis.

During yesterday’s trading session EUR/CAD traded within the range of 1.4635-1.4680 and closed at 1.4640, losing 0.19% on a daily basis.

At 6:58 GMT today EUR/CAD was gaining 0.06% for the day to trade at 1.4649. The pair touched a daily high at 1.4655 at 6:25 GMT.

Fundamental view

Activity in Italy’s sector of services probably slowed down in July, with the corresponding PMI coming in at a reading of 53.6, as projected by experts, from 53.9 in June. Values above the key level of 50.0 indicate increased activity. Markit Economics is expected to release the official data at 7:45 GMT.

France’s final services PMI probably exited from the zone of contraction during July, while confirming the preliminary PMI reading of 50.4, which was reported in July. The official reading is due out at 7:50 GMT.

The final reading of German services PMI probably confirmed the preliminary value for July, with the index coming in at 56.6. Markit will release the official reading at 7:55 GMT.

The final services PMI in the Euro zone probably also confirmed the preliminary value for July, with the index remaining at 54.4. The official reading is scheduled to be released at 8:00 GMT. The PMI is based on a monthly survey, encompassing a sample of business entities, which represent private sector conditions in terms of new orders, output, employment, prices etc. Higher than expected readings would provide support to the common currency.

In addition, annualized retail sales in the Euro area as a whole probably rose 1.4% in June, according to the median forecast by experts, after in May sales climbed 0.7%. In monthly terms, retail sales probably increased 0.5% during June, after being flat in June. This is a short-term indicator, which provides key information about consumption on a national scale. In case the index of retail sales rose at a faster than projected pace, this would have a bullish effect on the euro. Eurostat is expected to publish the official data at 9:00 GMT.

Technical view

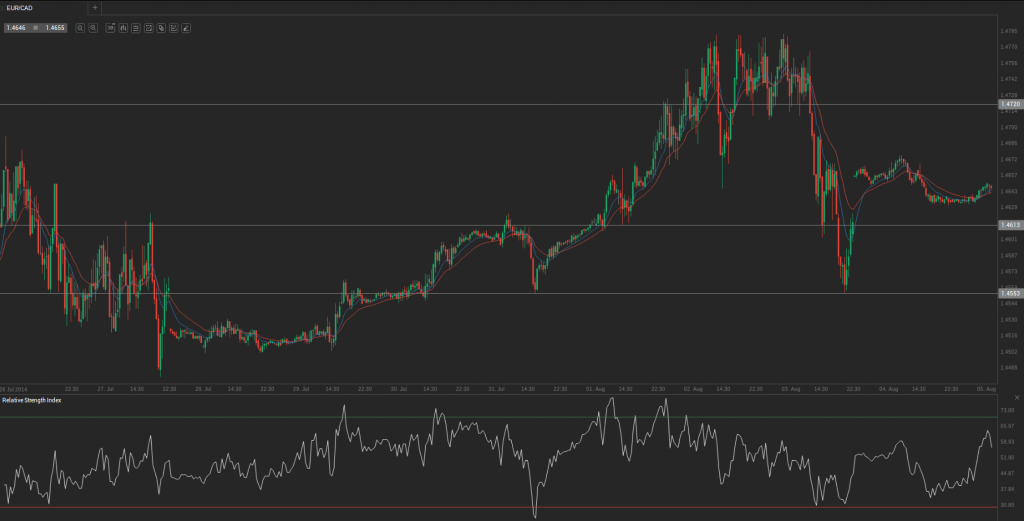

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 1.4652. In case EUR/CAD manages to breach the first resistance level at 1.4668, it will probably continue up to test 1.4697. In case the second key resistance is broken, the pair will probably attempt to advance to 1.4713.

If EUR/CAD manages to breach the first key support at 1.4623, it will probably continue to slide and test 1.4607. With this second key support broken, the movement to the downside will probably continue to 1.4578.

In weekly terms, the central pivot point is at 1.4613. The three key resistance levels are as follows: R1 – 1.4720, R2 – 1.4780, R3 – 1.4887. The three key support levels are: S1 – 1.4553, S2 – 1.4446, S3 – 1.4386.