Demand for EVs in Europe:Market Shifts and Growth Trends by Country in 2025

The internal combustion engine continues to rule most European countries, even as the EU prepares to end sales of new petrol and diesel cars by 2035. For now, only a few nations, led by the Nordics, are close to fully replacing hydrocarbon-based fuels with greener alternatives. Curious to track the global demand for electric cars, the team at Tradingpedia examined the sales and new registrations figures throughout 2025 from the European Automobile Manufacturers’ Association (ACEA) to reveal which nations lead in EV adoption.

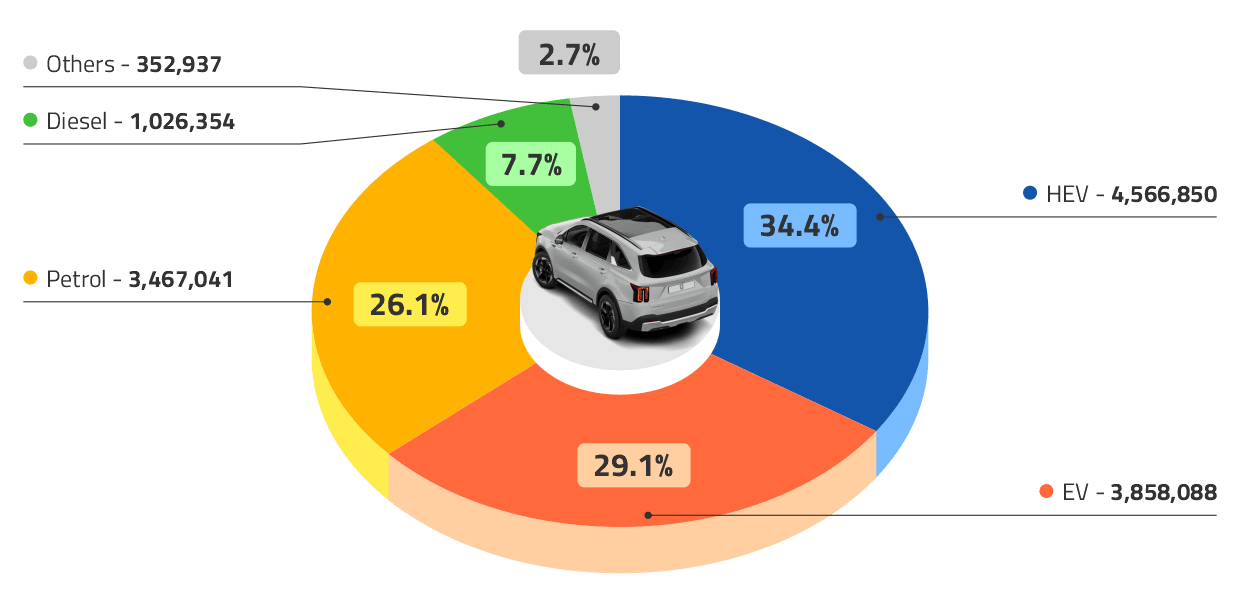

Data shows that across Europe, the growth of battery-electric vehicles (BEVs) has slowed in 2025, due to a range of factors including reduced subsidies and infrastructure challenges. In contrast, plug-in hybrid electric vehicles (PHEVs) are gaining traction, with sales up 33%, while hybrid-electric vehicles (HEVs) continue to grow in popularity. HEVs now hold the largest share of the market at 34.4% of all new car registrations, compared with a combined 33.8% for petrol and diesel vehicles.

