The Most Affordable US States

and Cities for Tenants

With homeownership slipping further out of reach and mortgage rates still elevated, renting is no longer just a stepping stone but the only option for many households. The result: a rental market under intense pressure, where affordability is being tested like never before.

Hybrid and remote work trends, limited housing supply, and shifting economic conditions have created sharp regional divides; some cities are seeing rents surge, while others experience rare price relief.

To capture the true state of affordability, TradingPedia analysed median rent prices against average local incomes across US cities and states. This report ranks locations by rent-to-income ratio, highlighting where renters face the steepest burdens, where incomes provide the most cushion, and which markets have seen the biggest swings in rent costs since 2024.

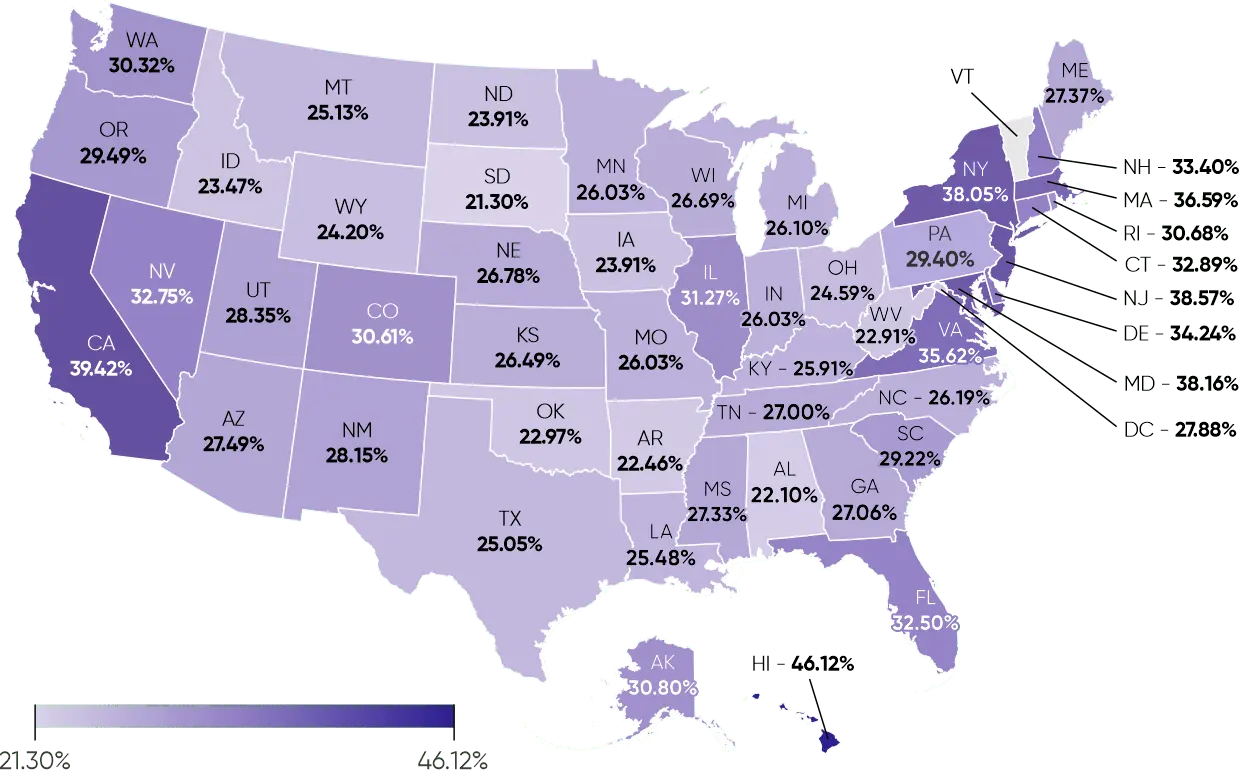

Rent as a percentage of the average monthly earnings in the US

US states with the lowest rents relative to income

Due to a combination of factors (low housing costs, low population growth, and abundant land), the South and the Midwest of the US consistently rank as the most affordable regions for renters. Fewer zoning restrictions and overall lower construction costs help to keep rents in check, while wages, though relatively low, tend to align closely with lower living costs.

