The buy now pay later phenomenon increased its popularity in Australia during the COVID 19 crisis, which saw the top service providers’ shares exploded within a short period. Before the COVID19 crisis, Roy Morgan’s research in September 2019 reveals that at least 1.95 million Australians use the buy now pay later service. Millennials are more likely to be the more extensive use of this service for online shopping, which is widely available.

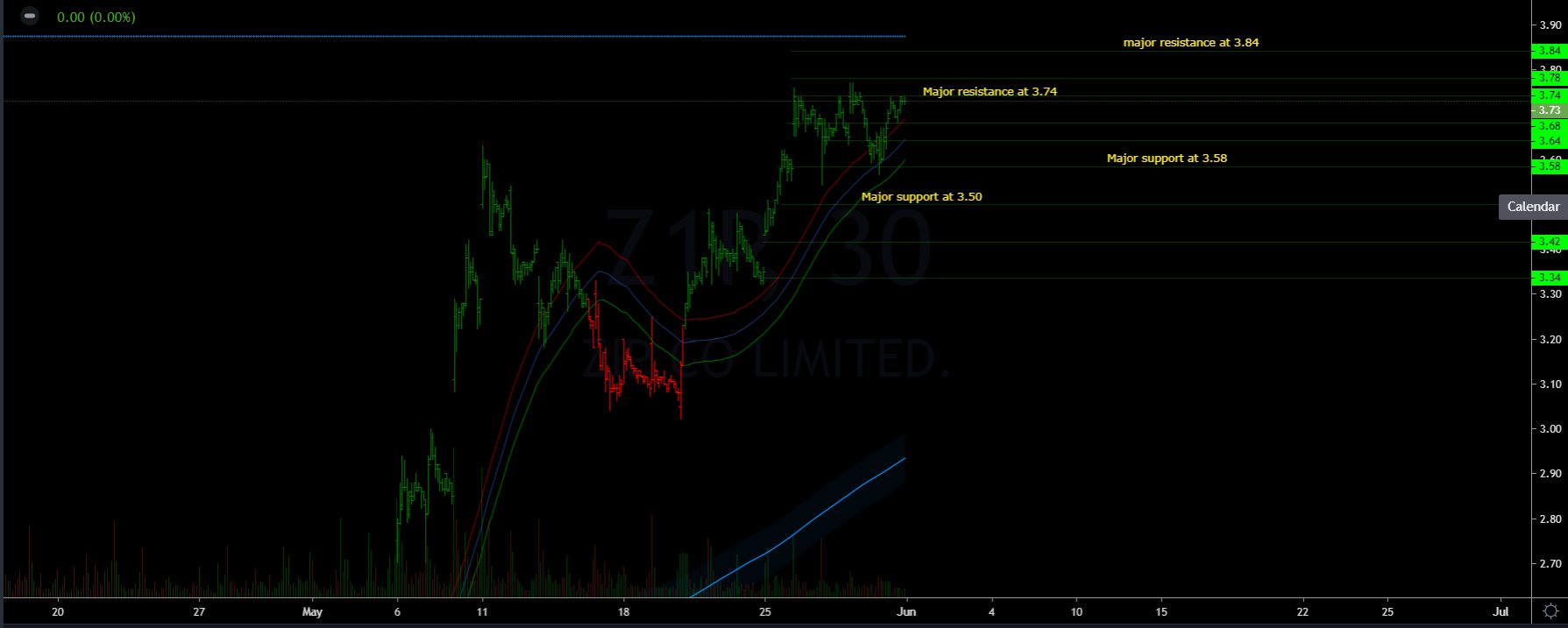

Afterpay(APT) shares rose from $20 in April to $47.16 on Friday, an astronomical increase of 135% in two months. APT share prices retreated from $50 highs to $44.90 and could continue to retest its previous highs if it holds above $46.82. If it fails, we might see it fall to $43.45, a critical point with lots of activities in the past. Share prices are looking exhausted after a great run; we might see a pullback before it continues to the upside.