Key Highlights

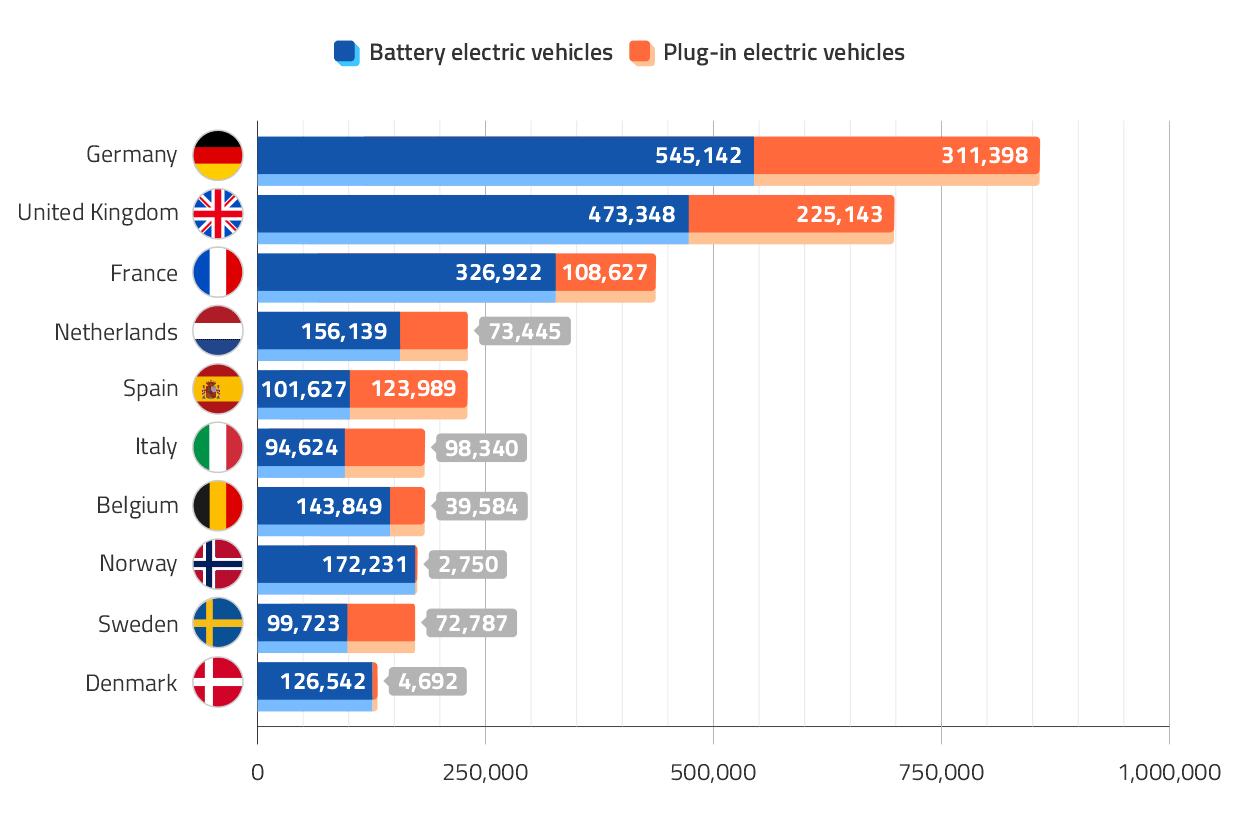

- The largest number of EVs in 2025 was sold in Germany: 856,540 vehicles were purchased, up 49.61% from 2024.

