Copper fell on Monday, snapping last weeks advance after data showed Chinas economy expanded slower in the second quarter compared to 2012.

Copper fell on Monday, snapping last weeks advance after data showed Chinas economy expanded slower in the second quarter compared to 2012.

On the Comex division of the New York Mercantile Exchange, copper futures for September delivery traded at $3.133 at 10:02 GMT, down 0.71% on the day. Prices held in range between days high and low of $3.168 and $3.131 respectively. The industrial metal declined 1% on Friday, but still settled the week 2.75% higher, boosted by a weaker dollar and record high imports in China tied to arbitrage.

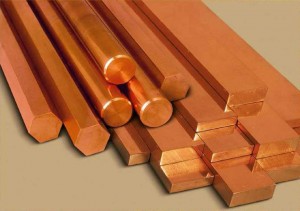

Copper plunged on Monday as overall weaker economic data from its top consumer China threatened demand prospects. The Asian country accounts for 40% of the metals global consumption. Signs of economic expansion or contraction have a strong influence on copper pricing as the red metal is widely used in Chinas industrial production.

China’s economy growth met projections at 7.5% in the second quarter but was below last year’s 7.7% reading. Although this marked a ninth decline for the past ten quarters, meeting expectations was a relief for investors as some anticipated even lower readings following statements from government officials last week. Chinese Finance Minister Lou Jiwei said on July 11 that a 6.5% growth wouldnt be a “big problem”. On a quarterly basis, Chinese GDP rose by 1.7%, above Q1′s 1.6%, but below projections for a 1.8% expansion.

According to China’s National Bureau of Statistics, the Asian country’s industrial production in June failed to meet expectations for a 9.1% surge and stood at 8.9%, also below May’s 9.2% reading. Retail Sales rose by 13.3% on an annual basis, exceeding both projections and the comparable period’s reading of 12.9%.

Cheng Xiaoyong, an analyst at Baocheng Futures Co., said for Bloomberg: “Data overall is in line with market expectations. Because officials have said these levels are acceptable, there probably wont be any policies rolled out to stimulate growth.”

Copper gained more than 2.7% last week after Fed Chairman Ben Bernanke backed as much as half of the FOMC policymakers in their opinion the central banks monetary easing program shouldnt be tapered yet. He said the U.S. economy needs Fed’s accommodative monetary easing program over the near-term as while the manufacturing sector, housing industry and other sectors from the industry have improved, the latest 7.6% unchanged reading of the Unemployment Rate pointed at a fragile labor market. Meanwhile, inflation remained stable and low, giving the central bank more room to ease money supply.

St. Louis Federal Reserve President James Bullard said on July 12 the U.S. central bank shouldnt taper its monetary easing program until inflation reaches its target. Meanwhile, Philadelphia Fed President Charles Plosser said the same day exactly the opposite. He stated the Federal Reserve should trim its bond purchasing in September and bring it to an end by the end of the year.

This week, Ben Bernanke is due to testify to Congress on Wednesday and Thursday, which should bring further insight into the future of the central bank’s monetary stimulus.

Investors are also looking ahead into this week’s key U.S. economic data, which will provide information about the economy’s recovery pace. Retail sales, Core Retail Sales, New York Empire Manufacturing Index and Business Inventories are due on Monday. Consumer inflation (Consumer Price Index) and Industrial production are scheduled for release on Tuesday, while on Wednesday Building Permits and Housing starts will provide data about the U.S. construction sector. The Labor Department will release Initial Jobless Claims on Thursday. The number of people who have filed for unemployment payments is expected to have dropped by 20 000 to 340 000 after last week an unexpected surge to 360 000 supported Bernankes statement that the U.S. labor market is still fragile.