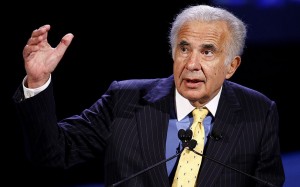

Investor Carl Icahn has grabbed a stake valued at over $1 billion in Apple Inc., pressing on the matter that more cash should be falling from the tech giants branches.

Investor Carl Icahn has grabbed a stake valued at over $1 billion in Apple Inc., pressing on the matter that more cash should be falling from the tech giants branches.

While Apple earlier this year announced a large buyback, Mr. Icahn said in an interview Tuesday that he wants to see it happen right away, near the current share price, which he considers cheap.

“This is a no-brainer to go buy stock in a company that can go borrow” at a low rate, Mr. Icahn said in an interview. “Buy the company here and even without earnings growth, we think it ought to be worth $625,” he said, referring to the stock price, which closed Tuesday at $489.57, having risen 5% on the news of Mr. Icahns investment.

Icahn said he thinks the tech giant is a highly undervalued company. “Had a nice conversation with Tim Cook today,” he said on Twitter. “Discussed my opinion that a larger buyback should be done now. We plan to speak again shortly.”

The shareholder did not disclose the size of his stake but several reports suggested he bought more than $1 billion worth of shares, which makes his Apple holding stand at around a quarter of one percent. Mr Einhorn’s last reported stake is worth just over $1 billion at Apple’s latest valuation. Apple’s largest shareholder, the Vanguard Group, an American fund manager, holds 4.76% of its stock, according to a March filing.

Mr. Icahn has lately been engaged in a battle over the future of another tech company – Dell Inc., whose CEO and founder is trying to take the company private. Mr. Icahn holds a stake of nearly 9% in the computer maker.

Mr. Icahns move into Apple is the latest example of a bullish investor activity, pursuing big game, in this case the largest company in the Standard & Poors 500-stock index. For executives and boards of companies large and small, anticipating, managing and responding to activist shareholders has emerged as a significant and ongoing task, considering the source of revenue for advisers on Wall Street who help companies with the challenge.

Mr. Icahns typical investment methods are to buy a large chunk of a company stock and agitate for changes to the companys management, how they use cash or other strategies he believes will boost stock prices. He also is known for picking fights with executives and directors of companies he believes arent acting in the interests of shareholders, including management at technology companies such as Netflix and Yahoo Inc. So far, both Mr. Icahn and Apple said the talks were amicable.