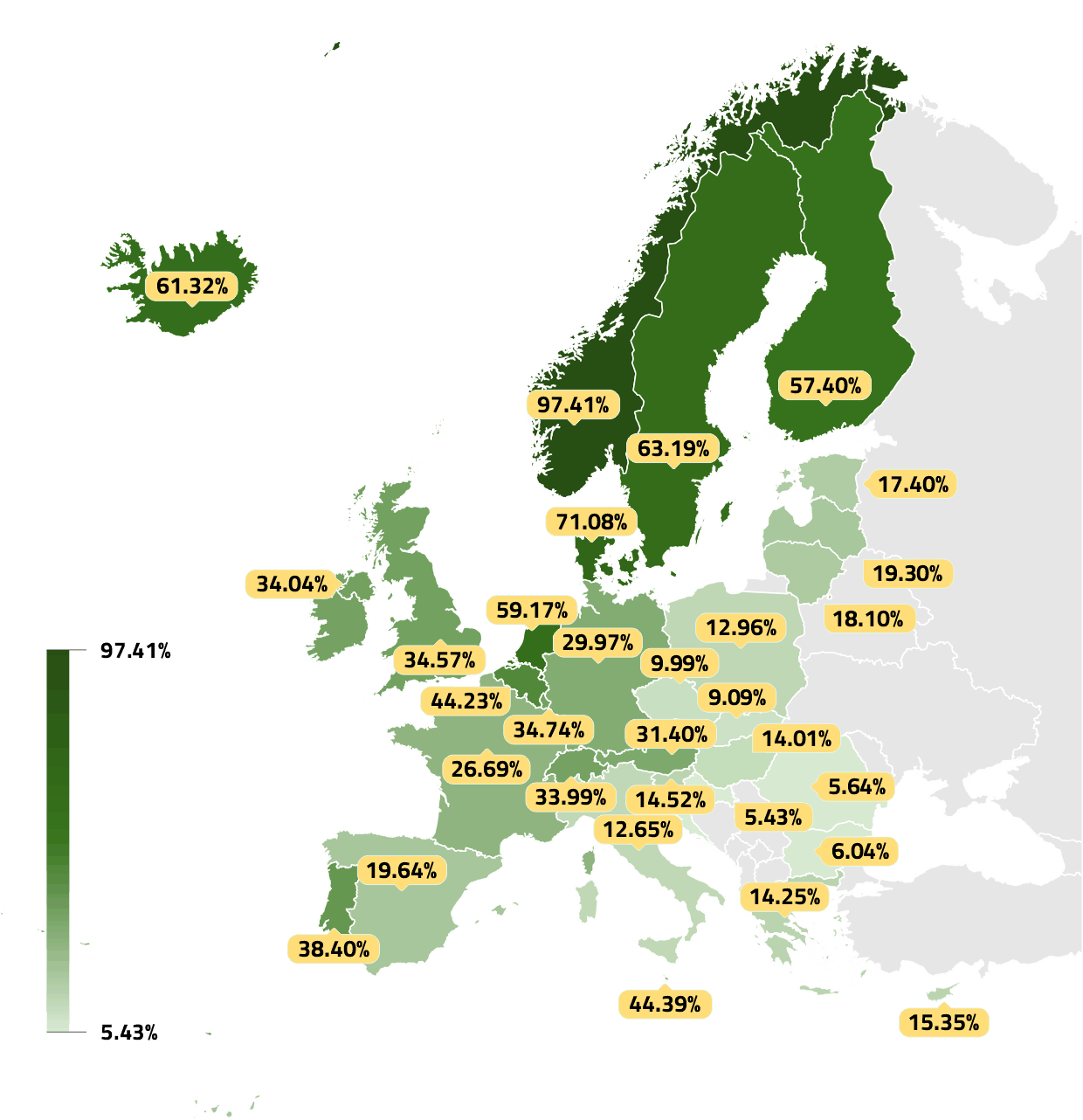

- The Nordics continue to lead Europe in the transition to electric mobility, with 97.41% of newly registered cars in Norway now fully electric.

- EVs account for 71.08% of new cars sold in Denmark, 63.19% in Sweden, and 61.32% in Iceland.

- Europe’s electric vehicle market expanded in 2025, with total sales rising 30.91% from the previous year to 3.86 million units.

Share of EVs Around the World

Share of BEVs and PHEVs in new car sales and registrations in 2025 (Jan-Dec)

*EVs include battery electric and plug-in electric vehicles

**For Romania, only BEV sales are included, as PHEV data is not available in the source.

Data Source: ACEA

Are EVs Really Replacing ICE Cars?

Electric vehicles are steadily transforming Europe’s roads, but not at the same pace everywhere. In Norway, the shift is nearly complete: 97.41% of all new cars registered in 2025 were electric, leaving petrol and diesel models in sharp decline, down more than 50% and 39%, respectively. The rest of Europe is catching up fast. In Poland, Lithuania, and Latvia all saw sharp increases in EV adoption compared with last year. Poland’s EV share more than doubled, rising 122.57% from 5.82% to 12.96%. Lithuania climbed 57.41%, from 11.5% to 18.1%, while Latvia increased 30.3%, from 11.81% to 19.30%. These jumps show that even smaller markets are accelerating rapidly toward electric mobility.

However, this replacement effect is far from uniform. Despite Latvia’s electric vehicle share nearly doubling, petrol and diesel models still dominate the market, accounting for 78.91% of all new car registrations in 2025. The contrast is even starker in Bulgaria, where 89.42% of new vehicles still run on conventional fuels, and petrol registrations have actually risen by 14.39% year-on-year. Factors such as income levels, charging infrastructure, and vehicle affordability continue to shape adoption rates, as consumers in lower-income markets remain more sensitive to upfront costs and limited charging networks.

In Germany, Europe’s largest auto market, BEV sales rose 43.23%, but the overall EV share stagnated at 29.97% of all new car registrations. The end of certain subsidies and price cuts from Chinese automakers reshaped demand: PHEVs rose sharply (+62.27%), suggesting consumers are hedging between affordability and range anxiety. France, meanwhile, saw a slight drop in total EV registrations, driven by a collapse in plug-in hybrid sales (-25.8%), as its new ‘green bonus’ rules excluded many imported EVs. Belgium also experienced a decline (5.60%) despite still-high EV penetration (over 43%), hinting at a post-subsidy cooldown.

Poland stands out as a potential turning point in Central Europe. BEV registrations almost tripled (+161.48%), with plug-in hybrids following closely (+119.36%), pushing the country’s EV share to 13%, more than twice last year’s level. Similarly, Czechia saw its EV market grow 47.99% overall, with plug-in hybrids in the lead (+87.89%). These shifts suggest that company fleets and EU incentives are beginning to filter into mid-income markets.

Largest Sales of EVs in 2025 (Jan-Dec)

Countries with the largest number of EV sales in 2025

Data Source: ACEA

Europe’s electric vehicle market gained momentum in 2025, with sales accelerating across both large and emerging markets. Total BEV registrations rose 29.73% year-on-year to nearly 2.6 million units, while plug-in hybrid (PHEV) sales grew even faster at 33.37%, reaching over 1.27 million units.

Major markets are driving this expansion. Germany, for example, sold 545,142 BEVs and 311,398 PHEVs in 2025, marking a 43.23% increase in BEVs and a 62.27% surge in PHEVs, highlighting the growing popularity of hybrid options alongside full electrics. The UK followed closely, registering 473,348 BEVs and 225,143 PHEVs, with growth of 23.92% for BEVs and 34.67% for PHEVs, demonstrating strong market demand even as incentives evolve.

