People these days are using different Forex platforms but no matter how good a piece of software is, it loses its appeal if it does not support automated trading. In most cases, retail Forex traders are not able to sit in front of their computers 24/7 to follow the movements of the markets. This is where automated Forex trading comes in.

People these days are using different Forex platforms but no matter how good a piece of software is, it loses its appeal if it does not support automated trading. In most cases, retail Forex traders are not able to sit in front of their computers 24/7 to follow the movements of the markets. This is where automated Forex trading comes in.

As you can guess, this approach to trading might be a bit risky because you are not necessarily in front of your PC when orders are executed. On the other hand, if you are using a good enough platform, you can boost your profits with automated trading, earning money while you are away from your desktop workspace.

The whole concept of automated Forex trading is really simple. With this method, the software uses algorithms based on a set of predetermined parameters to automatically execute orders on behalf of the trader. It comes with many different advantages including, improved speed, higher trading frequency, and greater efficiency.

The Concept of Automated Trading Explained

The concept behind automated trading is beyond simple. Also known as algorithmic, algo or black-box trading, this method relies on sophisticated trading software that uses complex algorithms to scan the markets for specific conditions. In essence, these algorithms comprise sets of predetermined rules outlined for the completion of a specific task. It all begins with an input value that produces an output value.

The concept behind automated trading is beyond simple. Also known as algorithmic, algo or black-box trading, this method relies on sophisticated trading software that uses complex algorithms to scan the markets for specific conditions. In essence, these algorithms comprise sets of predetermined rules outlined for the completion of a specific task. It all begins with an input value that produces an output value.

These parameters are predefined by the trader and include timing, trading volume, risk tolerance, financial instruments, pricing, money management rules, and entry and exit commands, among other variables. The trader sets their desired instructions for the software to follow.

The software then screens the Forex markets for pairs that fit the predefined criteria and executes trades based on the trader’s instructions. The trader can set their entry and exit parameters based on simple conditions such as the moving average crossover. It is also possible to base the automated system’s decisions on complex strategies that require an in-depth understanding of the programming language used in the respective trading platform.

One significant advantage that stems from this automated process is that it eliminates human errors along with trading based on emotions or hunches. Unlike human beings, computer programs are capable of carrying out complex, yet highly accurate calculations within a millisecond.

However, there is still some human intervention. The systems for algorithmic trading call for frequent monitoring and backtesting so that the trader can ascertain they are working properly.

Automated trading systems are broadly used by those who invest in the Forex markets. The purpose of these systems is to constantly monitor and analyze trading activities and currency-pair price charts.

The software assists the trader by identifying important trading signals, including any discrepancies in the spreads, instability patterns, and news pieces that could lead to significant price fluctuations. When it finds a profitable currency pair, it notifies the trader by sending a buy or sell alert.

The trader can react by executing the trade manually although many prefer to let the software handle their positions automatically. For instance, a person might instruct the automated system to open a long position when a given pair’s 50-day moving average exceeds its 200-day moving average.

Automated Trading with Forex Robots

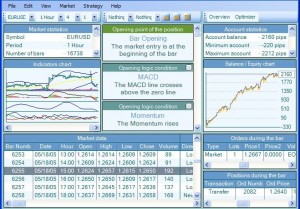

The best platforms that support this function normally feature built-in strategy wizards that enable users to make a pick from a list of frequently implemented technical indicators to create a set of instructions for automated trading.

The best platforms that support this function normally feature built-in strategy wizards that enable users to make a pick from a list of frequently implemented technical indicators to create a set of instructions for automated trading.

The process usually involves the use of Forex robots (called Expert Advisors in the popular MetaTrader platform). These are based on a set of trading signals that help determine whether to buy or sell a given pair at a specific time.

Forex robots are powerful enough to scan multiple charts simultaneously, something a human being is incapable of. They are created with a particular set of instructions, required to make trading decisions. Robots can identify and follow market trends to boost one’s profits and reduce or completely eliminate the chances of prospective losses.

With that said, it is also important to point out that using Forex robots is not a foolproof recipe for success. Robots are programmed to execute trades within a specific range. Being preprogrammed, they cannot account for the constantly changing conditions on the dynamic Forex markets.

A robot is usually capable of generating consistent but small profits from each trade. In the event of an unanticipated price breakout, these small earnings could be completely wiped out in a split second.

This is so because Forex robots are normally incapable of recognizing and reacting to dynamic changes in the market environment the way a human being would do. It is not uncommon for such robots to react inadequately to inaccurate information or false spikes in the market prices. This is something a human trader is likely to filter out.

Many advanced traders prefer to create their own custom indicators and robots for automated trading. While this requires significantly more effort compared to using the trading software’s built-in strategy wizard, it is often more rewarding where results are concerned.