As a result, the most affordable state for renting in August 2025 is South Dakota, where the median monthly rent ($885) is just 21.30% of the average wage ($4,155.64 per month before tax). South Dakota has the cheapest rents, but an even more important reason for its affordability is lower demand pressure compared with the rest of the country. The state’s small population (just below 1 million residents) – even in cities such as Sioux Falls and Rapid City – and its high home-ownership rate (69.3% of households owned their homes in 2023) help to keep demand low.

With median residential rents at $989 (the fourth lowest in the country) and an average wage of $4,475.36 before tax, Alabama ranks second in the US for affordable renting. On average, residents spend 22.10% of their earnings on accommodation each month, allowing for higher disposable income than in most of the country.

Three states from the South round out the five best states for renting in 2025: Arkansas, where the monthly rent accounts for 22.46% of wages; West Virginia (although many do not consider it Southern) at 22.91%; and Oklahoma at 22.97%. Although these states are not always viewed as part of the South culturally, geographically they belong there.

US states with the highest rent relative to income

All five states where rent constitutes the largest share of income lie either on the East or West Coast or, as in the case of Hawaii, outside the contiguous 48. Hawaii has long been among the most expensive places in the US, with high prices for everything from groceries and consumer goods to housing. The state records the highest rents nationwide, at $2,325 a month (and three- and four-bedroom houses are typically much pricier), while wages have failed to keep pace. The median rent therefore consumes nearly half (46.12%) of the average salary, which, as of June 2025, stands at $5,041.08 before tax.

Hawaii’s high housing costs are easy to explain and will not surprise anyone who has been following the property market in recent years. Land is limited, construction is costly, demand is exceptional, and supply is tightly constrained by geography and regulation. Furthermore, because it is a popular tourist destination, many landlords focus on high-revenue short-term lets rather than offer their units on the long-term rental market. This squeezes supply even further and makes it nearly impossible for residents to find a home to rent.

California is another state where housing demand is rapidly outpacing supply, pushing rents higher; it ranks as the second most expensive US state for tenants. As elsewhere, zoning and land-use restrictions, high construction costs and limited room for expansion in urban areas hamper new building. Moreover, California has a strong economy and job market: it is home to technology hubs, and the concentration of high-growth companies means incomes are significantly higher than in the rest of the country. When people are both willing and able to pay more for homes in highly desirable locations, asking prices and rents rise quickly.

Currently, the median rent in California is $2,197 a month, while the average salary is $5,572.96 before tax. Consequently, residents of the Golden State spend just over 39.42% of their wages on rent. Other similarly expensive states are New Jersey, where rents consume 38.57% of the monthly wage, Maryland at 38.16%, and New York at 38.05%.

California cities among the least affordable rental markets in the US

Nine of the ten most expensive US cities for renting are in California, which is hardly surprising. The least affordable is Thousand Oaks, the second-largest city in Ventura County, renowned for attracting affluent residents. Its suburban lifestyle, scenic backdrop and high average income, together with its proximity to Los Angeles and Santa Barbara, drive up housing prices and rents. As of summer 2025, the median rent in Thousand Oaks absorbs 65.57% of the average wage.

Top 10 cities with the least affordable rent relative to income

Similar trends are observed in the other Californian cities on this list: prime location, limited supply, prestigious employers, high incomes and intense market competition. Tenants should therefore be prepared to allocate more than half of their monthly earnings to rent. Despite Hawaii’s overall high rents, no Hawaiian city features in this ranking.

However, the city with the least affordable rents relative to income is Hoboken, New Jersey, where rent consumes more than two-thirds of the average monthly earnings (68.25%). Rents are sky-high because Hoboken is a small, in-demand city just across the river from New York City, with severely constrained supply and a landlord market that leverages data-driven pricing. Its proximity to Manhattan and lifestyle perks – walkable streets, riverfront parks, and so on – keep demand strong. The limited stock means rents are likely to keep rising, especially as more people choose Hoboken as an alternative to the pricey New York City neighbourhoods.

Top 10 cities with the most affordable rent relative to income

The most affordable US cities for tenants tend to be less in demand and have more stable housing markets. Unlike the hot markets in California, Florida or New York, they attract fewer institutional landlords or property investors, who often drive up rents through aggressive pricing and short-term lets. These cities remain affordable because they strike a rare balance: moderate or high wages relative to rents, ample housing supply, and less external investor pressure than the coastal hot spots.