Southern Europe is starting to catch up in the EV transition. Spain nearly doubled BEV sales to 101,627 and more than doubled PHEVs to 123,989, while Italy also posted strong growth (up 44.22% year-over-year to 94,624 BEVs, and up 86.60% to 98,340 PHEVs), driven by rising consumer interest and improving infrastructure. In contrast, France saw PHEV sales drop 25.8% to 108,627, and Belgium’s PHEVs fell 40.57% to 39,584, highlighting a fragmented market where hybrid adoption is highly sensitive to incentives and policy changes.

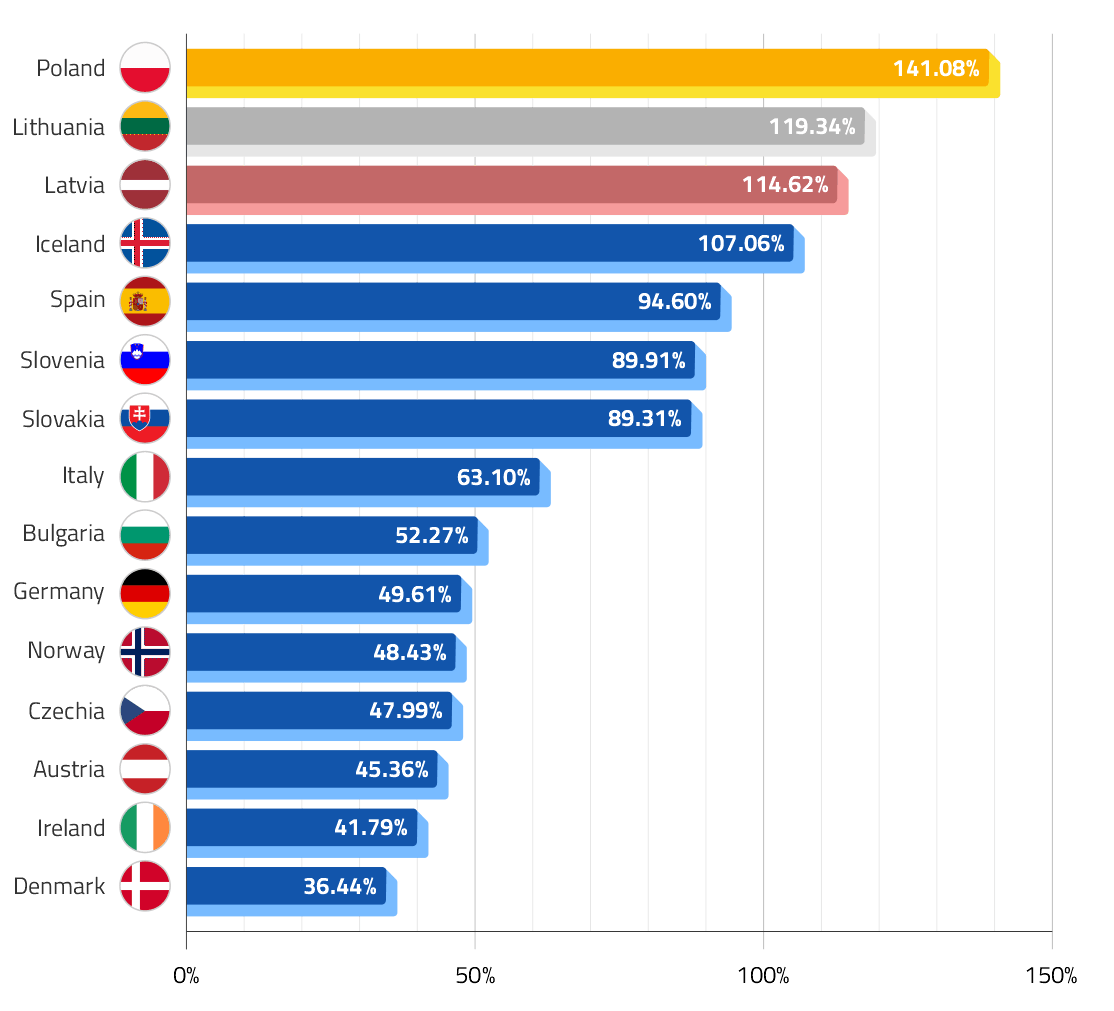

Impressive Growth in EV Sales in Certain Markets

Countries where EV sales increased the most between 2024 and 2025 (Jan-Dec)

*EVs include battery electric and plug-in electric vehicles

Data Source: ACEA

Smaller and emerging markets are outpacing their larger counterparts in the electric vehicle revolution, registering the most pronounced relative gains. Poland (141.08%), Lithuania (119.34%), and Latvia (114.62%) more than doubled their EV fleets compared with 2024, illustrating how electrification is surging from a low baseline in Central and Eastern Europe. Across southern Europe and the Nordic fringes, Spain (+94.60%) and Iceland (+107.06%) also witnessed sharp increases in EV sales, signalling a swift embrace of electric mobility beyond the traditional early-adopter strongholds.