Just bear in mind that the majority of automated trading systems require you to launch software connected to a direct-access brokerage. Also, you must write the specific set of instructions for automated trading in the proprietary language of the respective platform the broker is using.

The language differs between platforms. For example, strategies and robots for automated trading are written in the MQL language if you use the popular MetaTrader platform while NinjaTrader relies on the NinjaScript programming language. The cTrader platform, on the other hand, enables users to design automated trading robots and custom technical indicators in the commonly used C# language.

Requirements to Cover Before You Start with Automated Trading

Automated trading seems easy at first glance but there are still several requirements to cover if you are serious about adopting this approach. To begin with, you need a stable Internet connection and access to trading platforms to execute trades.

Automated trading seems easy at first glance but there are still several requirements to cover if you are serious about adopting this approach. To begin with, you need a stable Internet connection and access to trading platforms to execute trades.

Also needed is an adequate knowledge in coding and computer programing so that you can create your desired strategy for automated trading. Since programming and mathematical data are at the core of algorithmic trading, traders must have a sufficient understanding of calculus and statistics combined with theoretical knowledge and Forex know-how.

If you lack in this department, the solution is to hire the services of a professional programmer. The other recourse is to use the ready-made indicators and robots available via the trading platform you are using.

You also need access to market data feeds. The algorithm needs this to monitor for favorable trading opportunities. You should also have the capability to run backtests. This way, you can see how the automated trading system or robot performs before you launch it on the real market. Last but not least, you need sufficient historical data to run the backtests with, depending on how complex the instructions implemented in the trading algorithm are.

Commonly Used Strategies with Automated Trading

Many advanced investors implement automated trading strategies to identify favorable trading opportunities. This helps them reduce costs and improve their earnings. Some of the most frequently used strategies in automated trading are explained in the paragraphs below.

Many advanced investors implement automated trading strategies to identify favorable trading opportunities. This helps them reduce costs and improve their earnings. Some of the most frequently used strategies in automated trading are explained in the paragraphs below.

- Trend-based strategies are the easiest to understand and implement when using automated trading. Traders who resort to them are not required to make any predictions about price movements. Instead, they have to look out for trends related to range breakouts, moving averages, and market price fluctuations.

Orders are placed based on the manifestation of favorable trends. One of the most broadly used trend-related strategy is based on the 50-day and 200-day moving averages. Such strategies are suitable for traders who are interested in algorithmic trading but are reluctant to get involved in forecasts and predictive analysis. - High-frequency trading (HFT) strategies distinguish themselves with characteristics such as high turnover and order-to-trade ratios. Positions are held for brief periods while latency response is low. HFT is typically implemented by institutional investors, hedge funds, and major investment banks.

High-frequency trading requires computers with powerful enough computational capabilities, which can carry out millions of orders at lightning speed. Sophisticated algorithms are used for market analysis so that the computers might identify the smallest shifts in a marketplace.

Once an emerging trend is spotted, the system would send a huge bulk of deals for certain asset classes into the marketplace at bid/ask prices beneficial to the traders. Success largely depends on the technology’s computational capability and its speed. Scalping is one of the most commonly implemented forms of high-frequency trading. - The purpose of arbitrage trading strategies is to generate money for the trader from the minuscule price discrepancies between assets that have a strong correlation with each other, like currency pairs for instance. Those who use this technique while trading Forex currency pairs must usually open sizable positions to generate profits due to the small price fluctuations inherent to the foreign exchange market.

Triangular arbitrage is one of the most popular forms of this technique. It requires you to pick two Forex pairs along with another pair that combines currencies from the first two. An example of one such “triangle” is GBP/USD, USD/CHF, and GBP/CHF. In brief, you first purchase GBP using USD and then you open a short position for GBP in exchange for CHF before you finally buy USD with CHF. This is an example of USD to USD triangular arbitrage trading. - Mean reversion strategies rest on the idea major price spikes and slumps are short-term phenomena. Therefore, the prices will inevitably revert to their average (mean) value every now and then. The trader must spot and determine the price range before they use an algorithm based on it. The system would then automatically place orders whenever the price of the currency pair breaks in and out of the specified range.

- The time-weighted average price strategy (TWAP) splits up more sizable orders and places them as smaller chucks on the market. It uses equally divided timeframes between a trade’s start and finish times. The main purpose of TWAP strategies is to reduce market impact. This is achieved by executing the orders at the average price value between start and end times.

Popular Platforms Supporting Automated Trading

Some investors believe a trader is as good as the software they implement. There is certainly truth to this statement when it comes to automated trading, even more so if we consider the vast amount of data one must observe and interpret to adequately evaluate the market and identify favorable opportunities.