Huntsville, Alabama, tops the list, with a median rent of $1,006 accounting for just 18.23% of the average monthly wage ($5,519). Housing costs are relatively low but, more importantly, wages are supported by strong local industries such as aerospace, defence and technology. Land is plentiful, construction costs are lower, and urban-density pressures are less severe than in coastal markets.

Other cities on the list, such as Detroit, MI, and Toledo, OH, still have very low property values relative to incomes after decades of population decline and economic restructuring. Although wages have improved modestly, housing supply still far exceeds demand, keeping rents low. Places like LaGrange, GA, and Seguin, TX, are within commuting distance of larger metropolitan areas (Atlanta and San Antonio respectively) but do not face the same rental pressure. This allows residents to earn metropolitan-level wages while paying small-city rents. Cities such as Madison, AL (part of the fast-growing Huntsville metro) and Clute, TX (near Houston but outside the high-demand core) are expanding, but housing construction has kept pace with population increases, preserving affordability.

US cities where rents increased the most since 2024

-

Abilene,

TX

$1,102

$1,248

13.25% -

San Francisco,

CA

$2,712

$2,999

10.58% -

Yonkers,

NY

$1,866

$2,017

8.09% -

Clute,

TX

$1,080

$1,161

7.50% -

Grand Forks,

ND

$1,043

$1,120

7.38% -

Beaumont,

TX

$1,081

$1,158

7.12% -

Oak Park,

IL

$1,797

$1,924

7.07% -

Suffolk,

VA

$1,595

$1,702

6.71% -

Waukegan,

IL

$1,313

$1,401

6.70% -

Lowell,

MA

$1,739

$1,855

6.67%

We also examined the cities where rents increased the most over the past year. Fluctuations can be attributed to various factors, including inflation, low inventory, barriers to home-ownership, and shifts in tenant demand.

The city that recorded the highest year-on-year rent hike in 2025 is Abilene, Texas, a relatively small city with a population of around 130,000 and an economy focused on the military (Dyess Air Force Base), healthcare, education (three universities), energy and regional services. Between July 2024 and July 2025, the median rent rose by 13.25% to $1,248, while compared with 2021 the increase is even more significant at 25.55%. While Abilene’s rental market may look less heated than those in larger hubs such as Austin and Dallas-Fort Worth, the limited supply of purpose-built rental properties pushes rents up.

Another city that saw rents increase significantly from last year is San Francisco, CA, where they climbed by 10.58% to $2,712 per month. The skyrocketing rents reflect ongoing housing shortages, limited construction and, of course, the strong tech employment in and around the city.

US cities where rents dropped the most since 2024

-

Seguin,

TX

$1,094

$906

-17.18% -

Davenport,

IA

$997

$873

-12.44% -

Casa Grande,

AZ

$1,376

$1,224

-11.05% -

LaGrande,

GA

$1,137

$1,021

-10.20% -

Bozeman,

MT

$1,573

$1,427

-9.28% -

Cedar Park,

TX

$1,606

$1,461

-9.03% -

Forney,

TX

$1,645

$1,507

-8.39% -

Leander,

TX

$1,648

$1,510

-8.37% -

Glendale,

CO

$1,733

$1,589

-8.31% -

Northglenn,

CO

$1,758

$1,612

-8.30%

Rents, however, also fell in a number of places across the US. In Seguin, Texas, they dropped by 17.18% year-on-year in July to $906, the most significant annual decline we observed among the 634 cities and metropolitan areas analysed. In general, declining rents can be seen in smaller cities, with Davenport, Iowa, being the only exception among the ten locations with the largest decreases. The city has a population of just over 100,000 but is also one of the Quad Cities (the others are Bettendorf in south-eastern Iowa, and Rock Island, Moline and East Moline in north-western Illinois).

Methodology

To compile this report, we analysed rental affordability across 49 US states and the District of Columbia, excluding Vermont due to insufficient data. For easier comparison, the states were grouped into five regions: Northeast, Southeast, Midwest, Southwest and West. We also examined affordability across 634 cities and metropolitan areas.

Median rent data by state, city and apartment type were sourced from ApartmentList and include the latest available rates, for July 2025. For the average salary, we used official figures from the US Bureau of Labor Statistics; as these figures are published for the previous month, we used the June 2025 wages for our calculations.

We calculated rent as a percentage of monthly wages to enable clear comparison between the states and cities, as well as effective visualisation.