In the Nordics, Norway continued to post strong absolute growth (+48.43%), although certain segments lagged: plug-in hybrid (-21.18%) and hybrid (-65.92%) registrations fell, even as battery-electric vehicles surged. Finland (+12.33%) and Sweden (+9.57%) showed steady, incremental gains, though hybrids in Finland declined by over 13%, reflecting a shift in consumer preference toward full electrics.

Meanwhile, in the Netherlands, EV adoption showed signs of slowing with growth largely plateauing during the first three quarters of the year. Battery-electric vehicle sales increased by just 3.9%, while overall EV sales rose a modest 15%. This slowdown, however, proved temporary. In the final two months of 2025, the market regained traction, with total 2025 EV sales jumping 24.15%, driven by an 18.14% rise in battery-electric vehicles and a much stronger 39.21% surge in plug-in hybrid sales.

Overall, Europe’s largest markets are transitioning from explosive early growth toward a more mature phase, where absolute volumes remain high, but year-on-year percentage increases are more moderate compared with the smaller, emerging markets leading the electrification surge.

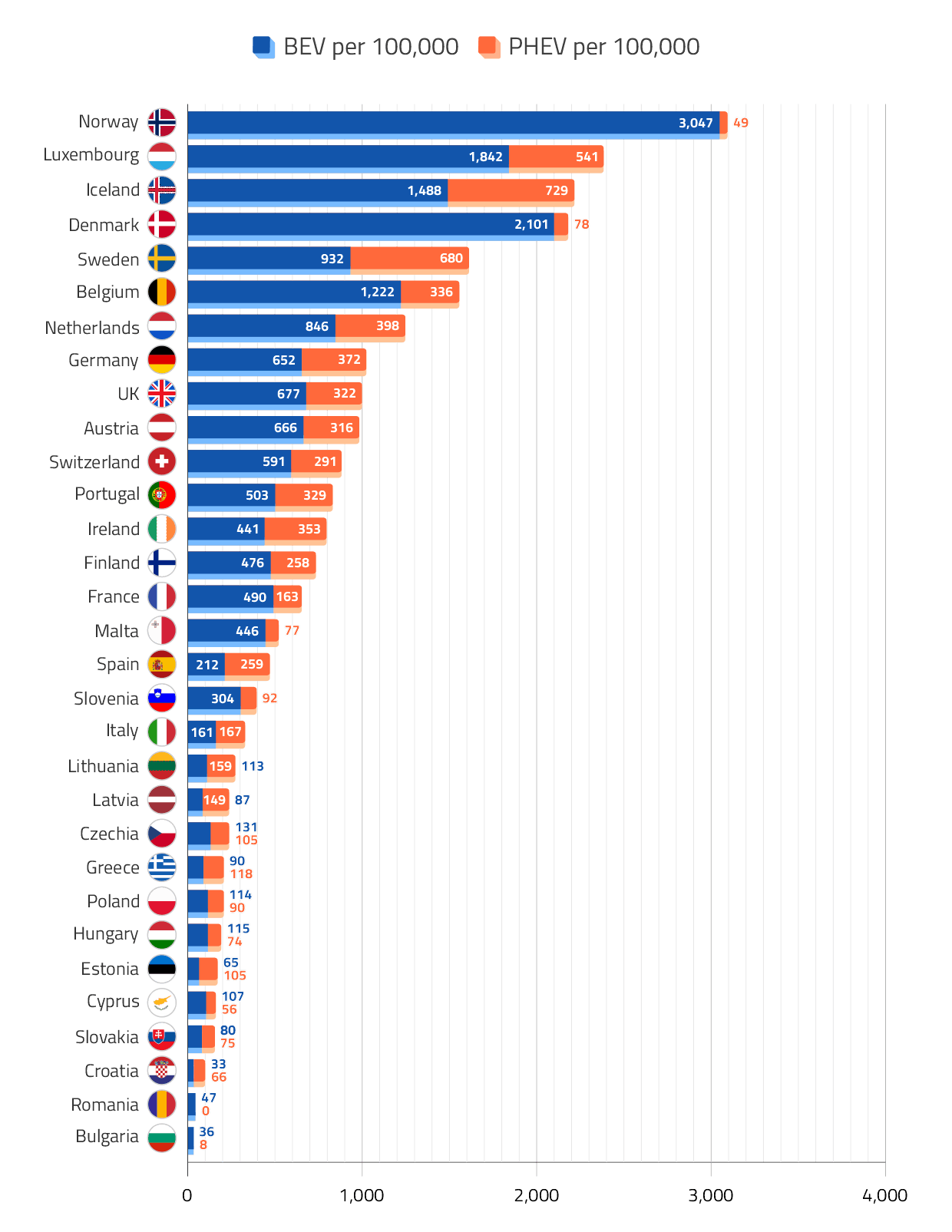

Countries with the Most EV Sales per Capita

New BEV and PHEV registrations per 100,000 citizens

*For Romania, only BEV sales are included, as PHEV data is not available in the source.

