Breakouts from trend lines

This lesson will cover the following

- Trading with the trend until a trend line breach

- What determines the strength of a trend line breach?

It is vital to underscore that a trader needs to make his/her entries only in the direction of trend lines and as soon as he/she spots a breach of a key trend line, only then it may be appropriate to look for entries against the trend.

As we said earlier, trend reversals begin with: first, a breach of a trend line and second, an overshoot of a trend channel line and then a reversal. In both cases a breakout from a trend line is present. Until such occurs there is actually very little confidence in trading against the trend. When there is no trend line breach, this implies that the strong trend is still present, therefore, a trader needs to ensure that he/she has taken every suitable entry in the direction of the trend, regardless of that he/she may have missed a scalp or two against the trend.

Actual V bottoms and V tops, especially when there is no trend channel line overshoot and then a reversal, occur in rare cases. So, a trader should concentrate on more common setups and if he/she misses a rare pattern, there will eventually be a pullback, which may provide him/her with the opportunity to enter in the direction of the new trend.

Formidable trend channel line reversals are produced from overextended trends and they usually reach quite far after breaking the trend line. The first pullback, following the reversal, is usually short, because both sides in the market have come to an agreement that the trend has reversed. It is this confidence that causes most traders to use even a more aggressive approach – to add to their positions on the shortest pause, while abstaining from locking in gains. This leads to shallow pullbacks.

What determines the strength of a trend line breach?

If the move through the trend line is exceptionally strong, a second leg after the pullback is usually present. The stronger the breach, the higher the possibility of a second leg is. The pullback may often test the extreme in the trend and it may overshoot the trend channel line (a higher high at the end of an uptrend and a lower low at the end of a downtrend), or undershoot it (a lower high in a new downtrend and a higher low in a new uptrend).

Sometimes there may be an overshoot of the trend channel line, which extends beyond the old extreme in the trend. This way the reversal is neutralized, while the original trend continues. If a trader is looking for an entry against the trend, he/she needs to wait for another breach of a trend line or overshoot of a trend channel line.

There are a number of indications of how strong a breach of a trend line (the first leg of a potential reversal) is.

First, the move encompasses a lot of points/pips and many bars (ten or more);

Second, the move goes far beyond the exponential moving average (EMA);

Third, other strong previous trend line breaches were present;

Fourth, in a reversal to the downside, the move reaches below the final higher low in the uptrend. In a reversal to the upside, the move reaches above the final lower high in the downtrend;

Fifth, the reversal back, which tests the extreme of the old trend stops at the exponential moving average (EMA) or the old trend line and does not approach very much the extreme itself;

Sixth, the reversal back, which tests the extreme of the old trend does not have momentum (the move has a lot of bars with considerable overlap and many of them are bars in the direction of the new trend).

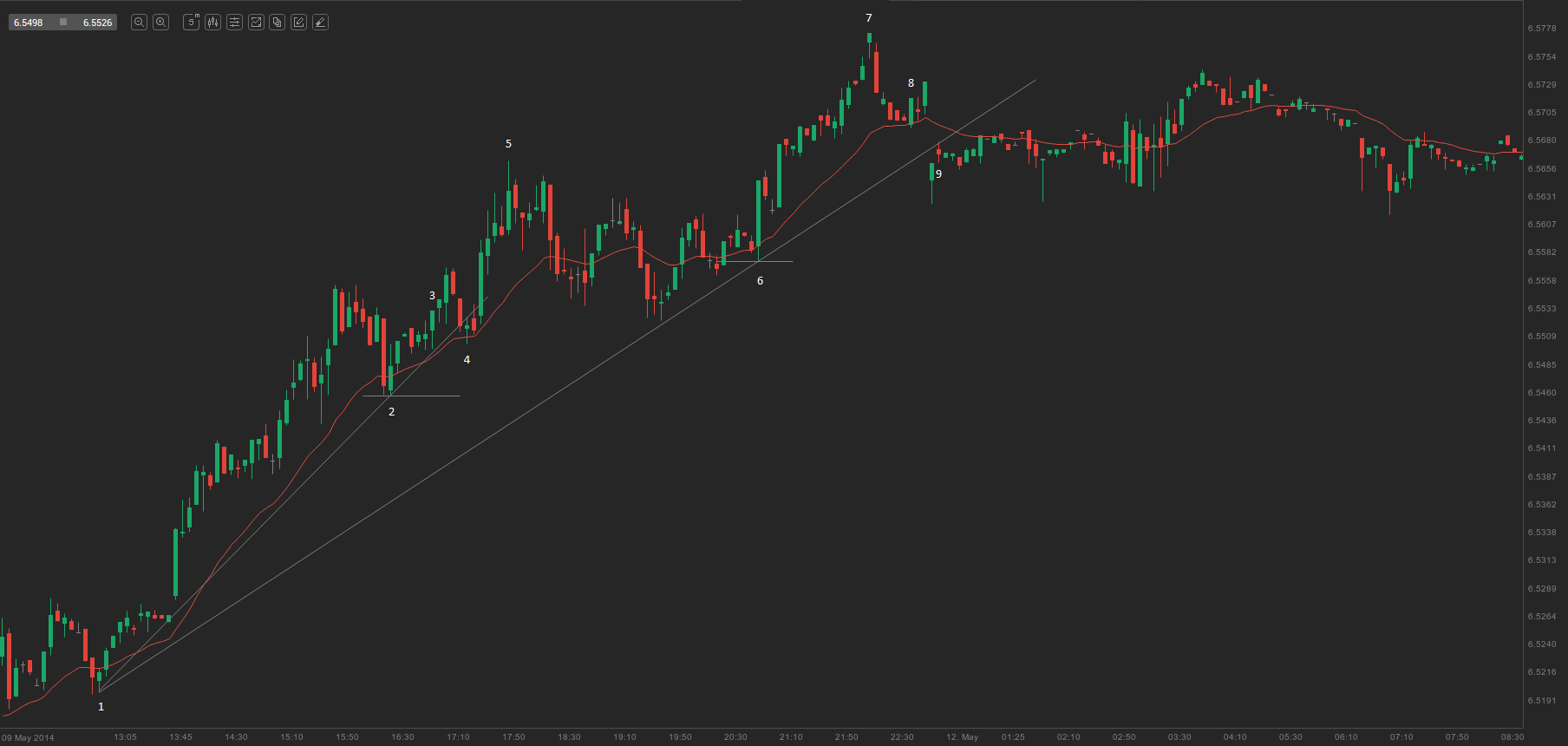

On the 5-minute chart of USD/SEK above there was a weak bear leg to bar 4, which hardly breached the bull trend line and did not manage to fall below the last higher low in the uptrend (bar 2) and also could not break through the exponential moving average. The down leg to bar 9, on the other hand, managed to breach below a longer bull trend line and the exponential moving average. These are indications that there is a certain strength behind the trend line breach, which boosts the probability for at least another leg to the downside and even for a successful reversal. Remember, countertrend positions should not be taken until after there has been a break of a key trend line!

After a key bull trend line has been broken, many traders will begin drawing bear trend lines, which may turn out to be of utmost importance, especially if the price reverses its direction and begins forming lower highs and lower lows.