Some investors believe a trader is as good as the software they implement. There is certainly truth to this statement when it comes to automated trading, even more so if we consider the vast amount of data one must observe and interpret to adequately evaluate the market and identify favorable opportunities.

It is physically impossible for a human being to achieve the same efficiency as a computer capable of analyzing data at high frequency and executing orders across multiple asset classes at the same time.

The good news is different brokers offer different platforms allowing for automated trading. Each platform has its distinctive features for market analysis and screening. The question is how to pick the best one.

How to Choose a Platform for Automated Trading

Choosing a decent software for automated trading is no picnic, especially when multiple options are available. Some traders are skilled enough to create their own automated trading software from scratch, which enables them to tailor it to their individual preferences and trading style. However, if you lack programming capabilities, you can make an informed software pick based on the following criteria.

Choosing a decent software for automated trading is no picnic, especially when multiple options are available. Some traders are skilled enough to create their own automated trading software from scratch, which enables them to tailor it to their individual preferences and trading style. However, if you lack programming capabilities, you can make an informed software pick based on the following criteria.

- Latency is of essential importance because it could make or break your entire automated trading experience. Delays should be as short as possible so that traders can receive the most accurate data about market prices. When choosing software for automated trading, you must make sure the latency is reduced to microseconds.

- The support of backtesting is another thing worth checking for. Backtesting is essential because it enables you to evaluate your strategies’ expectancy and practicality based on historical market data from the past. If need be, you can always give your strategy a few tweaks to improve it before you use it on the live markets. Of course, you need access to said historical data to backtest, so ensure the broker whose platform you intend to use offers this information.

- The ability to create personalized indicators and strategy robots is another thing you need to look into. Of course, you should possess sufficient knowledge in coding and programming for this purpose.

Check whether the software was written in a programming language you are familiar with, be it C#, Python, Java or Matlab. Some platforms that allow for automated trading were written in proprietary languages as is the case with MetaTrader’s MQL and NinjaTrader’s NinjaScript. - Built-in wizards that allow you to set up custom strategies for automated trading can be of great use if you lack programming knowledge yourself. There is usually a list of technical indicators traders can choose from to determine the predefined conditions the algo-trading software must monitor for. This gives them more flexibility and freedom when developing different trading concepts.

- Access to the markets you want to trade is also essential. You must ensure the automated trading software you intend to use supports the financial instruments you are interested in. MetaTrader 4 (MT4), for instance, was built for trading Forex currency pairs, in particular, while its successor MetaTrader 5 (MT5) supports trading with stocks, bonds, options, and futures alongside Forex pairs.

MetaTrader 4

MetaTrader 4 easily wins the race in terms of functionality and trading efficiency. The platform is courtesy of the Russian fintech company MetaQuotes Software and was launched in 2005. Traders continue to prefer it today and this alone speaks volumes about its powerful capabilities.

MetaTrader 4 easily wins the race in terms of functionality and trading efficiency. The platform is courtesy of the Russian fintech company MetaQuotes Software and was launched in 2005. Traders continue to prefer it today and this alone speaks volumes about its powerful capabilities.

Not only does MT4 support automated trading but it also allows you to create custom strategies and robots in its proprietary programming language. MQL4 is rather similar to the C family of programming languages.

Expert Advisors (EA) are the platform’s biggest claim to fame. These dedicated robots are intended for the implementation and testing of different strategies for automated trading. Traders can either create their own Expert Advisors in the MQL4 language or purchase some from the MetaTrader 4 Market.

They will find more than 2,100 technical indicators and over 1,700 trading robots. It is also possible to rent them out for a limited period or give them a test drive by downloading the free demos. If trading currency pairs is not your cup of tea, we suggest you try MetaTrader 5 which supports a broader set of financial instruments in addition to Forex.

cTrader

Spotware Systems’ cTrader is another popular platform with powerful capabilities for algorithmic trading. The software has a natively integrated solution for automated trading, called cTrader Automate.

Spotware Systems’ cTrader is another popular platform with powerful capabilities for algorithmic trading. The software has a natively integrated solution for automated trading, called cTrader Automate.

It was designed to operate seamlessly alongside the other functionalities of the cTrader platform. Make sure you install the downloadable desktop version of cTrader if you insist on using this feature. Automated trading is unavailable in the browser-based cTrader Web.

The solution is equipped with all the tools for strategy optimization and backtesting one could possibly need. It enables you to create custom-made technical indicators and trading robots in the commonly used C# programming language. Building detailed automated strategies is made simple with cTrader Automate since traders have access to in-depth market data, history, error information, and different types of orders.

There are two particularly useful features here, starting with the plug-and-play functionality that allows cTrader users to instantly load indicators and robots for algorithmic trading. Downloading them from other members of the cTrader Automate community is also an option.