Data Source: ACEA, World Population Review

The BEV-PHEV Divide: What Europe’s EV Mix Reveals About Wealth, Policy, and Full Electrification Readiness

The ratio of battery electric vehicles (BEVs) to plug-in hybrids (PHEVs) is a strong indicator of a country’s EV maturity. A higher BEV share reflects advanced infrastructure, strong zero-emission policies, and higher incomes, while PHEV dominance points to transitional markets with weaker charging networks or affordability barriers. In essence, this balance captures both economic readiness and policy commitment to full electrification.

Among Europe’s wealthiest nations, Norway, Luxembourg, Iceland, and Denmark, BEVs now dominate the market, a pattern rooted in high disposable incomes, well-funded incentive schemes, and dense charging coverage. Together, these factors illustrate how economic strength and policy consistency translate into faster, deeper decarbonisation of road transport.

PHEV-heavy markets such as Ireland, Spain, and Italy highlight uneven infrastructure development and lingering consumer hesitation toward full electrification. Sweden stands out as a high-income exception, where PHEV adoption (680 per 100,000) is close to the BEV uptake (932 per 100,000), a balance shaped by generous company-car incentives and the practical advantages hybrids offer in colder climates.

In Southern and Eastern Europe, PHEVs are often viewed as a practical middle ground between traditional and fully electric vehicles. BEV adoption remains limited by price sensitivity, slower infrastructure rollout, and uneven policy support, underscoring the region’s more cautious and affordability-driven transition toward electrification.

Europe New Car Sales by Type in 2025

*EVs include battery electric and plug-in electric vehicles

Data Source: ACEA

Hybrids Claim Largest Slice of New Car Sales

Europe’s new car market is being reshaped by the surge of electrification. Hybrid electric vehicles (HEVs) claim the top spot, with 4.57 million units sold in 2025, capturing 34.4% of the market. Fully electric vehicles follow closely with 3.86 million registrations (29.10%), edging past conventional petrol cars, which accounted for 3.47 million units (26.10%). Diesel continues its long-term retreat, representing just 7.7% of sales, while alternative fuels remain niche at 2.7%.

These figures highlight a profound transformation in European motoring. Consumers are increasingly gravitating toward electrified options, with hybrids offering a pragmatic bridge between traditional engines and full electrification. Meanwhile, battery-electric and plug-in electric vehicles are rapidly encroaching on petrol’s territory, signalling that the continent is accelerating toward a future dominated by clean, sustainable mobility.