Critical support and resistance:

Support – 46.82, 43.45, 40.14

Resistance – 49.25, 15.28

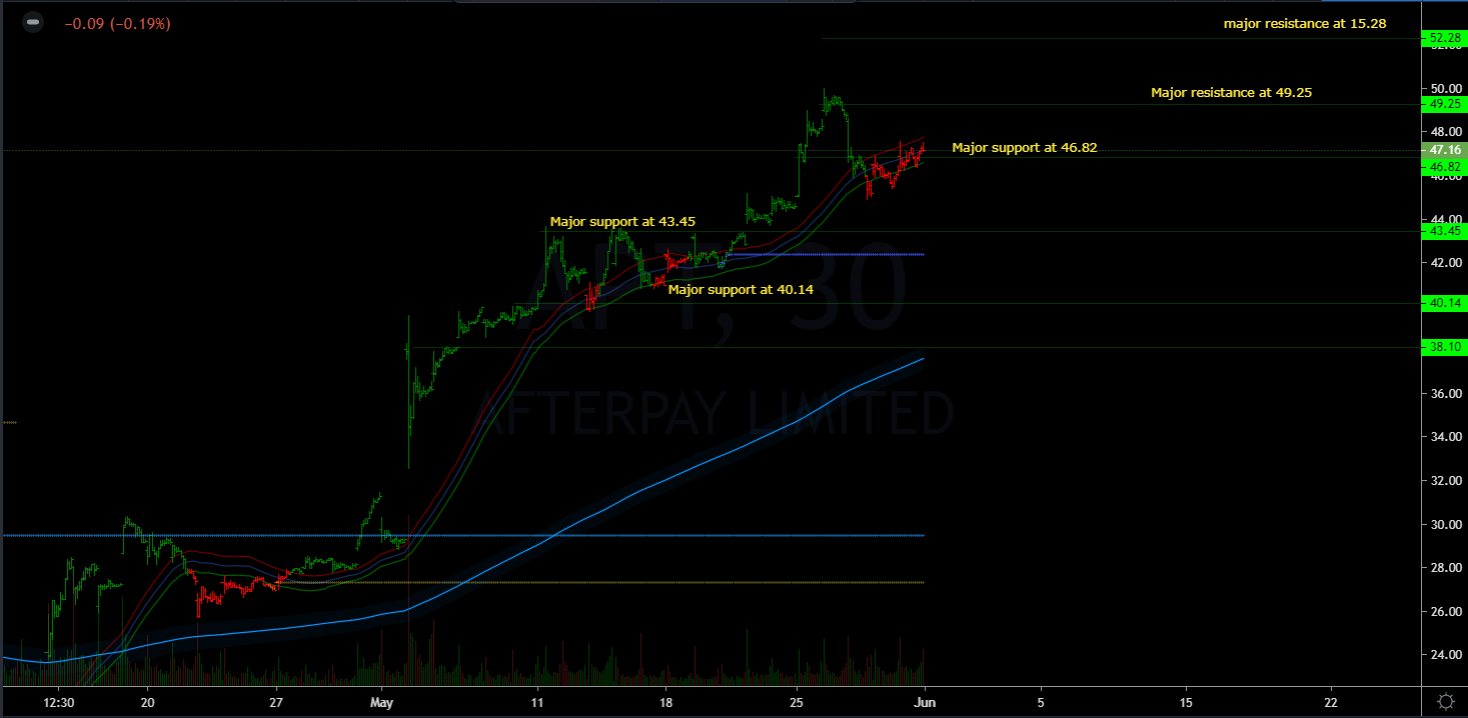

ZIP CO Ltd(ZIP) shares jumped from $1.64 in April to 3.73 on Friday, a phenomenon run with an increase of 127%, as traders all know that a great run is often followed by a price retracement or a pullback.

Share prices have reached a trading point this week where it seems to be hitting a potential triple top price formation in the 30 minutes price chart; a technical reverse pattern occurs typically before a price retracement or a pullback. ZIP needs to break and hold above 3.74 to continue to the upside.

Critical support and resistance:

Support – 3.64, 3.58, 3.50,3.42

Resistance – 3.74, 3.84