The second feature of interest is the Code Editor, which is intended to make coding as simple and straightforward as possible. It has a bunch of useful functionalities including code completion and automated formating.

ZuluTrade

ZuluTrade is a robust platform that enjoys great popularity in the copy trading community. Traders can use the ZuluTrade Automator as their own personal assistant. It monitors the markets and sends alerts when it detects favorable trading opportunities.

ZuluTrade is a robust platform that enjoys great popularity in the copy trading community. Traders can use the ZuluTrade Automator as their own personal assistant. It monitors the markets and sends alerts when it detects favorable trading opportunities.

You can respond to the notifications manually or let the platform execute trades on your behalf automatically. All you have to do is outline your preferred instructions for the Automator to follow.

The platform also supports copy trading, which means you can receive trading signals from professional investors. The software can reproduce the signal providers’ strategies in your portfolio by opening and closing the same positions in your account automatically.

4 Strengths and 4 Weaknesses of Automated Trading

It is pretty much obvious algorithmic trading comes with numerous advantages from the perspective of traders. The most apparent benefit here is that it saves time and effort where monitoring the markets for favorable trading opportunities is concerned. Here are its other advantages in brief:

It is pretty much obvious algorithmic trading comes with numerous advantages from the perspective of traders. The most apparent benefit here is that it saves time and effort where monitoring the markets for favorable trading opportunities is concerned. Here are its other advantages in brief:

- It reduces the impact of emotions on the trading process. It is easier for a person to stick to a given trading strategy when their emotions are eliminated from the equation. There is no room for hesitation or change of heart here since orders are placed automatically based on a set of predefined instructions outlined by the human trader. Additionally, this approach helps prevent overtrading, i.e. the excessing purchasing and selling of assets, a practice that may lead to a significant loss of capital.

- Algorithmic trading greatly improves the speed of order entry. Unlike human beings, computers are capable of generating orders as soon as the conditions outlined by a trader have been met. The software would also generate Take Profit and Stop Loss orders as soon as the respective position is opened. This not only saves time but also improves your chances of ending a trade on profit. Opening or closing a position a couple of seconds earlier can have a significant impact on the outcome, especially when we consider the dynamic price movements in the Forex markets.

- Automated trading can help you diversify your portfolio with less effort. It enables traders to simultaneously manage several accounts and implement different strategies at the same time. Automated trading also allows them to extend their volatility across various financial instruments. The automated trading software is capable of scanning for beneficial trading opportunities, handling orders, and monitoring different markets all at once. This can be something extremely challenging, if not straight out impossible, for a human being.

- Automated trading platforms enable you to run backtests. Backtesting is an important element of successful trading because it helps traders assess the viability of different strategies. The trader takes a specific set of trading instructions and tests how it performs against historical market data before exposing any real money to risk. Backtesting also enables you to fine-tune your new strategies and establish their expectancy, i.e. how much you can expect to lose or win on average when implementing a given approach.

While it has plenty of benefits to offer, automated trading is not without its faults. Read on for brief explanations of the main pitfalls associated with this approach to trading.

- Over-optimization is a common shortcoming that results from automated trading. This issue is particularly widespread among traders who perform frequent backtests. They end up creating trading strategies that seem great on paper but fall flat when you expose them to live market conditions. Such strategies are often unreliable in real life as a result of excessive curve-fitting. Regardless, it is important to remember there is no foolproof trading strategy that leads to 100% success on the Forex markets.

- Technical errors are not unheard of when one uses an automated trading system. With some automated trading platforms, orders are stored on computers rather than servers. Respectively, the system may not send the order on time if an interruption in the Internet connection occurs.

- Contrary to popular belief, automated trading requires systematic monitoring. Unversed traders commonly assume they could just input the predefined instructions for the system to follow and leave it to deal with trades on its own throughout the day. But it does not work this way. As we said earlier, there is still room for technical failures despite the fact the trading process is entirely automated. The thing about computers, and technology in general, is that they are not 100% insured against system crashes, power outages or loss of connectivity. The human trader must monitor and observe for such issues and anomalies to be able to respond to them adequately.

- Algorithmic trading could potentially have an adverse effect when it comes to liquidity. This automated process can greatly boost liquidity by rapidly placing orders. The trouble is said liquidity can vanish in thin air within a split second, too, destroying traders’ chances of turning a profit from price movements.

Automated trading can also result in a quick loss of liquidity. A research paper put forth by the Bank of England in 2018 suggests a strong connection between algorithmic trading and the massive loss of liquidity in the Forex markets after the Swiss National Bank (SNB) unexpectedly removed the fixed cap for the EUR/CHF pair on January 15th, 2015.