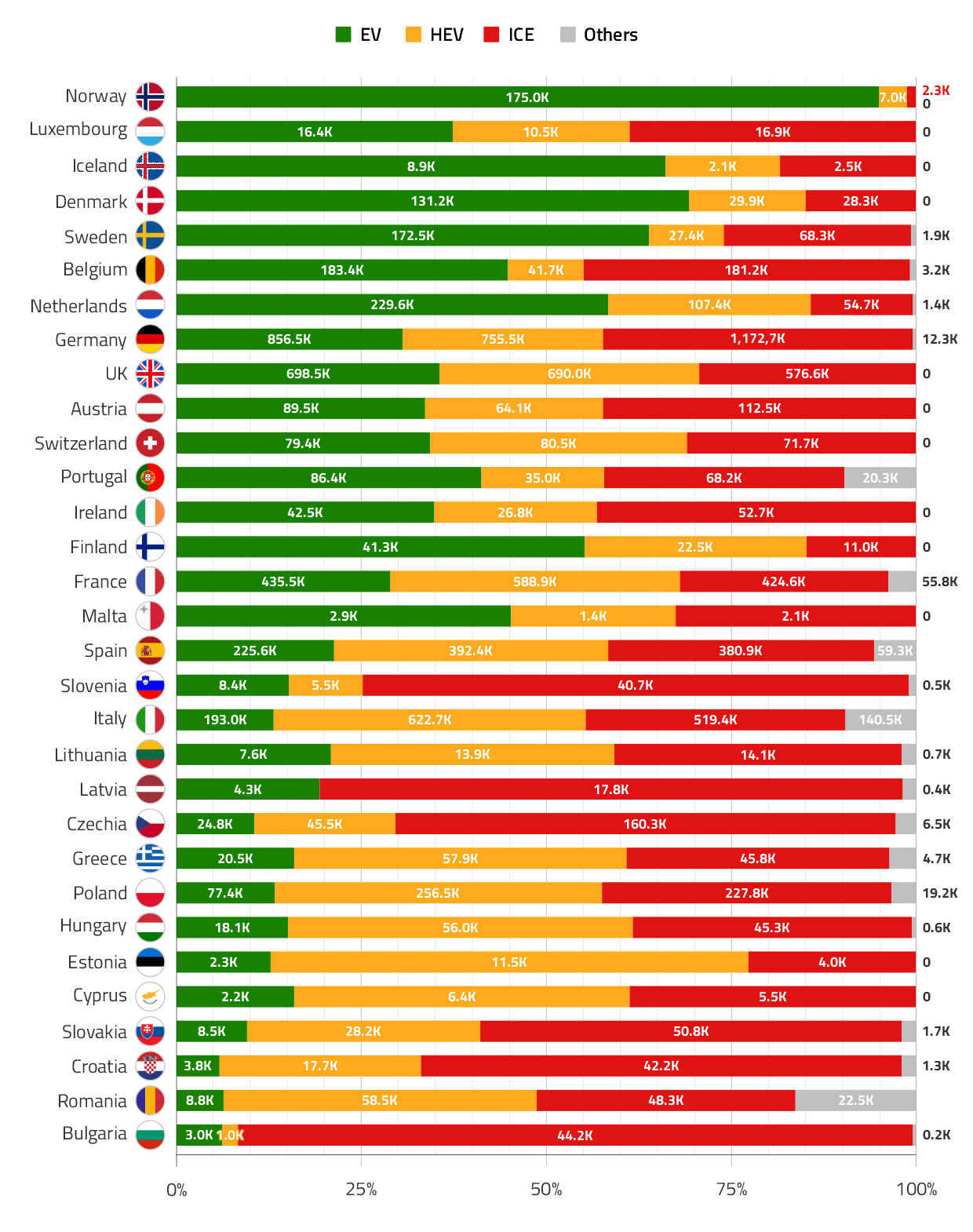

Countries’ New Car Registrations by Type (Jan-Dec 2025)

**For Romania, only BEV sales are included, as PHEV data is not available in the source.

Data Source: ACEA

Europe’s Uneven Road to Electrification: From Norway’s EV Dominance to the Hybrid Hurdle in the East

Norway remains the benchmark for full electrification, a model of policy consistency and consumer confidence. The Netherlands, Denmark, and Sweden have also crossed a critical threshold where electric models now outpace both hybrids and combustion engines, while smaller, affluent markets such as Luxembourg and Iceland approach near-parity between EVs and traditional vehicles.

In contrast, large economies like Germany, the UK, and France remain in transition. The UK and France have already seen EV sales surpass ICE vehicles, but France still leans on hybrids as a cautious, policy-led bridge. Austria, Portugal, and Switzerland mirror this balance, signaling steady but incomplete progress.

Further south and east, the shift is more gradual. In markets such as Italy, Spain, Greece, and Hungary, hybrids dominate as consumers balance affordability with limited charging options. Central European countries like Poland and Czechia follow a similar trajectory, relying on HEVs as an interim step, but internal combustion engine (ICE) vehicles still hold the largest share of new car sales.

Countries like Bulgaria, Croatia, Slovakia, and Romania remain largely ICE-dependent, with EVs still below 10% of registrations. Here, electrification advances at a measured pace, constrained by income disparities, infrastructure gaps, and weaker policy support.

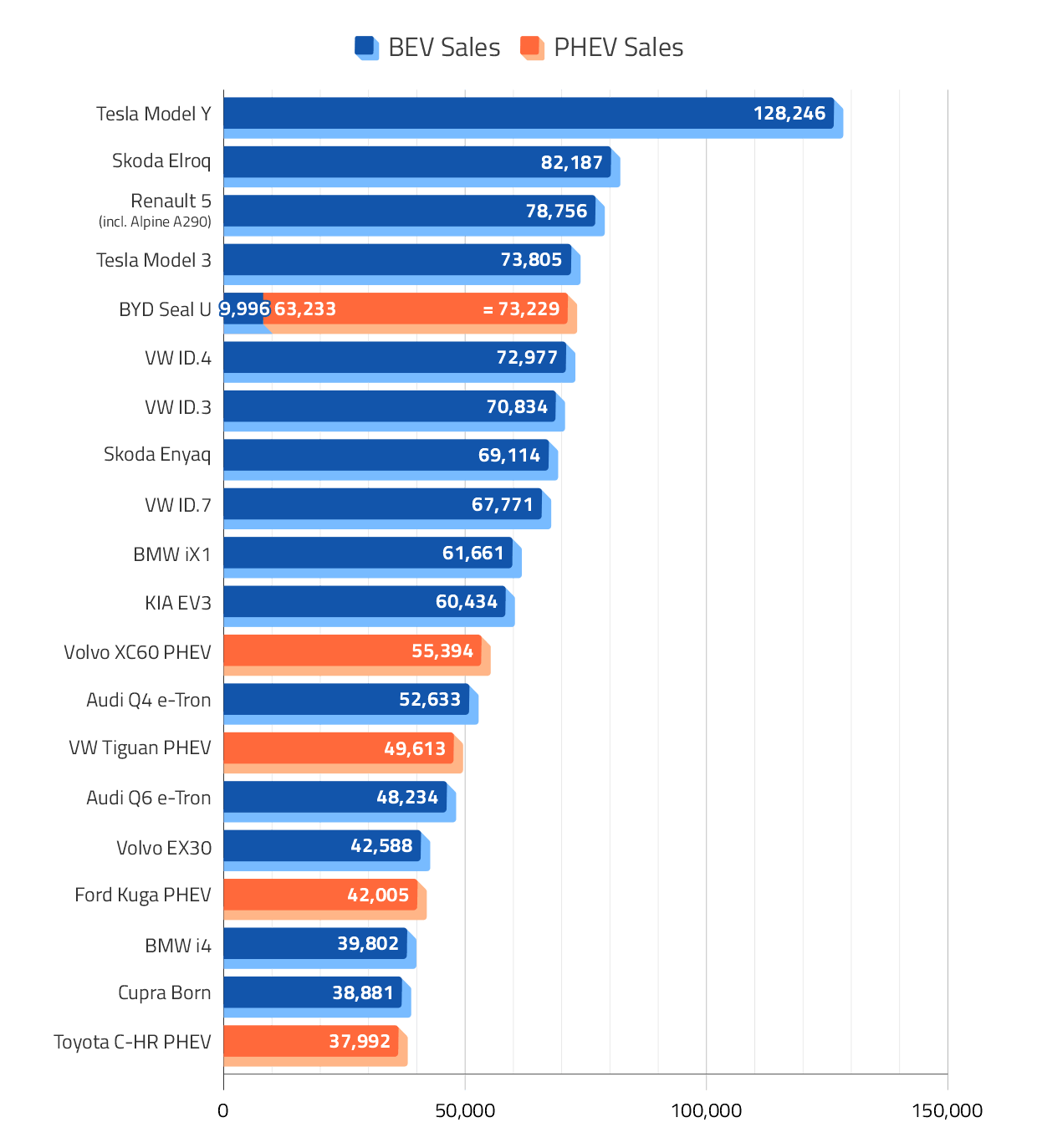

The Car Models Driving the European EV Revolution

Data Source: CleanTechnica

As Europe’s electric vehicle market expands and charging technology improves, certain models have established a reputation for reliability, capturing the lion’s share of sales.

Tesla has been on the decline in Europe for over a year, due to intense competition from European and Chinese automakers, reports of inconsistent build quality, and the political stances of its founder and CEO, Elon Musk. Despite these challenges, the Tesla Model Y has emerged as the continent’s top-selling electric vehicle in 2025, with nearly 117,000 new units registered between January and October. Remarkably, Tesla set a new record for car sales in Norway, selling 28,606 vehicles from January to November, more than any other manufacturer, EV or otherwise, has ever sold in a single year in the country.

Tesla Model Y has emerged as the continent’s top-selling electric vehicle in 2025, with 128,246 new units registered between January and November. Remarkably, Tesla set a new record for car sales in Norway, selling 28,606 vehicles in that period, more than any other manufacturer, EV or otherwise, has ever sold in a single year in the country.

As one of the Volkswagen Group’s defining strengths, its multibrand strategy continues to pay off in 2025, with four models – the Škoda Elroq, VW ID.4, VW ID.3, and Škoda Enyaq – all ranking among Europe’s top ten best-selling EVs. The group’s diverse portfolio spans everything from compact city cars to mid-size SUVs, enabling it to target multiple market segments while capitalising on strong brand recognition and an extensive dealership network across the continent.

The broader BEV segment reflects a shift toward more compact, affordable electric cars. Models like the Renault 5, Kia EV3, Cupra Born, and VW ID.3 highlight rising consumer appetite for urban-oriented EVs that balance price, range, and efficiency. Meanwhile, premium offerings such as the Audi Q4 e-Tron, Audi Q6 e-Tron, BMW iX1, and BMW i4 continue to attract drivers seeking higher-end features and performance, keeping luxury EV demand resilient even as subsidies fluctuate.

Plug-in hybrids remain an important bridge technology in markets where charging infrastructure is uneven or affordability concerns persist. The BYD Seal U leads PHEV sales with 63,233 units, demonstrating the growing pressure Chinese manufacturers are placing on their European rivals within the region’s electrification landscape. Strong performances from the Volvo XC60 PHEV, VW Tiguan PHEV, Ford Kuga PHEV, and Toyota C-HR PHEV further highlight that consumers continue to prioritise flexibility and lower upfront costs, particularly in countries outside the Nordic region, where fully electric adoption is progressing at a slower pace.

To analyse global electric vehicle sales, we used new car registration data published by the European Automobile Manufacturers’ Association (ACEA) for the period January-December 2024 and 2025. Additional information on the electric models (BEV and PHEV) sold across Europe was sourced from CleanTechnica.